Ca Ftb Form 100

What is the Ca Ftb Form 100

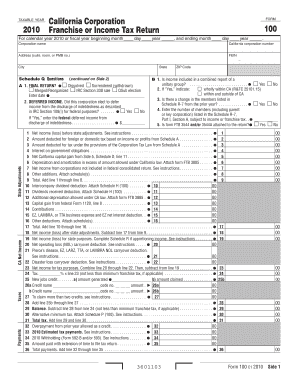

The Ca Ftb Form 100 is the California Corporation Franchise Tax Board's tax return form specifically designed for corporations operating within the state. This form is essential for reporting income, calculating taxes owed, and ensuring compliance with state tax regulations. Corporations, including C corporations and certain limited liability companies (LLCs), must file this form annually to report their financial activities and determine their tax liabilities.

How to obtain the Ca Ftb Form 100

To obtain the Ca Ftb Form 100, individuals can visit the California Franchise Tax Board's official website, where the form is available for download in PDF format. Additionally, physical copies can be requested through mail or by visiting local tax offices. It is advisable to ensure that you have the correct version of the form for the specific tax year, as forms may be updated annually.

Steps to complete the Ca Ftb Form 100

Completing the Ca Ftb Form 100 involves several key steps:

- Gather financial documents: Collect all necessary financial records, including income statements, balance sheets, and any relevant deductions.

- Fill in corporate information: Enter the corporation's name, address, and identification number at the top of the form.

- Report income: Accurately report all sources of income, including sales, services, and any other revenue streams.

- Calculate deductions: Identify and calculate applicable deductions to reduce taxable income.

- Determine tax owed: Use the provided tax tables to calculate the total tax liability based on reported income and deductions.

- Sign and date the form: Ensure that an authorized individual signs the form before submission.

Legal use of the Ca Ftb Form 100

The Ca Ftb Form 100 is legally binding when completed accurately and submitted in accordance with California tax laws. It serves as an official declaration of a corporation's financial status and tax obligations. To ensure its legal validity, it is crucial to maintain compliance with all filing requirements and deadlines set by the California Franchise Tax Board.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the Ca Ftb Form 100 to avoid penalties. Generally, the form is due on the 15th day of the fourth month after the close of the corporation's fiscal year. For corporations operating on a calendar year, the deadline is typically April 15. Extensions may be available, but it is important to file the extension request before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Ca Ftb Form 100 can be submitted through various methods to accommodate different preferences:

- Online: Corporations can file electronically using the California Franchise Tax Board's online services, which may offer a streamlined process.

- Mail: Completed forms can be printed and mailed to the appropriate address specified in the form instructions.

- In-Person: Corporations may also choose to deliver the form in person at designated tax offices for immediate processing.

Quick guide on how to complete ca ftb form 100

Prepare Ca Ftb Form 100 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Ca Ftb Form 100 on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to adjust and electronically sign Ca Ftb Form 100 with ease

- Obtain Ca Ftb Form 100 and click on Get Form to commence.

- Make use of the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ca Ftb Form 100 to ensure excellent communication at every phase of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ca ftb form 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2010 CA FTB Form 100?

The 2010 CA FTB Form 100 is the California Corporation Franchise Tax Board return form used by corporations operating in California. It is essential for businesses to report their income, deductions, and tax payments accurately. Completing this form correctly ensures compliance with California tax laws.

-

How can airSlate SignNow help with the 2010 CA FTB Form 100?

airSlate SignNow provides a streamlined platform to create, send, and eSign the 2010 CA FTB Form 100. With its user-friendly interface, you can easily manage multiple signers and track document statuses, simplifying the tax filing process for your business.

-

Is there a cost associated with using airSlate SignNow for the 2010 CA FTB Form 100?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses looking to manage their documents, including the 2010 CA FTB Form 100. By choosing a plan that fits your organization, you can enjoy efficient features at a reasonable cost.

-

What features does airSlate SignNow offer for handling the 2010 CA FTB Form 100?

airSlate SignNow provides features such as templating, document tracking, and in-app notifications for the 2010 CA FTB Form 100. These tools simplify the preparation and submission of tax documents, ensuring you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for the 2010 CA FTB Form 100?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, allowing for smooth handling of the 2010 CA FTB Form 100. This integration ensures that your data is consistent and accurate across all platforms.

-

What are the benefits of using airSlate SignNow for the 2010 CA FTB Form 100?

Using airSlate SignNow for the 2010 CA FTB Form 100 offers benefits such as increased efficiency in document management, reduced errors, and faster filing times. These advantages lead to a stress-free tax filing experience for your business.

-

Is airSlate SignNow compliant with California tax regulations for the 2010 CA FTB Form 100?

Yes, airSlate SignNow adheres to all necessary legal and compliance standards related to California tax regulations. This compliance ensures that when you use our platform to manage the 2010 CA FTB Form 100, your submissions are secure and valid.

Get more for Ca Ftb Form 100

- Zoning petition form mainegov

- Zoning petition form maine

- Apprenticestudent lobster amp crab harvesting 2018 form

- Annual fee 2600 2016 bait wholesale application mainegov maine form

- Maine guide license 2017 2019 form

- Maine guide renewal 2016 form

- Notification of intent to operate a special state of michigan michigan form

- Mattawan michigan mechanical permit 2012 2019 form

Find out other Ca Ftb Form 100

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy