California Payment Voucher Paper File Form

What is the California Payment Voucher Paper File

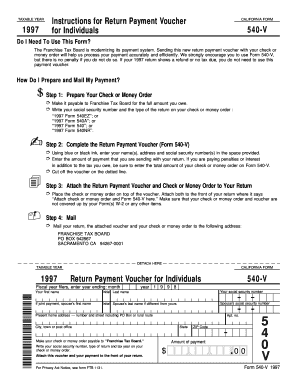

The California payment voucher paper file, commonly referred to as the form 540 V, is a document used by taxpayers in California to submit payment for their state income tax liabilities. This form is essential for individuals who owe taxes and prefer to make payments via check or money order. It serves as a remittance slip that accompanies the payment, ensuring that the funds are applied to the correct tax account. The form includes important information such as the taxpayer's name, address, and the amount being paid, making it a crucial component of the tax filing process.

How to use the California Payment Voucher Paper File

Using the California payment voucher paper file involves a few straightforward steps. First, taxpayers should download the form from the California Franchise Tax Board (FTB) website. Once downloaded, the taxpayer needs to fill out their personal information, including their name, address, and Social Security number. Next, the taxpayer should indicate the amount they are paying. After completing the form, it should be printed and included with the payment. The completed voucher and payment can then be mailed to the appropriate address provided by the FTB.

Steps to complete the California Payment Voucher Paper File

Completing the California payment voucher paper file requires attention to detail. Follow these steps:

- Download the form 540 V from the FTB website.

- Provide your full name, address, and Social Security number in the designated fields.

- Indicate the payment amount clearly.

- Sign and date the form to validate your payment.

- Attach your check or money order, made payable to the "Franchise Tax Board."

- Mail the completed voucher and payment to the address specified on the form.

Legal use of the California Payment Voucher Paper File

The California payment voucher paper file is legally binding when filled out and submitted correctly. It complies with the regulations set forth by the California Franchise Tax Board, ensuring that payments are processed accurately. Using this form helps taxpayers fulfill their legal obligations regarding state income tax payments. It is essential to keep a copy of the completed voucher for personal records, as it serves as proof of payment in case of any discrepancies or audits.

Filing Deadlines / Important Dates

Timely submission of the California payment voucher paper file is crucial to avoid penalties and interest. Generally, payments are due on the same date as the state income tax return, which is typically April 15 for most taxpayers. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the FTB website for any updates regarding specific filing deadlines and important dates related to tax payments.

Required Documents

To complete the California payment voucher paper file, taxpayers need the following documents:

- A completed form 540 V.

- A check or money order for the payment amount.

- A copy of the California tax return (if applicable) for reference.

Having these documents ready will streamline the payment process and ensure compliance with state tax regulations.

Quick guide on how to complete california payment voucher paper file

Prepare California Payment Voucher Paper File effortlessly on any device

Virtual document administration has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the needed template and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any delays. Manage California Payment Voucher Paper File on any system using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign California Payment Voucher Paper File without hassle

- Obtain California Payment Voucher Paper File and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Select important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow that are designed specifically for this.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign California Payment Voucher Paper File and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california payment voucher paper file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA 540V form and why do I need to download it?

The CA 540V form is a payment voucher for California state personal income tax. You need to download the CA 540V to ensure you submit your taxes accurately and on time. Using airSlate SignNow simplifies the process, allowing you to eSign and manage your tax documents seamlessly.

-

How can I download the CA 540V form using airSlate SignNow?

To download the CA 540V form, simply log into your airSlate SignNow account, navigate to the forms library, and search for the CA 540V. Once located, you can easily download it directly to your device for printing or eSigning.

-

Is there a fee associated with downloading the CA 540V form?

There is no fee specifically for downloading the CA 540V form through airSlate SignNow; however, you may require a subscription to access advanced features. The pricing is designed to be cost-effective, providing great value for businesses and individuals alike.

-

What features does airSlate SignNow offer for managing the CA 540V download?

airSlate SignNow offers a range of features for managing your CA 540V download, including electronic signatures, document tracking, and customizable templates. This ensures that you can complete your tax forms quickly and efficiently, reducing the risk of errors.

-

Can I integrate other tools with airSlate SignNow for my CA 540V download?

Yes, airSlate SignNow supports integrations with various productivity tools, making it easy to manage your CA 540V download alongside your favorite applications. Integrate with platforms like Google Drive and Dropbox to streamline your document workflow.

-

What are the benefits of using airSlate SignNow for my CA 540V download?

Using airSlate SignNow for your CA 540V download offers numerous benefits, including time savings, enhanced security for sensitive documents, and an intuitive user interface. It empowers you to eSign and organize your tax documents without the hassle of traditional paperwork.

-

Is airSlate SignNow secure for handling sensitive documents like the CA 540V?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your sensitive documents like the CA 540V. You can confidently manage your tax documents, knowing your information is safe.

Get more for California Payment Voucher Paper File

Find out other California Payment Voucher Paper File

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease