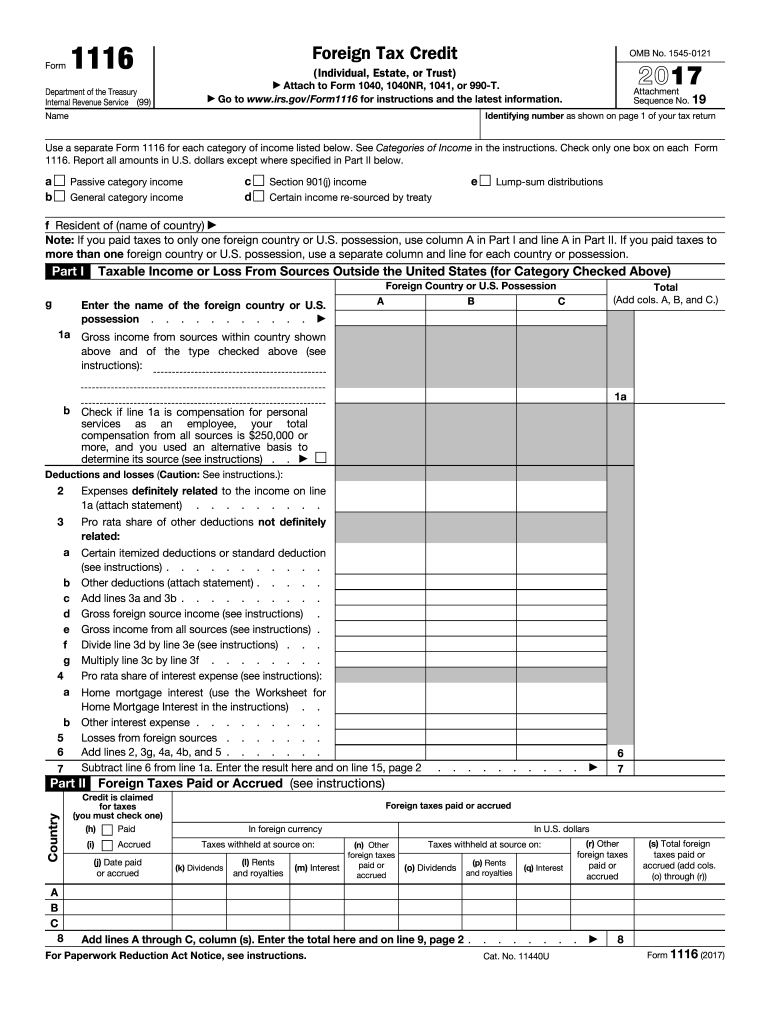

Irs Form

What is the IRS?

The IRS, or Internal Revenue Service, is the federal agency responsible for administering and enforcing the United States tax laws. It oversees the collection of taxes, processes tax returns, and issues refunds. The IRS also provides guidance on tax regulations and ensures compliance with tax laws, which are essential for funding government operations and services.

How to Use the IRS

Using the IRS involves understanding your tax obligations and utilizing their resources to file your taxes accurately. Taxpayers can access forms, instructions, and guidelines directly from the IRS website. It's important to determine which forms apply to your specific tax situation, whether you are an individual, a business, or a nonprofit organization. Familiarizing yourself with the available resources can simplify the filing process.

Steps to Complete the IRS Form

Completing an IRS form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Choose the correct IRS form based on your tax situation, such as Form 1040 for individual income tax.

- Fill out the form accurately, ensuring all required information is included.

- Review the completed form for errors or omissions.

- Submit the form electronically or by mail, following the specific instructions provided by the IRS.

Legal Use of the IRS

The legal use of IRS forms is crucial for compliance with U.S. tax laws. Each form must be filled out according to the IRS guidelines to ensure it is valid and accepted. Failure to comply with these guidelines can result in penalties or audits. Understanding the legal implications of your submissions helps in maintaining accurate records and avoiding issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for IRS forms vary depending on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Business tax deadlines can differ, so it is essential to check the IRS calendar for specific dates relevant to your situation. Missing these deadlines may result in penalties or interest on unpaid taxes.

Required Documents

When completing IRS forms, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the filing process and reduce the chance of errors.

Penalties for Non-Compliance

Failure to comply with IRS regulations can lead to various penalties. These may include fines for late filing, interest on unpaid taxes, and potential legal action for serious violations. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate tax submissions. Staying informed about your responsibilities helps avoid unnecessary penalties.

Quick guide on how to complete irs 100637075

Complete Irs effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Irs on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Irs with ease

- Locate Irs and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your preference. Modify and eSign Irs to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs 100637075

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for IRS document submissions?

airSlate SignNow provides features that streamline the process of submitting documents to the IRS. Users can easily create, send, and eSign IRS forms and documents, ensuring compliance and efficiency. The platform also allows for secure storage and tracking of these documents, minimizing the risk of errors and delays.

-

How does airSlate SignNow ensure IRS compliance?

With airSlate SignNow, you can be confident in IRS compliance as the platform adheres to industry-standard security protocols. It offers features like audit trails and secure signatures, so users have complete visibility of document handling. This is essential for compliance with IRS regulations and avoiding potential issues.

-

Is airSlate SignNow cost-effective for submitting IRS documents?

Yes, airSlate SignNow is a cost-effective solution for submitting IRS documents. Its pricing plans are designed to accommodate businesses of all sizes without hidden fees. This affordability, combined with robust features, makes it an ideal choice for those looking to manage IRS submissions efficiently.

-

What integrations does airSlate SignNow offer to facilitate IRS document processing?

airSlate SignNow integrates seamlessly with a variety of applications to simplify IRS document processing. Whether you use CRM systems, cloud storage solutions, or accounting software, these integrations enhance workflow efficiency. This ensures that your IRS-related documents are managed easily alongside your existing tools.

-

Can airSlate SignNow handle multiple IRS forms simultaneously?

Absolutely! airSlate SignNow allows users to manage multiple IRS forms at once, streamlining the submission process. You can send and receive signatures on various documents without the hassle of handling each one separately. This capability is especially beneficial during peak tax seasons.

-

How secure is airSlate SignNow for handling IRS documents?

Security is a top priority for airSlate SignNow, particularly when handling sensitive IRS documents. The platform employs strong encryption methods and secure access controls to protect your data. This means you can sign and store IRS documents with complete peace of mind.

-

What is the benefit of using airSlate SignNow for IRS-related tasks?

Using airSlate SignNow for IRS-related tasks brings several benefits, including time savings and enhanced efficiency. Its user-friendly interface enables quick document preparation and signing. Additionally, it minimizes the likelihood of errors, which can lead to IRS complications.

Get more for Irs

Find out other Irs

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document