1x Form

What is the 1x Form

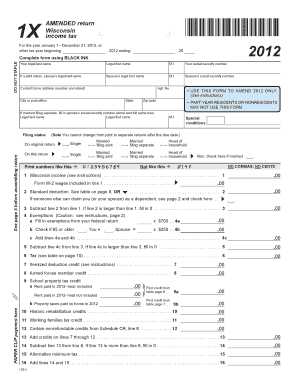

The 1x form is a crucial document used primarily for amending tax returns in the state of Wisconsin. It allows taxpayers to correct errors or make changes to their previously filed Wisconsin income tax returns. This form is essential for ensuring that all tax information is accurate and up-to-date, which can help prevent potential penalties or issues with the Wisconsin Department of Revenue.

How to use the 1x Form

Using the 1x form involves several straightforward steps. First, obtain the form from the Wisconsin Department of Revenue website or through authorized tax preparation software. Next, fill out the form with the necessary information, including your personal details and the specific changes you are making. It is important to provide accurate figures and explanations for any amendments. Finally, submit the completed form either electronically or via mail, following the instructions provided on the form.

Steps to complete the 1x Form

Completing the 1x form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes.

- Fill out the personal information section, ensuring your name, address, and Social Security number are correct.

- Indicate the tax year you are amending and explain the reasons for the amendment in the designated section.

- Make sure to recalculate your tax liability based on the changes and provide the updated amounts.

- Review the form for accuracy before submission to avoid delays or rejections.

Legal use of the 1x Form

The 1x form is legally recognized as a valid method for amending tax returns in Wisconsin. To ensure its legal standing, it must be filled out accurately and submitted within the appropriate time frame. The form must comply with state regulations, and it is advisable to keep copies of all submitted documents for your records. Proper use of the 1x form can help protect against legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 1x form are critical to ensure compliance with Wisconsin tax laws. Generally, taxpayers must file the 1x form within three years of the original return's due date. Additionally, if you are claiming a refund, it is important to submit the form within the specified timeframe to avoid losing the opportunity for a refund. Always check the Wisconsin Department of Revenue for any updates or changes to deadlines.

Form Submission Methods

The 1x form can be submitted through various methods to accommodate different preferences. Taxpayers can file the form electronically using approved e-filing software, which is often the quickest method. Alternatively, the form can be mailed to the Wisconsin Department of Revenue or submitted in person at designated locations. Each method has its own processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete 1x form

Complete 1x Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 1x Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign 1x Form with ease

- Find 1x Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal standing as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, or shareable link—or download it to your computer.

Eliminate concerns about missing or lost files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Edit and electronically sign 1x Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1x form in airSlate SignNow?

A 1x form in airSlate SignNow refers to a single-use document that can be completed and signed once. This feature is designed for efficiency, allowing users to send documents that require immediate attention without the need for repetitive access. By utilizing 1x forms, businesses can streamline their signing processes and ensure timely completion.

-

How do I create a 1x form in airSlate SignNow?

Creating a 1x form in airSlate SignNow is straightforward. Simply select the 'Create Document' option, upload your file, and choose the '1x form' option during the setup process. This allows you to specify that the document will be used for single signing sessions, enhancing control over document access.

-

What are the benefits of using 1x forms for my business?

Using 1x forms offers several benefits for businesses, including enhanced security and reduced response times. These forms eliminate the need for multiple access, ensuring that documents are only seen and signed by the intended users. This targeted approach minimizes the risk of unauthorized access and accelerates workflow.

-

Are 1x forms compatible with other document types in airSlate SignNow?

Yes, 1x forms are fully compatible with various document types in airSlate SignNow. You can convert existing documents into 1x forms or create new ones from scratch. This compatibility ensures that businesses can utilize their preferred document formats while maintaining the benefits of single-use flexibility.

-

What pricing options are available for using 1x forms in airSlate SignNow?

airSlate SignNow offers various pricing plans that accommodate users of all sizes. The ability to utilize 1x forms is included in most plans, providing an accessible solution for businesses to streamline their signing processes without incurring extra costs. Visit our pricing page to find the plan that best suits your needs.

-

Can 1x forms be integrated with other applications?

Absolutely! airSlate SignNow provides integrations with many applications, allowing 1x forms to be seamlessly incorporated into your existing workflows. Whether you are using CRM software or project management tools, our integration capabilities ensure that you can enhance productivity and keep everything connected.

-

Is it easy to track the status of 1x forms sent out for signing?

Yes, airSlate SignNow offers robust tracking capabilities for all 1x forms. You can easily monitor the status of documents from your dashboard, ensuring you stay updated on who has signed and when. This feature provides peace of mind and helps maintain efficient follow-up processes.

Get more for 1x Form

- Get 404034234 form

- National dairy quality awards nomination form nmconline

- Ktc form

- Ismp form

- Permission to transfer credit form college of liberal arts libarts olemiss

- Construction phase plan template form

- Tenant application form newdocxdoc

- Free trade agreement between canada and korea cbsa asfc gc form

Find out other 1x Form

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed