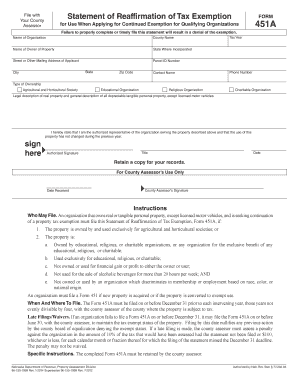

Form 451a

What is the Form 451a

The Form 451a is a specific document used primarily in Nebraska for tax purposes. It serves as a declaration form that individuals or businesses must complete to report certain information to the state. This form is essential for ensuring compliance with state tax regulations and helps streamline the tax filing process. Understanding the purpose and requirements of the Form 451a is crucial for taxpayers to avoid potential penalties and ensure accurate reporting.

How to use the Form 451a

Using the Form 451a involves several steps to ensure that all required information is accurately reported. First, gather all necessary documents and information that pertain to your tax situation. This may include income statements, previous tax returns, and any other relevant financial documentation. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency.

Steps to complete the Form 451a

Completing the Form 451a requires attention to detail and adherence to specific guidelines. Follow these steps to ensure proper completion:

- Begin by obtaining the latest version of the Form 451a from the official state website or authorized sources.

- Fill in your personal or business information, including name, address, and tax identification number.

- Provide any required financial details, such as income, deductions, and credits that apply to your situation.

- Review the form for accuracy, ensuring that all information is complete and correct.

- Submit the completed form according to the instructions provided, either electronically or via mail.

Legal use of the Form 451a

The Form 451a is legally binding when completed and submitted according to state regulations. It is important to understand that inaccuracies or omissions can lead to legal repercussions, including fines or audits. The form must be signed and dated by the individual or authorized representative to validate its contents. Compliance with all relevant laws and regulations is essential to ensure that the form is accepted by the state authorities.

State-specific rules for the Form 451a

Each state may have specific rules and requirements regarding the Form 451a. In Nebraska, it is essential to be aware of any unique provisions that may affect how the form is completed or submitted. This includes understanding deadlines for filing, any additional documentation that may be required, and specific instructions from the Nebraska Department of Revenue. Staying informed about state-specific regulations helps ensure compliance and avoids potential issues during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 451a are critical for compliance. Typically, the form must be submitted by a specific date each year, coinciding with the overall tax filing deadline. It is important to check the Nebraska Department of Revenue’s official calendar for the exact dates, as they may vary from year to year. Missing the deadline can result in penalties or interest charges, making timely submission essential for all taxpayers.

Required Documents

When preparing to complete the Form 451a, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns, which provide a reference for current reporting.

- Documentation of any deductions or credits claimed.

- Identification numbers, such as Social Security numbers or Employer Identification Numbers (EIN).

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete form 451a

Effortlessly Prepare Form 451a on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 451a on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign Form 451a with Ease

- Obtain Form 451a and then click Get Form to begin.

- Take advantage of the tools we provide to fill out your document.

- Emphasize key parts of your documents or conceal sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to finalize your edits.

- Choose how you wish to share your form: via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 451a to guarantee clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 451a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 451a and how can airSlate SignNow help with it?

Form 451a is a specific document used in various administrative processes. airSlate SignNow offers an efficient platform for creating, sending, and eSigning form 451a, ensuring you comply with legal requirements while saving time.

-

Is there a free trial available for using airSlate SignNow with form 451a?

Yes, airSlate SignNow offers a free trial that allows you to explore all its features, including those tailored for managing form 451a. This trial lets you experience how intuitive and beneficial the service is before committing to a paid plan.

-

What features does airSlate SignNow provide for form 451a?

airSlate SignNow provides features like document templates, real-time tracking, secure eSigning, and cloud storage specifically for form 451a. These features streamline the process and enhance collaboration among users, contributing to faster completion times.

-

How does airSlate SignNow ensure the security of my form 451a?

Security is a top priority for airSlate SignNow. All interactions with form 451a are protected using advanced encryption methods, ensuring that your sensitive information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other applications while using form 451a?

Absolutely! airSlate SignNow supports seamless integrations with various applications, allowing you to manage form 451a alongside other tools you already use. This flexibility enhances productivity and improves workflow efficiency.

-

What are the pricing options for using airSlate SignNow with form 451a?

airSlate SignNow offers several pricing tiers to accommodate different business needs when managing form 451a. Whether you are a small business or a large enterprise, you can find a plan that suits your budget and requirements.

-

How can I track the status of my form 451a documents in airSlate SignNow?

With airSlate SignNow, tracking the status of your form 451a documents is simple. You will receive real-time notifications, allowing you to monitor whether your documents are viewed, signed, or completed, ensuring full control over the process.

Get more for Form 451a

Find out other Form 451a

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form