Transaction Privilege Use and Severance Tax Return Form

What is the Transaction Privilege Use And Severance Tax Return

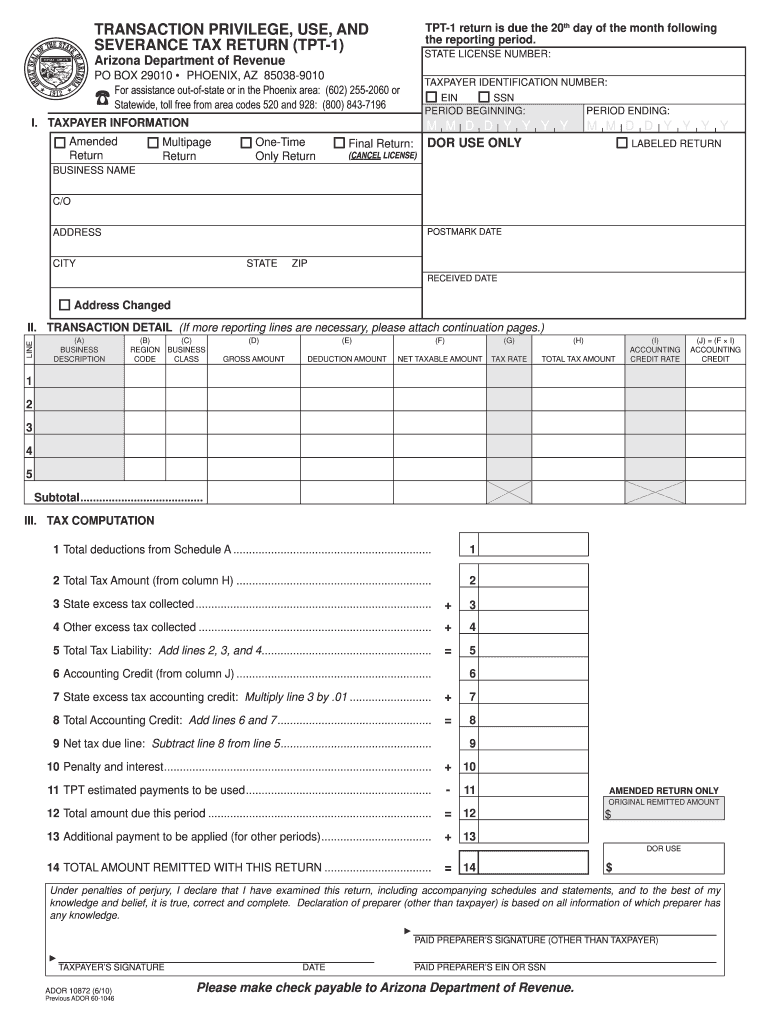

The Transaction Privilege Use And Severance Tax Return is a tax form used primarily in the United States to report and pay taxes on transactions involving the use of tangible personal property and services. This form is essential for businesses that engage in retail sales, rental, or leasing of tangible goods. It serves to ensure compliance with state tax laws and regulations, allowing businesses to accurately report their taxable activities. Understanding this form is crucial for maintaining legal compliance and avoiding potential penalties.

Steps to complete the Transaction Privilege Use And Severance Tax Return

Completing the Transaction Privilege Use And Severance Tax Return involves several key steps:

- Gather necessary financial records, including sales receipts and purchase invoices.

- Determine the total taxable sales for the reporting period.

- Calculate the applicable tax rate based on the jurisdiction where the sales occurred.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Transaction Privilege Use And Severance Tax Return

The legal use of the Transaction Privilege Use And Severance Tax Return is governed by state tax laws. Businesses must ensure that they are using the correct form and following the prescribed guidelines to avoid legal issues. This includes adhering to filing deadlines and accurately reporting taxable transactions. Non-compliance can lead to penalties, including fines and interest on unpaid taxes. It is advisable for businesses to consult with a tax professional to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Transaction Privilege Use And Severance Tax Return can vary by state. Generally, businesses are required to submit their returns on a monthly, quarterly, or annual basis, depending on their sales volume. It is crucial to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important tax dates can help ensure timely filing and compliance.

Form Submission Methods (Online / Mail / In-Person)

The Transaction Privilege Use And Severance Tax Return can typically be submitted through various methods, including:

- Online: Many states offer online filing options through their tax department websites, allowing for quick and efficient submission.

- Mail: Businesses can print the completed form and mail it to the appropriate state tax office.

- In-Person: Some states allow for in-person submission at designated tax offices, providing an opportunity for immediate assistance.

Penalties for Non-Compliance

Failure to comply with the requirements of the Transaction Privilege Use And Severance Tax Return can result in significant penalties. These may include:

- Monetary fines for late filing or underreporting of taxable sales.

- Interest charges on unpaid taxes, which can accumulate over time.

- Potential legal action for continued non-compliance, including audits and investigations by state tax authorities.

Quick guide on how to complete transaction privilege use and severance tax return

Effortlessly Prepare Transaction Privilege Use And Severance Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Transaction Privilege Use And Severance Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

Efficiently Modify and eSign Transaction Privilege Use And Severance Tax Return with Ease

- Obtain Transaction Privilege Use And Severance Tax Return and click on Get Form to initiate the process.

- Utilize the tools we supply to finalize your document.

- Mark important sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Transaction Privilege Use And Severance Tax Return to ensure outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transaction privilege use and severance tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Transaction Privilege Use And Severance Tax Return?

A Transaction Privilege Use And Severance Tax Return is a tax document that businesses must file to report the sale of tangible personal property and certain services. It helps in compliance with state tax requirements and ensures that businesses pay the correct amount of tax.

-

How can airSlate SignNow assist with filing a Transaction Privilege Use And Severance Tax Return?

airSlate SignNow facilitates the easy signing and sharing of documents associated with the Transaction Privilege Use And Severance Tax Return. This allows businesses to efficiently manage their tax paperwork without the hassle of manual signatures.

-

What features make airSlate SignNow ideal for managing Transaction Privilege Use And Severance Tax Returns?

airSlate SignNow offers features such as customizable templates, in-app payments, and secure document storage, specifically beneficial for managing Transaction Privilege Use And Severance Tax Returns. These features streamline the entire process, making compliance simpler for businesses.

-

Is airSlate SignNow a cost-effective solution for handling Transaction Privilege Use And Severance Tax Returns?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage their Transaction Privilege Use And Severance Tax Returns. Our flexible pricing plans provide affordable options tailored to various business sizes and requirements.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including Transaction Privilege Use And Severance Tax Returns, provides benefits like time savings, reduced paperwork, and improved compliance. Additionally, the ease of electronic signatures enhances workflow efficiency.

-

Can airSlate SignNow integrate with other accounting software for Transaction Privilege Use And Severance Tax Returns?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms. This allows businesses to synchronize their Transaction Privilege Use And Severance Tax Returns with their existing financial systems for greater accuracy and efficiency.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents, including the Transaction Privilege Use And Severance Tax Return. Users can trust that their data is safe and secure throughout the signing process.

Get more for Transaction Privilege Use And Severance Tax Return

Find out other Transaction Privilege Use And Severance Tax Return

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template