Ga State Withholding Form

What is the Ga State Withholding Form

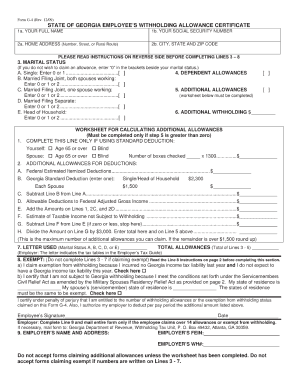

The Georgia State Withholding Form is a document used by employers to determine the amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with Georgia tax laws and helps employees manage their state tax obligations effectively. The form collects information such as the employee's filing status, number of allowances, and any additional withholding amounts the employee wishes to specify.

How to use the Ga State Withholding Form

Using the Georgia State Withholding Form involves several steps. First, employees must fill out the form accurately, providing their personal information and tax preferences. Once completed, the employer should review the form for accuracy and then retain it in their records. The information provided will guide the employer in calculating the correct amount of state tax to withhold from each paycheck. It is essential for employees to update this form whenever their personal or financial situations change, such as getting married or having a child.

Steps to complete the Ga State Withholding Form

Completing the Georgia State Withholding Form requires careful attention to detail. Here are the steps to follow:

- Enter your full name, address, and Social Security number at the top of the form.

- Select your filing status from the options provided, such as single, married, or head of household.

- Indicate the number of allowances you are claiming. This number affects the amount withheld from your paycheck.

- If desired, specify any additional amount you wish to withhold from each paycheck.

- Sign and date the form to certify that the information is accurate.

Key elements of the Ga State Withholding Form

Several key elements are crucial for the Georgia State Withholding Form to be valid and effective:

- Filing Status: This determines the tax rate applicable to the employee.

- Allowances: The number of allowances claimed directly impacts the withholding amount.

- Additional Withholding: Employees can request additional amounts to be withheld for tax purposes.

- Signature: The employee's signature certifies the accuracy of the information provided.

Legal use of the Ga State Withholding Form

The Georgia State Withholding Form is legally binding when completed correctly. It must comply with state tax regulations to ensure that the withholding amounts are accurate. Employers are required to keep this form on file for their records, as it may be requested by the Georgia Department of Revenue during audits or compliance checks. Failure to use the form properly can lead to penalties for both the employer and employee.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Georgia State Withholding Form can be done through various methods, depending on the employer's preferences. The form can be submitted:

- Online: Some employers may allow electronic submission through payroll software.

- Mail: Employees can send the completed form to their employer's payroll department via postal mail.

- In-Person: Employees can also deliver the form directly to their employer's HR or payroll office.

Quick guide on how to complete ga state withholding form

Complete Ga State Withholding Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle Ga State Withholding Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Ga State Withholding Form with ease

- Find Ga State Withholding Form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Ga State Withholding Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga state withholding form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a state withholding form?

A state withholding form is a document that employers use to determine how much state income tax should be withheld from an employee’s paycheck. It allows employees to specify their filing status and any additional amounts they want to withhold. Accurately completing your state withholding form ensures compliance with state tax laws and helps avoid tax liabilities.

-

How can I create a state withholding form using airSlate SignNow?

Creating a state withholding form with airSlate SignNow is straightforward. You can choose from customizable templates or upload your own to integrate your branding. The platform allows for easy editing and sharing of the form for electronic signatures, making the process seamless for both employers and employees.

-

What are the pricing options for using airSlate SignNow for state withholding forms?

AirSlate SignNow offers various pricing plans to suit different business sizes. Whether you're a small business or a large enterprise, there is a plan that accommodates your needs for managing documents like the state withholding form. Pricing is competitive and includes features like unlimited templates and integrations.

-

Does airSlate SignNow support integrations with other software for managing state withholding forms?

Yes, airSlate SignNow supports a wide range of integrations with popular software solutions, including HR and payroll systems. This ensures that your state withholding form data can be easily synchronized with existing platforms. With these integrations, you can streamline your workflow and ensure accuracy in tax compliance.

-

What features does airSlate SignNow offer for managing state withholding forms?

AirSlate SignNow provides robust features for managing state withholding forms, including customizable templates, secure eSigning, and real-time tracking of document status. Users can also set reminders for renewals or updates to ensure compliance with changing state tax regulations. These features simplify the process and enhance productivity.

-

Is airSlate SignNow secure for handling sensitive information like state withholding forms?

Absolutely! AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information found in state withholding forms. Your data is safeguarded against unauthorized access, ensuring compliance with privacy regulations.

-

Can I access my state withholding forms from multiple devices with airSlate SignNow?

Yes, airSlate SignNow is designed for accessibility across multiple devices. You can access and manage your state withholding forms from any computer, tablet, or smartphone with an internet connection. This flexibility allows you to work from anywhere, making document management convenient.

Get more for Ga State Withholding Form

- Certification of financial responsibility fillable form

- Contra costa standardized hmis intake form contra costa health cchealth

- How to fill tranfer request form

- Sky zone providence waiver form

- Response motion change form

- Form 40c 118113

- Custody registration form please initial virginia beach

- Distribution request nonqualifiediraroth sepsarsep lincoln form

Find out other Ga State Withholding Form

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT