Michigan Home Heating Credit Calculator Form

What is the Michigan Home Heating Credit Calculator

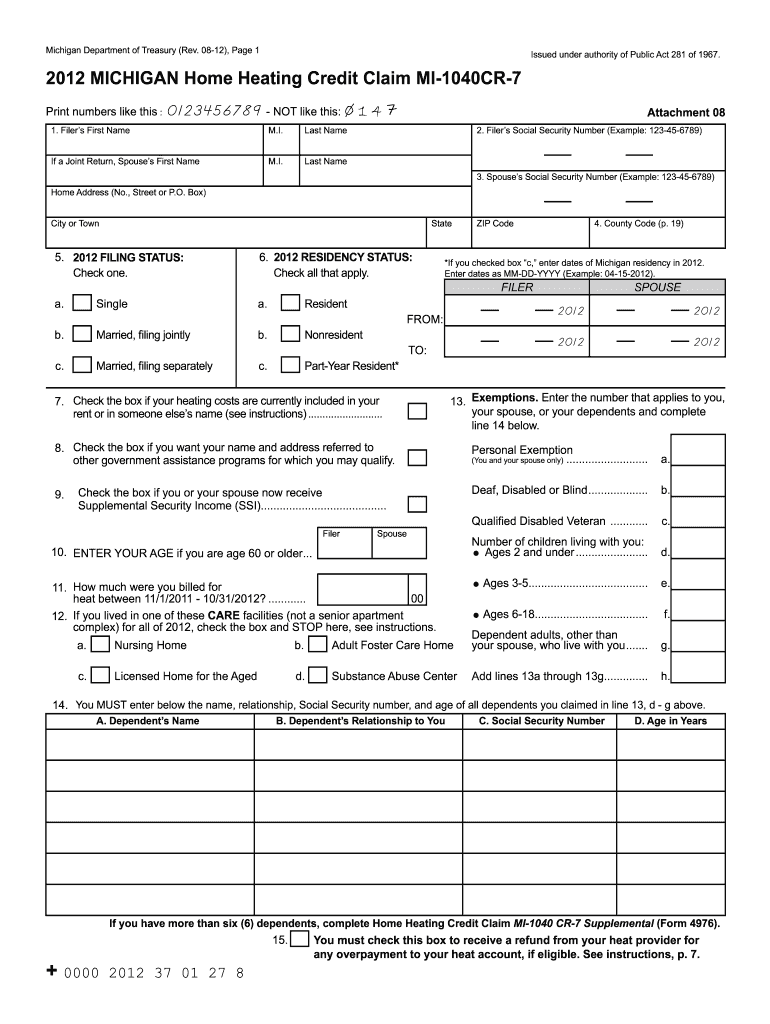

The Michigan Home Heating Credit Calculator is a valuable tool designed to assist residents in determining their eligibility for financial assistance with home heating costs. This calculator takes into account various factors, including household income, the number of dependents, and the type of heating used. By inputting relevant information, users can get an estimate of the potential credit they may receive, helping them manage their heating expenses more effectively.

How to use the Michigan Home Heating Credit Calculator

To use the Michigan Home Heating Credit Calculator, follow these steps:

- Gather necessary information, such as your household income, number of dependents, and heating type.

- Access the calculator online through the official state website or designated platforms.

- Input your details into the calculator fields accurately.

- Submit the information to receive an estimate of your potential home heating credit.

This process allows individuals to quickly assess their eligibility and understand the financial support available to them.

Steps to complete the Michigan Home Heating Credit Calculator

Completing the Michigan Home Heating Credit Calculator involves several straightforward steps:

- Visit the calculator tool online.

- Enter your total household income from all sources.

- Indicate the number of people living in your household.

- Specify the type of heating source used, such as natural gas, propane, or electric.

- Review the information for accuracy before submitting.

Once submitted, the calculator will provide an estimate of the credit you may qualify for, streamlining the process of applying for assistance.

Eligibility Criteria

To qualify for the Michigan Home Heating Credit, certain eligibility criteria must be met:

- Applicants must be Michigan residents.

- Household income should fall below specified limits, which vary based on household size.

- Applicants must demonstrate a need for assistance with heating costs.

Understanding these criteria is essential for those looking to utilize the credit effectively.

Required Documents

When using the Michigan Home Heating Credit Calculator and applying for the credit, specific documents are necessary:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, including a driver’s license or state ID.

- Information regarding your heating bill or provider.

Having these documents ready can expedite the application process and ensure accurate calculations.

Form Submission Methods

After calculating your potential credit, you can submit your application through various methods:

- Online submission via the state’s official website.

- Mailing the completed form to the designated processing center.

- In-person submission at local government offices.

Each method has its advantages, allowing applicants to choose the most convenient option for their needs.

Quick guide on how to complete michigan home heating credit calculator

Effortlessly Set Up Michigan Home Heating Credit Calculator on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the right format and securely keep it online. airSlate SignNow equips you with all the functionalities required to create, modify, and electronically sign your documents promptly without delays. Manage Michigan Home Heating Credit Calculator on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to Alter and eSign Michigan Home Heating Credit Calculator with Ease

- Obtain Michigan Home Heating Credit Calculator and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Produce your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Michigan Home Heating Credit Calculator and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan home heating credit calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan home heating credit calculator?

The Michigan home heating credit calculator is a tool designed to help residents determine their eligibility for heating assistance credits. It takes into account various factors such as income and household size to provide an accurate estimate of potential benefits. Using this calculator can simplify the application process and ensure you receive the credits you're entitled to.

-

How can I access the Michigan home heating credit calculator?

You can easily access the Michigan home heating credit calculator online on the official Michigan government website. Simply visit the site and navigate to the resources section where you’ll find the calculator. This tool is user-friendly and designed for quick and efficient use.

-

Is there a cost associated with using the Michigan home heating credit calculator?

No, the Michigan home heating credit calculator is completely free to use. There are no hidden fees or charges involved in calculating your potential heating credit. This allows you to get the information you need without any financial burden.

-

What information do I need to use the Michigan home heating credit calculator?

To effectively use the Michigan home heating credit calculator, you’ll need to provide details such as your household income, the number of people living in your home, and your heating costs. Collecting this information beforehand can help speed up the calculation process and yield more accurate results.

-

What are the benefits of using the Michigan home heating credit calculator?

The primary benefit of using the Michigan home heating credit calculator is that it helps you understand the potential credits you may qualify for, which can lead to signNow savings. Additionally, it simplifies the application process, making it easier for residents to navigate heating assistance programs. Ultimately, this can ensure that homes stay warm during the cold months while alleviating financial strain.

-

Can the Michigan home heating credit calculator be integrated with other financial tools?

Yes, some versions of the Michigan home heating credit calculator can integrate with budgeting or financial planning tools. This integration allows users to get a comprehensive view of their finances and assist them in managing their household expenses effectively. Check the specific features of the tool you’re using for integration capabilities.

-

How accurate is the Michigan home heating credit calculator?

The Michigan home heating credit calculator is designed to provide accurate estimates based on the data you input. However, the accuracy also depends on the correctness of the information provided. It's always recommended to double-check your eligibility with local agencies or resources for the most precise guidance.

Get more for Michigan Home Heating Credit Calculator

- Licensed vehicle storage facility lien foreclosure form vtr 265 vsf dmv state tx

- 211 055 2015 2019 form

- 00 for failure to apply for title within 30 days of assignment form

- Work sharing ws unemployment insurance plan application de 8686 form

- Ira distribution request form tda 0619

- Motion form maryland 2014

- Pvo 0100 parkingcamera violations appeal application nycgov nyc form

- Tc 941 form 2015 2019

Find out other Michigan Home Heating Credit Calculator

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document