Standby Letter of Credit Sample Hsbc 2015-2026

What is the standby letter of credit sample HSBC

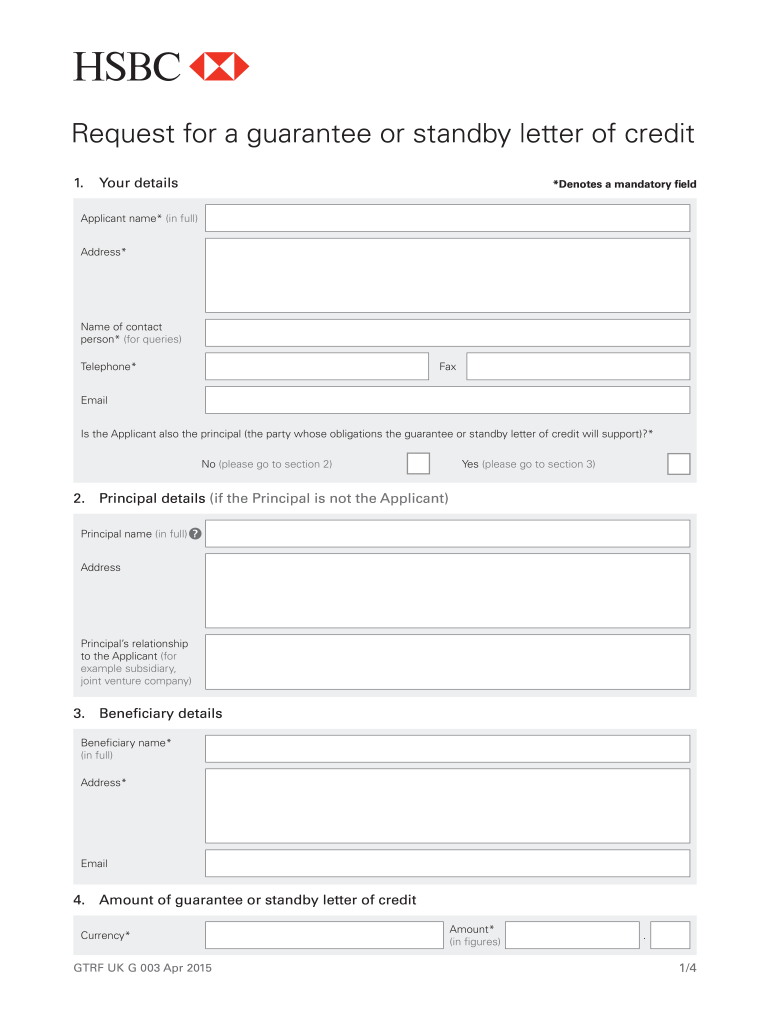

A standby letter of credit (SBLC) from HSBC is a financial instrument that serves as a guarantee for payment in case the applicant fails to fulfill contractual obligations. This document assures the beneficiary that they will receive payment up to a specified amount if the applicant defaults. The SBLC is often used in international trade, real estate transactions, and various business agreements to enhance trust between parties. The sample provided by HSBC outlines the necessary terms, conditions, and format required for a valid standby letter of credit.

Key elements of the standby letter of credit sample HSBC

The standby letter of credit sample from HSBC includes several critical components:

- Applicant Information: Details of the party requesting the SBLC.

- Beneficiary Information: Information of the party that will receive the payment guarantee.

- Amount: The maximum amount that the bank will pay under the SBLC.

- Expiration Date: The date when the SBLC will no longer be valid.

- Terms and Conditions: Specific requirements that must be met for the payment to be executed.

- Bank Details: Information about HSBC, including contact details and branch information.

Steps to complete the standby letter of credit sample HSBC

To properly fill out the standby letter of credit sample from HSBC, follow these steps:

- Gather Required Information: Collect all necessary details about the applicant, beneficiary, and transaction.

- Fill Out the Form: Accurately complete the sample form, ensuring all fields are filled in accordance with the requirements.

- Review for Accuracy: Double-check all information for correctness to avoid delays or rejections.

- Submit the Form: Send the completed form to HSBC through the preferred submission method, which may include online, mail, or in-person delivery.

- Confirm Receipt: Ensure that HSBC has received the application and verify any additional steps needed for processing.

Legal use of the standby letter of credit sample HSBC

The standby letter of credit sample from HSBC is legally binding once it is properly filled out and accepted by the bank. It must comply with relevant laws and regulations, ensuring that both the applicant and beneficiary understand their rights and obligations. The document serves as a safeguard in transactions, providing legal recourse in case of default. It is important to consult with legal counsel to ensure that the SBLC meets all necessary legal standards and requirements.

How to obtain the standby letter of credit sample HSBC

To obtain the standby letter of credit sample from HSBC, you can visit the official HSBC website or contact your local HSBC branch. The sample may also be available through customer service representatives who can provide guidance on the application process. Ensure you have all necessary documentation ready to facilitate the process. Additionally, HSBC may offer digital resources or templates that can be downloaded for convenience.

Examples of using the standby letter of credit sample HSBC

Standby letters of credit can be utilized in various scenarios, including:

- Construction Projects: Contractors may require an SBLC to guarantee payment for materials and labor.

- International Trade: Importers may use an SBLC to assure overseas suppliers of payment upon delivery of goods.

- Real Estate Transactions: Buyers may provide an SBLC as a guarantee to sellers during the purchase process.

Quick guide on how to complete guarantee and standby lc application form pdf hsbc

A concise manual on how to prepare your Standby Letter Of Credit Sample Hsbc

Locating the appropriate template can pose a challenge when you need to furnish formal international documentation. Even if you possess the necessary form, it can be cumbersome to swiftly complete it according to all stipulations if you rely on hard copies rather than handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these hurdles. It allows you to acquire your Standby Letter Of Credit Sample Hsbc and promptly fill it out and sign it on-site without reprinting documents in the event of an error.

Here are the actions you need to follow to prepare your Standby Letter Of Credit Sample Hsbc with airSlate SignNow:

- Click the Get Form button to upload your document to our editor immediately.

- Begin with the first blank field, enter the information, and proceed with the Next feature.

- Complete the empty spaces with the Cross and Check tools from the toolbar above.

- Select the Highlight or Line options to mark the most important information.

- Click on Image and upload one if your Standby Letter Of Credit Sample Hsbc requires it.

- Utilize the right-side pane to add extra fields for you or others to complete if necessary.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Create, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing by clicking the Done button and choosing your file-sharing options.

Once your Standby Letter Of Credit Sample Hsbc is prepared, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized into folders according to your preferences. Don’t spend time on manual document completion; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

Is there any need to fill out an application form separately for AFMC and ACMS?

Hi,As far as the entrance exam is concerned there are only 3 entrance exam for MEDICAL ADMISSIONS IN INDIA. That isNEETAIIMSJIPMERNow for getting admission in AFMC PUNE and ACMS DELHI one needs to appear for NEET 2019.Post your NEET Exam for AFMC PUNE you need to click on AFMC PUNE once you will be filling the form for MCC/DGHS counseling online. If you don't give your consent for AFMC you will not be shortlisted for same.So, MCC/DGHS will do Counseling for AFMC PUNE.FOR ACMS DELHI, you will be required to fill a separate application form for DELHI STATE GOVERNMENT COLLEGES, that is IPU Counseling form. The counseling for ACMS will be done by Indraprastha University.Hope this helps…For more information about MEDICAL ADMISSIONS and live counseling update you can contact us at Gyanshetra - Counseling Differently

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How can I use my PC to fill in PDF forms and edit if needed?

You’ll need a PDF editor to fill out forms. You can try PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

Create this form in 5 minutes!

How to create an eSignature for the guarantee and standby lc application form pdf hsbc

How to make an eSignature for the Guarantee And Standby Lc Application Form Pdf Hsbc in the online mode

How to generate an eSignature for your Guarantee And Standby Lc Application Form Pdf Hsbc in Google Chrome

How to generate an electronic signature for putting it on the Guarantee And Standby Lc Application Form Pdf Hsbc in Gmail

How to generate an electronic signature for the Guarantee And Standby Lc Application Form Pdf Hsbc right from your smartphone

How to make an eSignature for the Guarantee And Standby Lc Application Form Pdf Hsbc on iOS

How to create an eSignature for the Guarantee And Standby Lc Application Form Pdf Hsbc on Android OS

People also ask

-

What is a Standby Letter of Credit Sample HSBC?

A Standby Letter of Credit Sample HSBC is a financial document issued by HSBC that guarantees payment to a beneficiary in case the applicant fails to fulfill contractual obligations. It serves as a safety net for transactions, ensuring that parties involved are protected. Understanding this sample can help businesses navigate similar agreements effectively.

-

How can I use a Standby Letter of Credit Sample HSBC in my business transactions?

You can use a Standby Letter of Credit Sample HSBC to secure commercial transactions by providing a guarantee of payment. This document can be essential in international trade, construction contracts, and other high-value agreements where trust and assurance are critical. It is a tool that can enhance your business credibility.

-

What are the benefits of using a Standby Letter of Credit Sample HSBC?

Using a Standby Letter of Credit Sample HSBC provides several benefits, including reduced risk in transactions, improved cash flow management, and enhanced trust between parties. It assures the seller that they will receive payment, even in case of unforeseen issues, making it a valuable financial instrument.

-

What features should I look for in a Standby Letter of Credit Sample HSBC?

When reviewing a Standby Letter of Credit Sample HSBC, look for clarity in terms, conditions, and expiration dates. Additionally, ensure that the sample outlines the procedures for claims and the required documentation for drawing funds. These features will help you understand how to utilize the letter effectively.

-

Are there any costs associated with obtaining a Standby Letter of Credit from HSBC?

Yes, there are costs associated with obtaining a Standby Letter of Credit from HSBC, which can include issuance fees, renewal fees, and other service charges. It's important to discuss these costs upfront with your bank to understand the total expense involved. This can help you budget accordingly.

-

How does airSlate SignNow integrate with banking services like HSBC for Standby Letters of Credit?

airSlate SignNow integrates seamlessly with banking services like HSBC, allowing you to electronically sign and manage Standby Letters of Credit with ease. This integration simplifies the documentation process, making it efficient and secure. You can send and eSign your documents without needing to leave the platform.

-

Can I customize a Standby Letter of Credit Sample HSBC for my specific needs?

Absolutely! You can customize a Standby Letter of Credit Sample HSBC to meet your specific business requirements. By adjusting the terms and conditions, you can tailor the document to fit your transaction needs, ensuring it provides the necessary protections for both parties involved.

Get more for Standby Letter Of Credit Sample Hsbc

Find out other Standby Letter Of Credit Sample Hsbc

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure