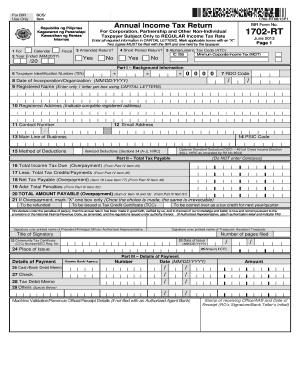

1702rt Form

What is the bir 1702 rt?

The bir 1702 rt is a tax form used by individuals and businesses in the United States to report annual income and calculate tax liabilities. This form is essential for ensuring compliance with federal tax regulations. It captures various income sources, deductions, and credits, allowing taxpayers to accurately report their financial situation to the Internal Revenue Service (IRS). Understanding the bir 1702 rt is crucial for effective tax planning and compliance.

How to use the bir 1702 rt

Using the bir 1702 rt involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Next, fill out the form by entering your personal information, income details, and deductions. It is important to review the form for accuracy before submission. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on your preference and the requirements of your state.

Steps to complete the bir 1702 rt

Completing the bir 1702 rt requires careful attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, report your total income from all sources, such as wages, dividends, and interest. After that, list any deductions you qualify for, such as business expenses or contributions to retirement accounts. Ensure that all calculations are accurate and double-check for any errors. Finally, sign and date the form before submitting it to the IRS or your state tax authority.

Legal use of the bir 1702 rt

The bir 1702 rt must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting all income and deductions, as well as adhering to filing deadlines. Failure to comply with these regulations can result in penalties, including fines or audits. It is essential to maintain accurate records and documentation to support the information provided on the form, as this can be crucial in the event of an inquiry from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the bir 1702 rt are critical to avoid penalties. Generally, the form must be submitted by April 15 of the year following the tax year being reported. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website or consult with a tax professional for any updates or changes to these deadlines, as they can vary based on individual circumstances or new legislation.

Required Documents

To complete the bir 1702 rt accurately, several documents are required. These typically include W-2 forms from employers, 1099 forms for additional income, records of any deductible expenses, and receipts for tax credits. Additionally, having previous tax returns on hand can be helpful for reference. Organizing these documents before starting the form can streamline the process and reduce the likelihood of errors.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the bir 1702 rt can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential audits. In severe cases, failure to file or report income accurately can result in criminal charges. It is essential to understand these risks and ensure timely and accurate filing to avoid such consequences.

Quick guide on how to complete 1702rt

Prepare 1702rt effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly and without delays. Handle 1702rt on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 1702rt effortlessly

- Find 1702rt and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign 1702rt and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1702rt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is bir 1702 rt and how can it benefit my business?

The bir 1702 rt is a crucial tax form for businesses in the Philippines that assists in reporting and paying taxes accurately. By using airSlate SignNow, you can easily send and eSign the bir 1702 rt, ensuring compliance and efficiency in your tax processes.

-

How does airSlate SignNow simplify the process of completing the bir 1702 rt?

airSlate SignNow streamlines the completion of the bir 1702 rt by providing a user-friendly interface that allows for quick document preparation and electronic signatures. This digital approach reduces paperwork and accelerates the submission process, making tax filing simpler for your business.

-

What features of airSlate SignNow support the bir 1702 rt documentation?

airSlate SignNow offers features such as customizable templates, collaboration tools, and secure eSigning that are specifically designed to support bir 1702 rt documentation. These capabilities help ensure that all required information is accurately captured and securely managed.

-

Is there a free trial available for airSlate SignNow to manage the bir 1702 rt?

Yes, airSlate SignNow offers a free trial that allows businesses to explore its features for managing the bir 1702 rt without any financial commitment. This trial enables you to evaluate how effectively the platform can streamline your documentation process.

-

How does pricing work for airSlate SignNow regarding the bir 1702 rt?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including for those needing to handle various forms like the bir 1702 rt. Pricing is based on the volume of transactions and features needed, making it a cost-effective solution for businesses.

-

Can I integrate airSlate SignNow with other software to manage the bir 1702 rt?

Absolutely! airSlate SignNow provides seamless integrations with various software applications, which can help you manage the bir 1702 rt alongside your existing tools. This ensures that your document workflows are more efficient and interconnected across platforms.

-

What are the security features of airSlate SignNow for sending the bir 1702 rt?

Security is a top priority for airSlate SignNow, with features like encryption and secure access controls to protect your bir 1702 rt documents. These measures help ensure that sensitive information remains confidential and is only accessible to authorized users.

Get more for 1702rt

Find out other 1702rt

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast