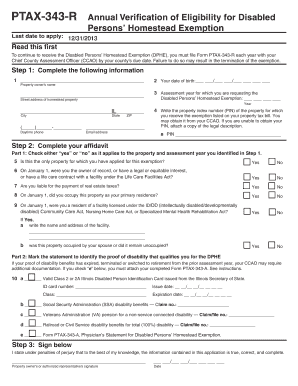

Ptax 343 R Form

What is the Ptax 343 R

The Ptax 343 R is a form used primarily for tax purposes in the United States, specifically related to property tax assessments. This form is essential for taxpayers who wish to contest or appeal their property tax assessments. By submitting the Ptax 343 R, individuals can formally request a review of their property’s assessed value, which may lead to a reduction in their property tax liability. Understanding the nuances of this form is crucial for effective tax management and ensuring compliance with local regulations.

How to use the Ptax 343 R

Using the Ptax 343 R involves several key steps. First, ensure that you have the correct form, which can typically be obtained from your local tax assessor's office or their website. Next, fill out the form with accurate information regarding your property and the reasons for your appeal. It is important to provide supporting documentation, such as recent property appraisals or comparable sales data, to strengthen your case. Once completed, submit the form to the appropriate tax authority by the designated deadline to ensure your appeal is considered.

Steps to complete the Ptax 343 R

Completing the Ptax 343 R requires careful attention to detail. Follow these steps for successful submission:

- Obtain the Ptax 343 R form from your local tax authority.

- Fill in your personal information, including your name, address, and property details.

- Clearly state the reason for your appeal, providing specific details about your property’s assessed value.

- Attach any necessary documentation to support your claim, such as property appraisals or market analysis.

- Review the completed form for accuracy before submission.

- Submit the form by mail, in-person, or online, depending on your local tax authority's requirements.

Legal use of the Ptax 343 R

The Ptax 343 R is legally binding when completed and submitted according to the guidelines set forth by local tax authorities. It is important to understand that the information provided on this form must be truthful and accurate, as any discrepancies could lead to penalties or denial of the appeal. Additionally, the form must be submitted within the specified deadlines to ensure that your request is processed. Familiarity with local laws regarding property tax appeals will help ensure that you are using the Ptax 343 R correctly and effectively.

Who Issues the Form

The Ptax 343 R is typically issued by the local property tax assessor's office or the relevant tax authority in your jurisdiction. This office is responsible for managing property assessments and ensuring compliance with tax laws. If you have questions about the form or the appeal process, contacting your local tax assessor's office can provide clarity and guidance.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 343 R can vary by state and local jurisdiction. It is crucial to be aware of these dates to ensure your appeal is submitted on time. Generally, deadlines are set shortly after property tax assessments are mailed out. Check with your local tax authority for specific dates related to your area to avoid missing the opportunity to contest your property tax assessment.

Quick guide on how to complete ptax 343 r

Complete Ptax 343 R effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and without delays. Handle Ptax 343 R on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to modify and eSign Ptax 343 R with ease

- Locate Ptax 343 R and click Get Form to begin.

- Utilize the features we offer to complete your form.

- Mark important areas of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to secure your modifications.

- Select your preferred way to send your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or missing files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ptax 343 R and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ptax 343 r and how does it relate to airSlate SignNow?

The ptax 343 r is a specific document that businesses may need to sign or submit electronically. With airSlate SignNow, you can easily eSign the ptax 343 r, ensuring compliance and streamlining your documentation process.

-

How can airSlate SignNow help in the completion of the ptax 343 r?

airSlate SignNow provides a user-friendly platform that allows you to efficiently fill out and eSign the ptax 343 r. Its intuitive interface simplifies the process, making it accessible for all users regardless of technical skills.

-

What are the pricing options for using airSlate SignNow for the ptax 343 r?

AirSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring you can manage the eSigning of the ptax 343 r affordably. You can choose from several tiers that provide different features depending on your requirements.

-

Are there any features in airSlate SignNow specifically for handling the ptax 343 r?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows that specifically facilitate the handling of the ptax 343 r. These features help you save time and reduce errors when filling out the document.

-

What are the benefits of using airSlate SignNow for the ptax 343 r?

Using airSlate SignNow for the ptax 343 r helps you save time and increase efficiency with its seamless eSigning process. Additionally, it enhances security, ensuring that your signed documents are safely stored and compliant with legal standards.

-

Can I integrate airSlate SignNow with other software for the ptax 343 r?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to easily manage the ptax 343 r within your existing systems. This ensures a smooth workflow and enhances overall productivity.

-

Is there a mobile app for airSlate SignNow to handle the ptax 343 r?

Yes, airSlate SignNow has a mobile app that enables you to eSign and manage the ptax 343 r on-the-go. This flexibility allows you to complete important documents anytime and anywhere, increasing your efficiency.

Get more for Ptax 343 R

Find out other Ptax 343 R

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later