Fillable Form 2210

What is the Fillable Form 2210

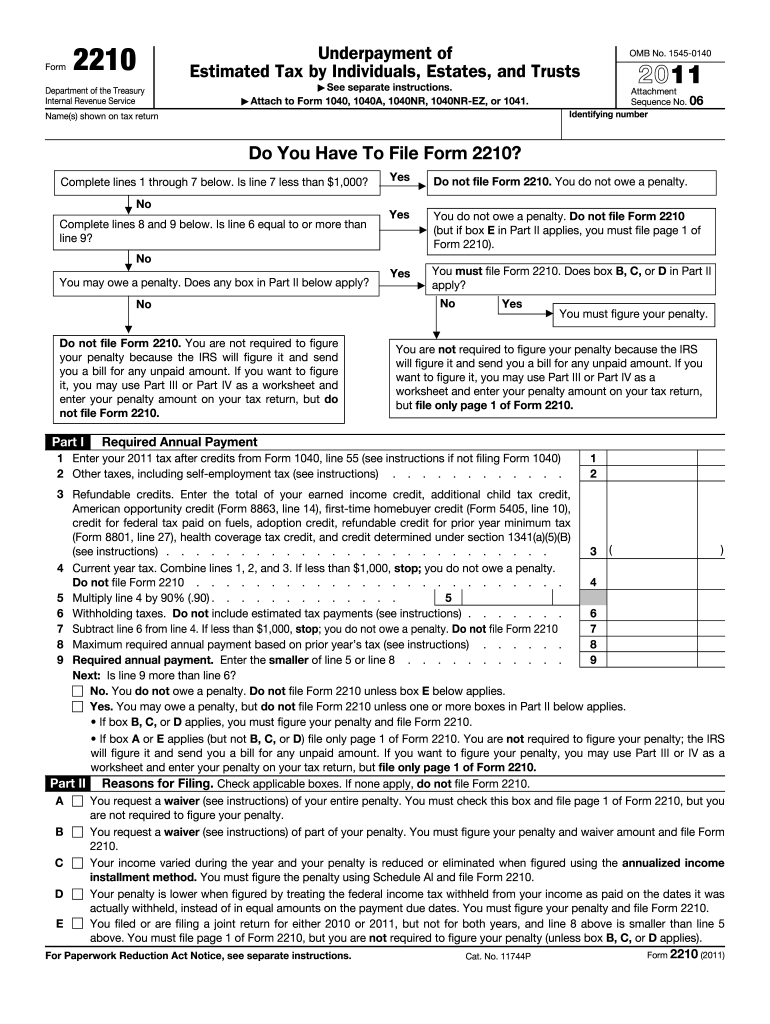

The Fillable Form 2210 is an essential document used by taxpayers in the United States to calculate any underpayment penalty for the tax year. This form is particularly relevant for individuals who did not pay enough taxes throughout the year, either through withholding or estimated tax payments. By completing the form, taxpayers can determine if they owe a penalty and, if so, how much. The form is designed to help individuals assess their tax situation and ensure compliance with IRS regulations.

How to Use the Fillable Form 2210

Using the Fillable Form 2210 involves several steps to accurately assess your tax payment status. First, gather all relevant financial documents, including income statements and previous tax returns. Next, access the form through a reliable source, ensuring it is the most current version. Fill out the required sections, focusing on your total tax liability and what you have already paid. The form will guide you through calculations to determine if you owe a penalty for underpayment. Finally, review your entries for accuracy before submitting the form to the IRS.

Steps to Complete the Fillable Form 2210

Completing the Fillable Form 2210 requires careful attention to detail. Follow these steps:

- Download the Fillable Form 2210 from a trusted source.

- Enter your personal information, including your name, address, and Social Security number.

- Calculate your total tax liability for the year using your income information.

- Document the total amount of tax you have paid through withholding and estimated payments.

- Follow the form’s instructions to determine if you owe a penalty for underpayment.

- Double-check all calculations and ensure all information is accurate.

- Submit the completed form to the IRS by the designated deadline.

Legal Use of the Fillable Form 2210

The Fillable Form 2210 must be used in accordance with IRS guidelines to ensure it is legally valid. This includes completing the form accurately and submitting it by the required deadlines. The form serves as a formal declaration of your tax situation and can be used to contest any penalties if you believe you have met your tax obligations. It is crucial to maintain copies of the completed form and any supporting documentation for your records, as these may be necessary for future reference or audits.

IRS Guidelines

The IRS provides specific guidelines for using the Fillable Form 2210. Taxpayers should familiarize themselves with these rules to ensure compliance. Key guidelines include understanding the thresholds for underpayment, the calculation methods for penalties, and the timelines for submitting the form. The IRS also offers resources and publications that can help clarify any questions regarding the form and its requirements. Staying informed about these guidelines can aid in avoiding potential penalties and ensuring a smooth filing process.

Penalties for Non-Compliance

Failing to submit the Fillable Form 2210 when required can result in significant penalties. The IRS may impose a penalty for underpayment of estimated taxes, which is typically calculated based on the amount owed and the length of time the payment is overdue. Understanding these penalties is essential for taxpayers to avoid unnecessary financial burdens. It is advisable to address any underpayment issues promptly and utilize the form to rectify the situation, thereby minimizing potential penalties.

Examples of Using the Fillable Form 2210

Practical examples of using the Fillable Form 2210 can help clarify its application. For instance, a self-employed individual who has not made sufficient estimated tax payments throughout the year may use the form to calculate their penalty. Similarly, a taxpayer who received a large bonus and did not adjust their withholding may find themselves needing to complete the form to avoid penalties. These scenarios illustrate the form's importance in ensuring compliance and managing tax liabilities effectively.

Quick guide on how to complete fillable form 2210

Effortlessly set up Fillable Form 2210 on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents swiftly without disruptions. Manage Fillable Form 2210 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Fillable Form 2210 with ease

- Find Fillable Form 2210 and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Mark essential parts of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to record your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Fillable Form 2210 to ensure effective communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable form 2210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable form underpayment?

A fillable form underpayment is a customizable document that allows users to input specific information, particularly in scenarios involving payment discrepancies. With airSlate SignNow, you can easily create and manage these forms, making it simple for both businesses and clients to track underpayment issues efficiently.

-

How does airSlate SignNow support fillable form underpayment creation?

airSlate SignNow offers intuitive tools to design fillable form underpayment documents without any technical expertise. You can utilize our drag-and-drop interface to streamline the creation process, ensuring that all necessary fields for underpayments are included and easily accessible.

-

What are the pricing options for using fillable form underpayment features?

Our pricing for using fillable form underpayment features is flexible and tailored to meet the diverse needs of businesses. airSlate SignNow offers various plans, from basic to advanced, allowing you to select a plan that fits your intended use of fillable forms and budget requirements.

-

Can I integrate fillable form underpayment features with other applications?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to link fillable form underpayment functionalities with your existing workflows. This integration helps streamline processes, making it easier to manage forms and track payments across platforms.

-

What benefits does airSlate SignNow provide for managing fillable form underpayment?

Using airSlate SignNow for fillable form underpayment offers numerous benefits, including improved accuracy, quicker turnaround times, and enhanced collaboration. Our platform ensures that all parties can easily complete, sign, and track their documents, signNowly reducing the risk of underpayment issues.

-

Is it easy to share fillable form underpayment documents with clients?

Yes, sharing fillable form underpayment documents with clients is straightforward using airSlate SignNow. You can send forms via email or share links, enabling quick access for clients to review and fill in necessary information, which enhances overall communication and efficiency.

-

What security measures are in place for fillable form underpayment documents?

airSlate SignNow prioritizes the security of your fillable form underpayment documents by implementing top-notch encryption and authentication protocols. Your data will always remain protected, ensuring that sensitive financial information related to underpayments is kept safe from unauthorized access.

Get more for Fillable Form 2210

- Official time usage in the federal government fy2016 opm form

- 10 us code2208 working capital fundsus codeus form

- How does debt affect military security clearances debtorg form

- Module 2 introduction to forms state controllers office

- Reconciliation of sale of government owned personal gsa form

- Comnavcruitcominst 1140 navy tribe form

- Rhode island fire safety welcome form

- Solved are packaging costs considered part of inventory costs form

Find out other Fillable Form 2210

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast