Fw8ben Form

What is the Fw8ben

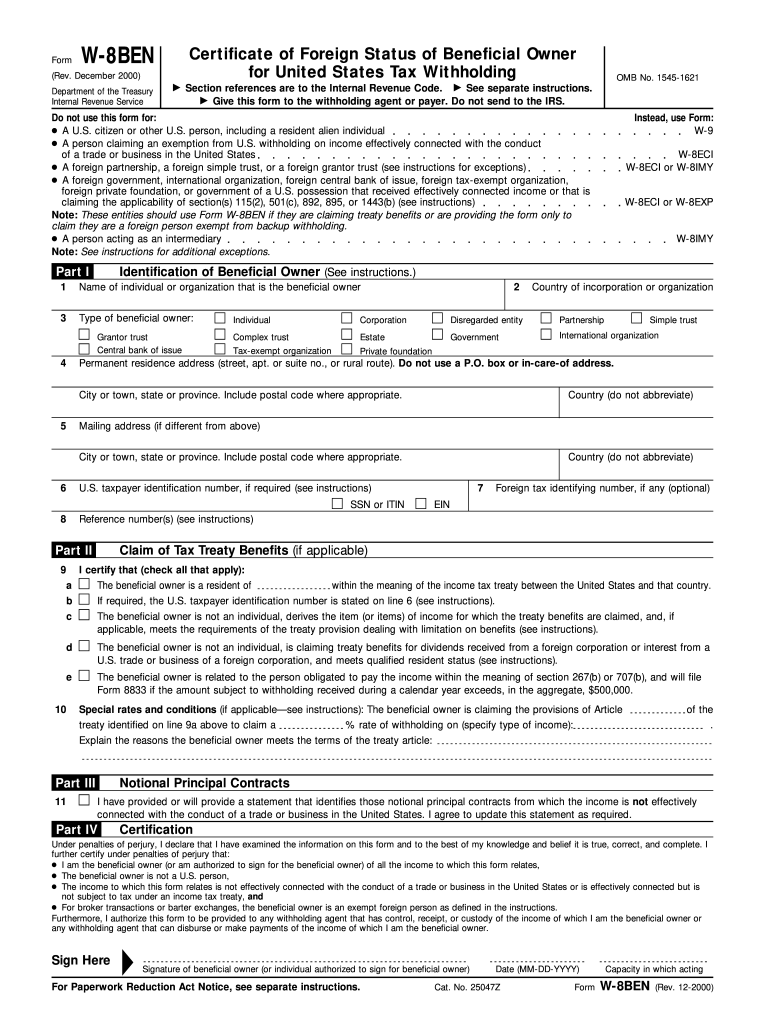

The Fw8ben form, officially known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), is a crucial document for foreign entities receiving income from U.S. sources. This form helps to establish that the entity is not a U.S. person and provides the necessary information for tax withholding purposes. By submitting the Fw8ben, foreign entities can claim benefits under an applicable tax treaty, potentially reducing the amount of tax withheld on U.S. income.

How to use the Fw8ben

Using the Fw8ben form involves several steps to ensure compliance with U.S. tax regulations. First, the entity must accurately complete the form, providing all required information, including the name, address, and taxpayer identification number. Next, the form should be submitted to the withholding agent or financial institution responsible for the payment. It is essential to keep a copy of the submitted form for record-keeping purposes. If any changes occur in the entity's status or information, a new Fw8ben must be submitted to reflect those changes.

Steps to complete the Fw8ben

Completing the Fw8ben form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Begin by entering the name of the beneficial owner and their country of incorporation.

- Provide the permanent address of the entity, ensuring it is not a P.O. box.

- Include the U.S. taxpayer identification number, if applicable, or state that it does not have one.

- Indicate the type of entity, such as corporation or partnership, and provide the relevant tax identification information.

- Sign and date the form, certifying that the information provided is accurate and complete.

Legal use of the Fw8ben

The Fw8ben form is legally binding when completed accurately and submitted to the appropriate parties. It serves as a declaration of the foreign entity's status and is essential for ensuring compliance with U.S. tax laws. The form must be filled out in accordance with IRS guidelines to be considered valid. Failure to submit a properly completed Fw8ben can result in higher withholding rates and potential penalties for non-compliance.

Key elements of the Fw8ben

Several key elements must be included in the Fw8ben form to ensure its validity:

- Beneficial Owner Information: Name, address, and taxpayer identification number.

- Entity Classification: Type of entity and country of incorporation.

- Claim of Tax Treaty Benefits: Specific articles of the treaty that apply.

- Signature: A signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Fw8ben form. Generally, the form should be submitted before the first payment is made to the foreign entity to avoid higher withholding taxes. Additionally, if there are any changes in the entity's status or information, a new Fw8ben must be filed promptly. Keeping track of these deadlines helps ensure compliance and minimizes potential tax liabilities.

Quick guide on how to complete fw8ben

Effortlessly Complete Fw8ben on Any Device

Digital document management has gained immense popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage Fw8ben on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

Effortlessly Edit and eSign Fw8ben

- Find Fw8ben and click on Get Form to begin.

- Utilize the provided tools to fill out your document.

- Use tools from airSlate SignNow to emphasize important sections or redact sensitive information.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and then click the Done button to save your changes.

- Choose how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or the need to print new copies due to errors. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign Fw8ben and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fw8ben

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fw8ben form and why is it important?

The fw8ben form is a key document used by foreign individuals and entities to signNow their foreign status for tax purposes in the United States. It helps in claiming a reduced tax rate on certain types of income. Understanding the fw8ben form is crucial for international businesses to ensure compliance and optimize their tax obligations.

-

How can airSlate SignNow assist with submitting the fw8ben form?

airSlate SignNow provides a streamlined platform for electronically signing and submitting the fw8ben form. With our easy-to-use interface, you can quickly complete and send your form, ensuring it signNowes the necessary authorities without delay. Our solution simplifies the entire process, making it efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for the fw8ben form?

Yes, airSlate SignNow offers several pricing plans designed to meet different business needs. Depending on the features you require, the cost can vary. Using our platform for the fw8ben form can prove to be a cost-effective solution, ensuring you avoid potential penalties and mistakes.

-

What features does airSlate SignNow offer for handling the fw8ben form?

airSlate SignNow offers features such as templates for the fw8ben form, user-friendly editing tools, and secure eSigning. You can also set reminders for recipients and track the document’s status in real time. These features ensure your fw8ben form is completed accurately and efficiently.

-

Can I integrate airSlate SignNow with my existing tools for the fw8ben process?

Absolutely! airSlate SignNow supports integrations with various applications that you may already use. This means you can easily incorporate the fw8ben form into your existing workflows, enhancing productivity and ensuring seamless communication between platforms.

-

What benefits does using airSlate SignNow provide for the fw8ben form?

Using airSlate SignNow for the fw8ben form offers numerous benefits, including time savings, enhanced security, and increased compliance. Automating the signing process reduces manual errors and helps maintain thorough records, which is essential for tax documentation and audits.

-

Is airSlate SignNow compliant with legal regulations for the fw8ben form?

Yes, airSlate SignNow complies with all relevant legal regulations and standards for electronic signatures. This ensures that your fw8ben form is legally binding and meets all necessary requirements. Trusting airSlate SignNow guarantees that your documentation processes are secure and compliant.

Get more for Fw8ben

Find out other Fw8ben

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF