Commonwealth of Pennsylvania Department of Revenue Bureau of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl Form

Understanding the Employee's Statement of Nonresidence in Pennsylvania

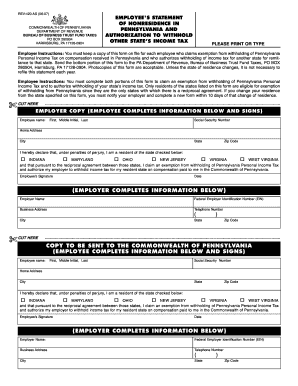

The Employee's Statement of Nonresidence in Pennsylvania is a crucial document for individuals who work in Pennsylvania but reside in another state. This form allows employees to declare their nonresidence status and authorize their employer to withhold taxes for their home state instead of Pennsylvania. It is essential for ensuring that employees are not subject to Pennsylvania state income tax, which could otherwise lead to double taxation.

This form is submitted to the Commonwealth of Pennsylvania Department of Revenue Bureau of Business Trust Fund Taxes, located at PO Box 280904, Harrisburg, PA 17. Proper completion and submission of this form can help streamline tax processes and ensure compliance with state regulations.

Steps to Complete the Employee's Statement of Nonresidence

Completing the Employee's Statement of Nonresidence in Pennsylvania involves several key steps:

- Obtain the form: The form can be downloaded from the Pennsylvania Department of Revenue website or requested directly from your employer.

- Fill in your personal information: Include your name, address, and Social Security number accurately to avoid any processing delays.

- Declare your nonresidence: Clearly state that you are a nonresident of Pennsylvania and provide details about your home state.

- Sign and date the form: Ensure that you sign the document to validate your declaration and authorize your employer to withhold taxes accordingly.

- Submit the form: Send the completed form to your employer, who will then forward it to the Pennsylvania Department of Revenue.

Legal Use of the Employee's Statement of Nonresidence

The legal use of the Employee's Statement of Nonresidence is governed by Pennsylvania tax law. This form is legally binding and must be completed accurately to ensure that the withholding tax is applied correctly. Employers are required to keep this form on file as part of their payroll records. Failure to submit this form may result in incorrect tax withholding and potential penalties for both the employee and employer.

Additionally, it is important to note that the form must be updated if there are any changes in residency status or employment. Keeping accurate records and complying with state regulations helps avoid legal complications.

Eligibility Criteria for the Employee's Statement of Nonresidence

To be eligible to complete the Employee's Statement of Nonresidence in Pennsylvania, an individual must meet the following criteria:

- Be a resident of a state other than Pennsylvania.

- Work in Pennsylvania and receive income from a Pennsylvania employer.

- Provide valid identification and proof of residency in the home state.

Meeting these criteria is essential for the successful processing of the form and to ensure that the correct state income tax is withheld.

Form Submission Methods for the Employee's Statement of Nonresidence

The Employee's Statement of Nonresidence can be submitted through various methods, depending on the employer's policies:

- In-person: Employees may submit the form directly to their employer's human resources or payroll department.

- By mail: The completed form can be mailed to the employer, who will then forward it to the Pennsylvania Department of Revenue.

- Online: Some employers may offer an electronic submission option through their payroll systems, allowing for quicker processing.

Choosing the appropriate method for submission can help ensure timely processing and compliance with tax regulations.

Quick guide on how to complete commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904

Effortlessly prepare Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and electronically sign your documents swiftly without delays. Manage Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl with ease

- Locate Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key areas of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or the need to print new document copies due to errors. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the employee's statement of nonresidence in Pennsylvania?

The employee's statement of nonresidence in Pennsylvania is essential for determining tax obligations for individuals who are not residents but work in the state. The form ensures accurate taxation in alignment with the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' This helps avoid unnecessary overtaxing of non-resident employees.

-

How can airSlate SignNow assist with filing forms related to Pennsylvania's tax requirements?

airSlate SignNow offers businesses a simple platform to eSign and send necessary documentation, including forms relevant to the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' Our service streamlines the process, ensuring that tax-related forms are submitted promptly and securely.

-

Are there any fees associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow provides a cost-effective solution for document management, starting with a range of pricing plans to suit different business needs. Users can manage their paperwork related to the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' efficiently without incurring high costs.

-

What features does airSlate SignNow offer for managing tax-related forms?

airSlate SignNow includes features such as document templates, eSigning, and secure cloud storage that simplify the handling of tax-related forms. You can easily utilize these tools for forms like the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' making managing tax obligations straightforward and efficient.

-

Can I integrate airSlate SignNow with other business applications?

Yes, airSlate SignNow supports integrations with a variety of business applications, enhancing the way you manage tax documents. You can seamlessly connect with your existing infrastructure to handle forms related to the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' efficiently.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority for airSlate SignNow. We provide advanced encryption measures to protect sensitive documents, including those related to the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' Rest assured your data is safe while managing your tax obligations electronically.

-

Is there customer support available for users of airSlate SignNow?

Absolutely! airSlate SignNow offers customer support to assist you with any inquiries regarding document management and eSignature processes. Whether you have questions about the 'commonwealth of pennsylvania department of revenue bureau of business trust fund taxes po box 280904 harrisburg pa 17128 0904 please print or typeemployee's statement of nonresidence in penns.' or any other issue, our team is here to help.

Get more for Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl

- Pc053048 notice of commencement work copy keep pascocountyfl form

- Complaintarrest affidavit 1306227002 201600064911 form

- 2017 gabwa membership application wordpresscom form

- Community internship log form xavier

- Get caloptima form

- Notice of right to reclaim or disposion of property under 500 disposing of property form

- Certificate of bequeathal indiana university anatomy medicine iu form

- Special use permit application pdf gwinnettcountyga form

Find out other Commonwealth Of Pennsylvania Department Of Revenue Bureau Of Business Trust Fund Taxes Po Box 280904 Harrisburg Pa 17128 0904 Pl

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy