Cp37d Form

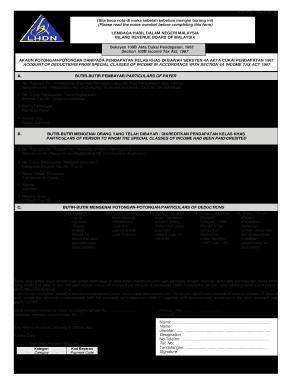

What is the CP37D Form?

The CP37D form, also known as the cp37 form 2024, is an essential document used in various administrative processes, particularly in tax-related matters. This form is typically issued by the IRS and serves to communicate important information regarding a taxpayer's status or obligations. Understanding the purpose and function of the CP37D form is crucial for ensuring compliance with federal regulations.

How to Use the CP37D Form

Using the CP37D form involves several key steps to ensure accurate completion and submission. First, carefully read the instructions provided with the form to understand the required information. Next, gather all necessary documents that may be needed to complete the form. This may include personal identification, tax documents, and any relevant correspondence from the IRS. Once you have all the information, fill out the form accurately, ensuring that all entries are clear and legible. After completing the form, review it for any errors before submission.

Steps to Complete the CP37D Form

Completing the CP37D form involves a systematic approach:

- Begin by downloading the latest version of the cp37 form 2024 from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide any requested financial details, such as income or deductions, as applicable to your situation.

- Review the completed form to ensure all information is accurate and complete.

- Sign and date the form before submission.

Legal Use of the CP37D Form

The CP37D form is legally recognized as a valid document when completed and submitted according to IRS guidelines. To maintain its legal standing, it is essential to ensure that all information provided is truthful and accurate. Misrepresentation or errors can lead to penalties or legal repercussions. Utilizing a reliable electronic signature solution, such as signNow, can enhance the legal validity of the form by providing a secure method for signing and submitting documents.

Filing Deadlines / Important Dates

Filing deadlines for the CP37D form can vary based on individual circumstances and IRS guidelines. It is important to stay informed about any specific dates related to your tax situation. Generally, forms should be submitted by the annual tax filing deadline, which is typically April 15 for individual taxpayers. However, extensions may apply in certain cases, so checking the IRS calendar for updates is advisable.

Required Documents

When preparing to fill out the CP37D form, certain documents may be necessary to ensure accurate completion. These typically include:

- Personal identification, such as a driver's license or passport.

- Tax returns from previous years, if applicable.

- Any correspondence from the IRS related to your tax status.

- Financial statements or documents that support the information provided on the form.

Form Submission Methods

The CP37D form can be submitted through various methods. Taxpayers have the option to file the form online, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the appropriate IRS address, or submitted in person at designated IRS offices. Each method has its own processing times, so it is important to choose the one that best suits your needs.

Quick guide on how to complete cp37d form

Effortlessly Prepare Cp37d Form on Any Device

Online document management has become increasingly prevalent among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Cp37d Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Cp37d Form

- Obtain Cp37d Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require recreating document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign Cp37d Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cp37d form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cp37d form used for?

The cp37d form is primarily used for submitting requests to the IRS regarding tax issues. It allows taxpayers to correct or amend tax returns, ensuring accurate information is processed. Understanding the cp37d form can help streamline your tax filing and ensure compliance.

-

How can airSlate SignNow help with the cp37d form?

AirSlate SignNow offers a simplified platform to eSign and send the cp37d form securely. With customizable templates and easy workflow integrations, you can ensure that your tax documents are completed and signed efficiently. The platform enhances collaboration and reduces the time spent on document processing.

-

Is there a cost associated with using airSlate SignNow for the cp37d form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effectiveness of our solution means you can manage your paperwork, including the cp37d form, at a fraction of the cost of traditional methods. You can choose a plan that best fits your budget and usage requirements.

-

What are the key features of airSlate SignNow for submitting the cp37d form?

AirSlate SignNow provides several key features, including secure eSigning, document templates, and real-time tracking. These features make it easier to prepare and manage the cp37d form without the hassle of physical paperwork. Additionally, the easy-to-use interface simplifies the entire document workflow.

-

Can airSlate SignNow integrate with other applications when handling the cp37d form?

Absolutely! AirSlate SignNow offers seamless integrations with popular applications to help manage the cp37d form and other documents. Whether you use CRM systems or project management tools, our integrations allow for a smooth flow of data, enhancing efficiency and team collaboration.

-

What are the benefits of using airSlate SignNow for the cp37d form?

Using airSlate SignNow for the cp37d form provides numerous benefits, including speed and convenience. You can complete, sign, and send the form electronically, reducing the turnaround time signNowly. This not only saves time but also enhances security and reduces the likelihood of errors.

-

How does airSlate SignNow ensure the security of the cp37d form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the cp37d form. Our platform employs advanced encryption, secure data storage, and compliant practices to protect your information. You can confidently eSign and submit documents knowing they are safeguarded.

Get more for Cp37d Form

- Emergency custody form

- Order setting hearing blank form

- Dr 1094w form

- Verification and certification of notice required by dc form

- Dc superior court servicemembers affidavit form

- Nh parenting form

- Petition for legal separation form kentucky

- Application for waiver of feesappointment of counsel jd fm 75 to print form

Find out other Cp37d Form

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form