Oklahoma 511nr Form

What is the Oklahoma 511nr

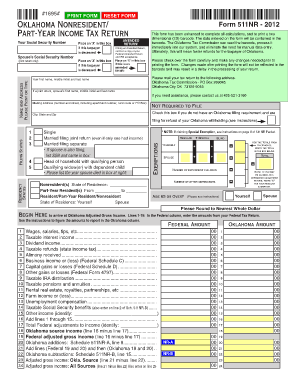

The Oklahoma Form 511 NR is a tax form specifically designed for non-residents who earn income in Oklahoma. This form allows individuals who do not reside in Oklahoma but have generated income from Oklahoma sources to report their earnings and calculate the appropriate tax liability. It is essential for ensuring compliance with state tax regulations and helps non-residents fulfill their tax obligations accurately.

How to use the Oklahoma 511nr

Using the Oklahoma Form 511 NR involves several steps to ensure accurate reporting of income and tax calculations. First, gather all necessary documentation, including W-2 forms and any other income statements from Oklahoma sources. Next, complete the form by entering your personal information, income details, and any applicable deductions. Once the form is filled out, review it for accuracy before submitting it to the Oklahoma Tax Commission.

Steps to complete the Oklahoma 511nr

Completing the Oklahoma Form 511 NR requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Oklahoma Form 511 NR.

- Fill in your personal information, including name, address, and Social Security number.

- Report all income earned from Oklahoma sources, including wages, interest, and dividends.

- Apply any eligible deductions or credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submitting it.

Legal use of the Oklahoma 511nr

The Oklahoma Form 511 NR is legally binding when completed and submitted according to state regulations. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, electronic submissions must comply with eSignature laws, such as the ESIGN Act and UETA, which recognize electronic signatures as legally equivalent to handwritten signatures. This compliance is crucial for the form to be accepted by the Oklahoma Tax Commission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Oklahoma Form 511 NR to avoid penalties. Typically, the form must be filed by April fifteenth of the year following the tax year in question. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may be available to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Form 511 NR can be submitted through various methods. Taxpayers have the option to file online through the Oklahoma Tax Commission's website, which offers a convenient and efficient way to submit tax forms. Alternatively, the form can be mailed directly to the Oklahoma Tax Commission or submitted in person at designated offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete oklahoma 511nr

Complete Oklahoma 511nr effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, as you can access the proper form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Oklahoma 511nr on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Oklahoma 511nr with ease

- Obtain Oklahoma 511nr and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your adjustments.

- Select your preferred method for delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Oklahoma 511nr and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma 511nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Form 511 NR 2022?

The Oklahoma Form 511 NR 2022 is a non-resident personal income tax form used by individuals who earn income in Oklahoma but reside in another state. This form allows non-residents to report their Oklahoma-source income and calculate their tax liability accurately.

-

How can airSlate SignNow help me complete the Oklahoma Form 511 NR 2022?

airSlate SignNow simplifies the process of completing the Oklahoma Form 511 NR 2022 by providing an intuitive platform for eSigning and sending documents securely. With easy templates and fields to fill, you can efficiently gather the necessary information for your tax submission.

-

Is airSlate SignNow a cost-effective solution for handling tax documents like the Oklahoma Form 511 NR 2022?

Yes, airSlate SignNow offers a cost-effective solution for managing your tax documents, including the Oklahoma Form 511 NR 2022. Our pricing plans are designed to suit businesses of all sizes, ensuring you get the features you need without overspending.

-

What features does airSlate SignNow provide for eSigning documents like the Oklahoma Form 511 NR 2022?

airSlate SignNow includes features such as customizable templates, multi-party signing, status notifications, and document tracking to streamline the eSigning process for the Oklahoma Form 511 NR 2022. These features ensure that your documents are handled professionally and securely.

-

Can I integrate airSlate SignNow with other applications for managing the Oklahoma Form 511 NR 2022?

Yes, airSlate SignNow offers integrations with various applications and platforms, allowing you to manage the Oklahoma Form 511 NR 2022 seamlessly. Whether you need to connect with CRM systems or cloud storage services, our integrations can enhance your workflow.

-

What are the benefits of using airSlate SignNow for my tax documents, including the Oklahoma Form 511 NR 2022?

Using airSlate SignNow for your tax documents like the Oklahoma Form 511 NR 2022 provides benefits such as increased efficiency, security, and ease of use. Our platform enables you to complete, send, and eSign your documents faster while ensuring that sensitive information is protected.

-

Is there customer support available for questions about the Oklahoma Form 511 NR 2022?

Absolutely! airSlate SignNow provides robust customer support to assist you with any questions regarding the Oklahoma Form 511 NR 2022. Our knowledgeable team is available to help you navigate the complexities of document management and eSigning.

Get more for Oklahoma 511nr

- Baycare doctors note form

- Utero license form

- Raymond james transfer on death form

- Form 9 transboundary movement

- South carolina certificate of religious exemption from form

- How fill up mva certification of insurance to operate vehicle form

- Muscogee creek nation clothing application 2014 form

- 2013 instructions for form 8801 internal revenue service irs

Find out other Oklahoma 511nr

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later