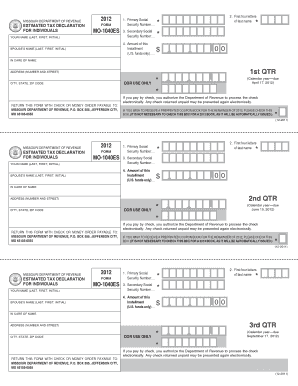

Mo 1040 Es Form

What is the Mo 1040 ES?

The Mo 1040 ES is a form used by taxpayers in Missouri to estimate and pay their state income tax. This form is particularly important for individuals who expect to owe tax of $100 or more when they file their annual return. The Mo 1040 ES allows taxpayers to make quarterly estimated tax payments, ensuring that they meet their tax obligations throughout the year rather than facing a large bill at tax time. This form is essential for self-employed individuals, freelancers, and those with significant income that is not subject to withholding.

Steps to Complete the Mo 1040 ES

Completing the Mo 1040 ES involves several straightforward steps:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year based on your expected income.

- Determine the amount you need to pay for each quarter, dividing your total estimated tax by four.

- Fill out the Mo 1040 ES form with your personal information and estimated tax amounts.

- Submit the form along with your payment by the due date for each quarter.

Legal Use of the Mo 1040 ES

The Mo 1040 ES is legally binding when filled out and submitted according to Missouri state tax laws. It is important to ensure that all information provided is accurate and complete to avoid penalties. The form must be submitted by the specified deadlines to maintain compliance with state regulations. Failure to submit the Mo 1040 ES on time can result in interest and penalties, which can add to the overall tax burden.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Mo 1040 ES. Payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is crucial to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Who Issues the Form

The Mo 1040 ES is issued by the Missouri Department of Revenue. This state agency is responsible for the administration of tax laws and ensures that taxpayers have access to the necessary forms and guidance for compliance. Taxpayers can obtain the Mo 1040 ES directly from the Department of Revenue’s website or through authorized tax preparation services.

Examples of Using the Mo 1040 ES

There are various scenarios in which taxpayers might need to use the Mo 1040 ES:

- A self-employed individual who earns income from freelance work and expects to owe taxes at the end of the year.

- A retiree with substantial investment income that is not subject to withholding.

- A business owner who anticipates profits exceeding the withholding amounts from their employees.

In each case, using the Mo 1040 ES helps manage tax payments proactively and avoids a large tax bill at year-end.

Quick guide on how to complete mo 1040 es

Complete Mo 1040 Es effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Mo 1040 Es on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Mo 1040 Es with ease

- Find Mo 1040 Es and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Mo 1040 Es and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1040 es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Missouri 1040ES and who needs it?

Missouri 1040ES is an estimated tax payment form used by individuals who expect to owe tax on income that is not subject to withholding. Taxpayers in Missouri who anticipate owing more than $100 in taxes should file this form to avoid penalties. Understanding the Missouri 1040ES is crucial for ensuring compliance and avoiding surprises come tax time.

-

How can airSlate SignNow help with the Missouri 1040ES process?

airSlate SignNow simplifies the process of filling out and submitting your Missouri 1040ES. Our platform allows you to securely eSign and send documents efficiently, reducing the time and effort typically needed for tax submissions. With airSlate SignNow, you can focus more on your taxes while we handle the paperwork.

-

Does airSlate SignNow support filing Missouri 1040ES online?

Yes, airSlate SignNow supports the online management and submission of the Missouri 1040ES. Our user-friendly interface allows you to complete your tax documents electronically, ensuring a faster and more convenient filing process. By going digital, you can also keep your records organized and easily accessible.

-

Are there any costs associated with using airSlate SignNow for Missouri 1040ES?

Yes, while airSlate SignNow offers a cost-effective solution for managing documents, there may be subscription fees based on your usage. However, these costs are typically outweighed by the time and hassle saved during the filing process for your Missouri 1040ES. We offer various pricing plans to suit different needs.

-

Can I integrate airSlate SignNow with other accounting software for Missouri 1040ES?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software tools. This makes it easier to manage your financial documents, including the Missouri 1040ES, all in one place and enhances your overall workflow efficiency.

-

What features does airSlate SignNow offer for Missouri 1040ES users?

airSlate SignNow provides features such as document templates, eSigning, and cloud storage to streamline your tax processes. These tools enhance user efficiency while managing the Missouri 1040ES, ensuring you have everything you need at your fingertips. Additionally, our platform offers real-time tracking for peace of mind.

-

Is airSlate SignNow secure for handling Missouri 1040ES documents?

Yes, airSlate SignNow prioritizes security and uses advanced encryption protocols to protect your sensitive information, including Missouri 1040ES documents. We are compliant with industry standards to ensure that your data is safeguarded during the signing and sending process, thus giving you peace of mind.

Get more for Mo 1040 Es

Find out other Mo 1040 Es

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document