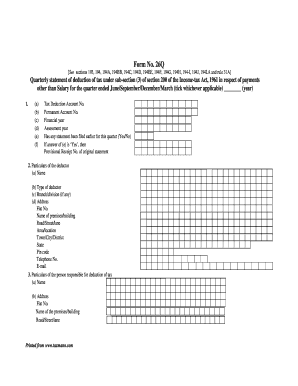

Form 26q

What is the Form 26Q

The Form 26Q is a tax document used in the United States for reporting tax deducted at source (TDS) on payments made to non-residents. This form is essential for businesses and entities that make payments to foreign individuals or companies, ensuring compliance with U.S. tax laws. It provides the Internal Revenue Service (IRS) with information about the amounts withheld and the recipients of these payments. Understanding the purpose and requirements of Form 26Q is crucial for accurate tax reporting and avoiding penalties.

How to Obtain the Form 26Q

To obtain the Form 26Q, you can visit the official IRS website, where the form is available for download in various formats, including PDF and Excel. The form can also be accessed through authorized tax software that supports TDS reporting. Ensure you download the most current version of the form to comply with the latest tax regulations. Keeping a copy of the form for your records is advisable, as it may be needed for future reference or audits.

Steps to Complete the Form 26Q

Completing the Form 26Q involves several key steps:

- Gather Required Information: Collect details about the payments made, including the recipient's name, address, and taxpayer identification number.

- Fill Out the Form: Input the relevant data into the form, ensuring accuracy in the amounts withheld and reported.

- Review for Errors: Double-check all entries to avoid mistakes that could lead to penalties.

- Submit the Form: Depending on the filing method, submit the completed form electronically or via mail to the appropriate IRS address.

Legal Use of the Form 26Q

The legal use of Form 26Q is governed by IRS regulations, which require accurate reporting of tax withheld on payments to non-residents. To ensure the form is legally binding, it must be completed in accordance with the guidelines set forth by the IRS. This includes adhering to deadlines for submission and maintaining proper documentation to support the reported figures. Compliance with these regulations helps prevent legal issues and penalties associated with incorrect filings.

Filing Deadlines / Important Dates

Filing deadlines for Form 26Q are critical to ensure compliance with IRS requirements. Typically, the form must be submitted quarterly, with specific due dates depending on the payment period. It is essential to stay informed about these deadlines to avoid late fees and penalties. Mark your calendar for these important dates to ensure timely filing and maintain good standing with tax authorities.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 26Q can result in significant penalties. These may include fines for late submissions, inaccuracies, or failure to file altogether. The IRS imposes these penalties to encourage timely and accurate reporting of tax information. Understanding the potential consequences of non-compliance highlights the importance of careful preparation and adherence to filing requirements.

Quick guide on how to complete form 26q

Effortlessly Prepare Form 26q on Any Device

The management of online documents has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed files, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Manage Form 26q on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign Form 26q with Ease

- Find Form 26q and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that function by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select your preferred method to send your form, be it via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your selection. Edit and eSign Form 26q to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 26q

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to download form 26q using airSlate SignNow?

To download form 26q using airSlate SignNow, simply log into your account and navigate to the documents section. Locate the form 26q you wish to download, click on it, and select the download option. This process is quick and ensures you have your form readily available.

-

Are there any costs associated with downloading form 26q from airSlate SignNow?

Downloading form 26q itself from airSlate SignNow is included in your subscription plan. Depending on your chosen plan, you may have unlimited access to download forms without any additional fees. Always check your plan details to understand what's covered.

-

Can I customize form 26q before downloading it with airSlate SignNow?

Yes, you can customize form 26q before downloading it on airSlate SignNow. The platform allows you to add fields, signatures, and other custom elements to ensure the form meets your specific needs. Once you're satisfied with the customization, you can easily download the modified form.

-

What are the benefits of using airSlate SignNow for form 26q?

Using airSlate SignNow for form 26q offers numerous benefits including easy e-signature capabilities, secure storage, and rapid processing times. The intuitive interface makes it easy to manage and download form 26q at your convenience. Additionally, you gain access to compliance support, ensuring your documents are always up to standard.

-

Does airSlate SignNow integrate with other applications to manage form 26q?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and others. This allows you to manage and store form 26q alongside your other documents easily. These integrations streamline your workflow, saving you time and effort.

-

Is it possible to track the status of form 26q after downloading it on airSlate SignNow?

While you cannot track the downloaded file itself, airSlate SignNow provides comprehensive tracking features for signed documents. You can see when form 26q has been sent, viewed, or signed. This transparency enhances your ability to manage document workflows efficiently.

-

What security measures are in place when downloading form 26q from airSlate SignNow?

airSlate SignNow prioritizes security with robust measures such as encryption and secure access protocols. When you download form 26q, your data is protected, ensuring that sensitive information remains confidential. Trust that airSlate SignNow complies with industry standards for document security.

Get more for Form 26q

- 2019 form 1041 es estimated income tax for estates and trusts

- Employees social security number ssn form

- 2019 form 1099 q payments from qualified education programs under sections 529 and 530

- Form w 3ss

- Inst w 2g and 5754 internal revenue service form

- 2019 form 1099 cap changes in corporate control and capital structure

- 2019 form w 2as american samoa wage and tax statement

- 2019 form 1099 h health coverage tax credit hctc advance payments

Find out other Form 26q

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form