Erc Form Download

What is the ERC Form Download

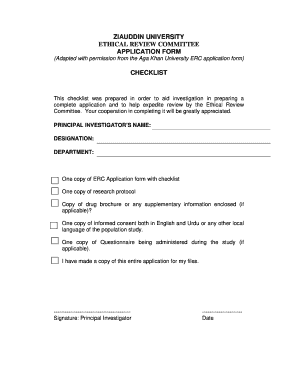

The ERC Form, specifically known as the ERC Form Ziauddin, is a critical document used for claiming the Employee Retention Credit (ERC). This form allows businesses to report eligible wages and claim tax credits designed to support employers during challenging economic times. Understanding the purpose of this form is essential for businesses looking to maximize their financial relief under the ERC program.

How to Use the ERC Form Download

Using the ERC Form Ziauddin involves several straightforward steps. First, download the form from a reliable source. Next, gather all necessary information, including employee wages and relevant tax details. Once you have completed the form, review it for accuracy before submitting it to the appropriate tax authority. This ensures that your claim is processed efficiently and reduces the risk of delays.

Steps to Complete the ERC Form Download

Completing the ERC Form Ziauddin requires careful attention to detail. Here’s a step-by-step guide:

- Download the ERC Form from a trusted source.

- Collect all required documentation, including payroll records and tax identification numbers.

- Fill out the form with accurate information regarding eligible wages and employee counts.

- Double-check the form for any errors or omissions.

- Submit the completed form to the IRS or your state tax agency as required.

Legal Use of the ERC Form Download

The ERC Form Ziauddin is legally binding when completed correctly and submitted in accordance with IRS guidelines. It is essential to adhere to the legal requirements surrounding the form, including maintaining accurate records and ensuring compliance with tax laws. Failure to do so may result in penalties or denial of the claimed credits.

Eligibility Criteria

To qualify for the Employee Retention Credit using the ERC Form, businesses must meet specific eligibility criteria. These criteria include demonstrating a significant decline in gross receipts or being subject to a government order that fully or partially suspends operations. Understanding these requirements is crucial for businesses to ensure they are eligible to claim the credit.

Form Submission Methods

The ERC Form Ziauddin can be submitted through various methods, depending on the specific requirements set by the IRS. Businesses may file the form electronically using approved e-filing systems or submit it via traditional mail. It is important to choose the method that best suits your business needs and ensures timely processing of your claim.

Quick guide on how to complete erc form download

Effortlessly Prepare Erc Form Download on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, amend, and electronically sign your documents promptly without any holdups. Handle Erc Form Download on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Erc Form Download effortlessly

- Find Erc Form Download and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or black out confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Erc Form Download and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the erc form download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the erc form ziauddin and how does it work?

The erc form ziauddin is specifically designed to facilitate efficient document signing and management. Using airSlate SignNow, businesses can easily upload, share, and eSign the erc form ziauddin, streamlining their workflow and ensuring compliance.

-

How much does it cost to use airSlate SignNow for the erc form ziauddin?

airSlate SignNow offers a variety of subscription plans that cater to different business needs. Prices are competitive, allowing you to efficiently manage processes involving the erc form ziauddin without breaking the bank.

-

What features does airSlate SignNow offer for the erc form ziauddin?

airSlate SignNow provides advanced features such as document templates, automatic reminders, and secure cloud storage for the erc form ziauddin. These tools enhance user convenience and ensure that important documents are signed promptly.

-

Can I integrate airSlate SignNow with other tools for the erc form ziauddin?

Yes, airSlate SignNow supports various integrations with popular tools like Google Drive, Dropbox, and Salesforce. This allows for seamless management of the erc form ziauddin across different platforms, enhancing productivity.

-

What are the benefits of using airSlate SignNow for the erc form ziauddin?

Using airSlate SignNow for the erc form ziauddin means you can expedite the signing process, reduce paper waste, and increase overall efficiency. The platform’s user-friendly interface simplifies the document management experience.

-

Is airSlate SignNow secure for handling the erc form ziauddin?

Absolutely! airSlate SignNow implements high-level security measures, including encryption and secure access protocols, to protect the erc form ziauddin and any sensitive data. You can rest assured that your documents are safe.

-

How can I get started with airSlate SignNow for the erc form ziauddin?

Getting started is easy! Simply sign up for an airSlate SignNow account, choose the subscription that best fits your needs, and begin uploading your erc form ziauddin for easy signing and management.

Get more for Erc Form Download

Find out other Erc Form Download

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement