Cra Form T1213 Oas

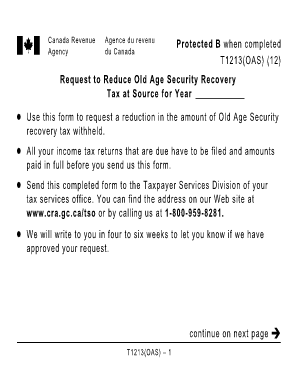

What is the CRA Form T1213 OAS?

The CRA Form T1213 OAS is a document used by individuals in Canada to request approval for a reduction in tax withholding on Old Age Security (OAS) benefits. This form is particularly relevant for those who expect to have lower taxable income in the year they receive OAS payments. By submitting this form, taxpayers can ensure that they do not overpay taxes on their benefits, allowing for better cash flow management throughout the year.

How to Obtain the CRA Form T1213 OAS

To obtain the CRA Form T1213 OAS, individuals can visit the official Canada Revenue Agency (CRA) website, where the form is available for download. It is important to ensure that you are using the most current version of the form to avoid any processing delays. Additionally, the form can be requested through local CRA offices or by contacting the CRA directly for assistance.

Steps to Complete the CRA Form T1213 OAS

Completing the CRA Form T1213 OAS involves several key steps:

- Gather necessary personal information, including your Social Insurance Number (SIN) and details about your OAS benefits.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Provide any supporting documentation that may be necessary to justify your request for reduced withholding.

- Review the completed form for accuracy before submission to avoid delays.

Legal Use of the CRA Form T1213 OAS

The CRA Form T1213 OAS is legally binding once submitted and approved by the CRA. It is essential to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or issues with tax compliance. The form serves as an official request for reduced withholding, aligning with Canadian tax laws and regulations.

Key Elements of the CRA Form T1213 OAS

Several key elements are crucial when filling out the CRA Form T1213 OAS:

- Identification Information: This includes your name, address, and SIN.

- OAS Benefit Details: Information about the expected amount of OAS benefits you will receive.

- Income Projections: An estimate of your total income for the year, which supports your request for reduced withholding.

- Signature: Your signature is required to validate the form and confirm that the information provided is accurate.

Form Submission Methods

The CRA Form T1213 OAS can be submitted through various methods:

- Online: Some taxpayers may have the option to submit the form electronically through the CRA's online services.

- Mail: The completed form can be mailed to the appropriate CRA office, as indicated on the form's instructions.

- In-Person: Individuals can also choose to deliver the form in person at their local CRA office for immediate processing.

Quick guide on how to complete cra form t1213 oas

Effortlessly Prepare Cra Form T1213 Oas on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly solution compared to traditional printed and signed documents, as you can access the appropriate template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your paperwork quickly, without any hold-ups. Manage Cra Form T1213 Oas on any device with the airSlate SignNow applications for Android or iOS and enhance any document-oriented task today.

The Simplest Way to Edit and eSign Cra Form T1213 Oas with Ease

- Obtain Cra Form T1213 Oas and then click Get Form to begin.

- Utilize the available tools to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which is quick and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, and mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device you choose. Edit and eSign Cra Form T1213 Oas to guarantee effective communication at any step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cra form t1213 oas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CRA Form T1213 OAS?

The CRA Form T1213 OAS is used by individuals to request a reduction in withholding tax on Old Age Security (OAS) payments. This form is essential for those seeking to manage their tax obligations efficiently. By using this form, you can ensure that the correct amount of tax is withheld on your OAS benefits.

-

How can airSlate SignNow help with the CRA Form T1213 OAS?

airSlate SignNow provides a user-friendly platform that allows you to fill out and send the CRA Form T1213 OAS electronically. The eSigning feature ensures that the documents are signed legally and securely. This streamlines the entire process, making it faster and more efficient for individuals handling tax paperwork.

-

Is there a cost associated with using airSlate SignNow for CRA Form T1213 OAS?

Yes, airSlate SignNow offers various pricing plans to fit different needs, including options for individuals who require assistance with forms like the CRA Form T1213 OAS. Pricing is competitive and designed to provide value through its features, making it a cost-effective solution for managing your tax documentation.

-

Can I integrate airSlate SignNow with other tools for CRA Form T1213 OAS management?

Absolutely! airSlate SignNow features numerous integrations that allow you to connect with popular CRM systems, cloud storage, and accounting software. These integrations enhance your ability to manage documents like the CRA Form T1213 OAS seamlessly within your existing workflows.

-

What features does airSlate SignNow offer for electronic signatures?

airSlate SignNow offers a range of powerful features for electronic signatures, including customizable templates, real-time tracking, and secure storage. These features ensure that your CRA Form T1213 OAS is handled with professionalism and compliance. You can also manage multiple signers effortlessly within the platform.

-

Are there any benefits to using airSlate SignNow for CRA Form T1213 OAS?

Using airSlate SignNow for the CRA Form T1213 OAS offers several benefits, such as reduced processing time and elimination of paper clutter. The platform enhances accuracy and reduces the risk of errors when filling out tax forms. Additionally, its legal compliance features give users peace of mind when managing sensitive documents.

-

How secure is my information when using airSlate SignNow for CRA Form T1213 OAS?

Security is a top priority at airSlate SignNow. The platform utilizes advanced encryption and secure cloud storage to protect your information while completing forms like the CRA Form T1213 OAS. You can confidently send and receive documents, knowing that your data is well-protected.

Get more for Cra Form T1213 Oas

- Referral form chestnut ridge counseling services inc

- Covina farmers market application form

- Rf 200 form

- Vacant unit rebate form

- Sc emp55352012 03 001e form

- Care of the well newbornlisa stellwagen pdf form

- Affidavit in support of registration of an out state of oregon courts oregon form

- Block party permit application street obstruction applications form

Find out other Cra Form T1213 Oas

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile