88 21 Tax Information

What is the 88 21 Tax Information

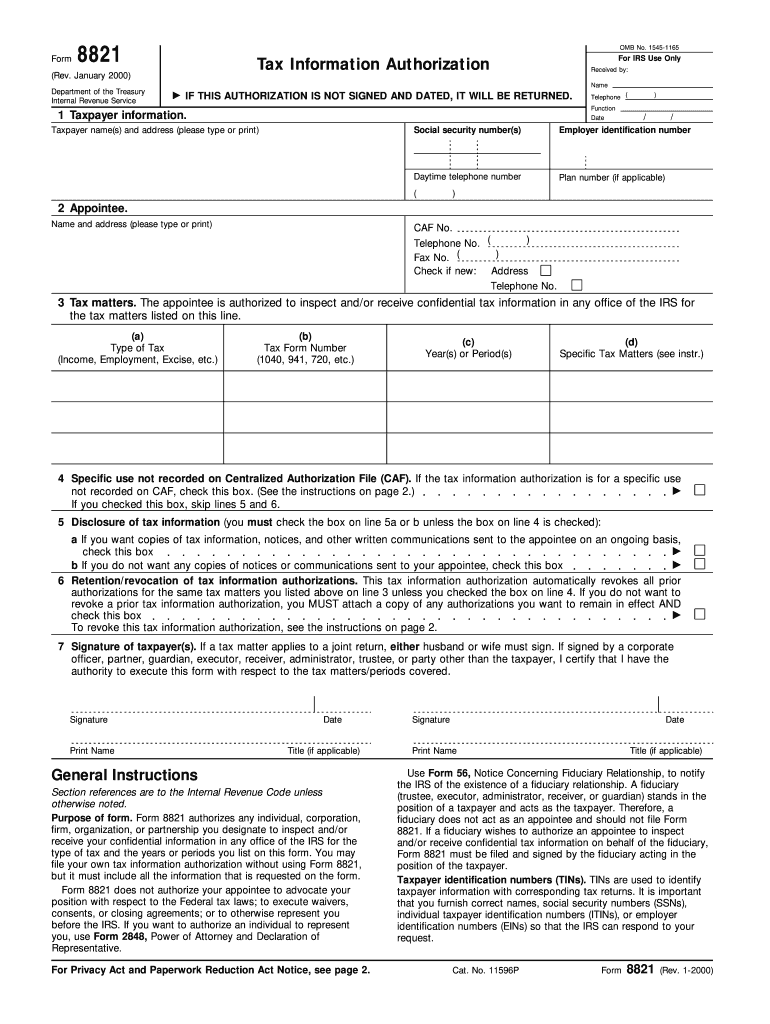

The 88 21 tax information refers to a specific form used for reporting tax-related information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to accurately report their income, deductions, and credits. It plays a crucial role in ensuring compliance with federal tax laws and regulations. Understanding the purpose and requirements of the 88 21 is vital for effective tax management and planning.

How to use the 88 21 Tax Information

Using the 88 21 tax information involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, receipts for deductions, and any relevant tax forms. Next, fill out the 88 21 form carefully, ensuring that all information is complete and accurate. Once completed, review the form for errors before submission. This form can be filed electronically or mailed to the appropriate IRS address, depending on your preference and the specific guidelines provided by the IRS.

Steps to complete the 88 21 Tax Information

Completing the 88 21 tax information requires a systematic approach:

- Gather necessary documents, including W-2s, 1099s, and expense receipts.

- Download or access the 88 21 form from the IRS website.

- Fill out the form with accurate personal and financial information.

- Double-check all entries for correctness and completeness.

- Submit the form electronically or via mail, following IRS submission guidelines.

Legal use of the 88 21 Tax Information

The legal use of the 88 21 tax information is governed by IRS regulations. To be considered valid, the form must be filled out truthfully and submitted within the designated deadlines. Misrepresentation or failure to comply with the IRS rules can lead to penalties and legal repercussions. It is essential to understand the legal implications of the information provided on this form to avoid potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 88 21 tax information vary based on the tax year and the taxpayer's specific situation. Generally, individual taxpayers must file their forms by April fifteenth of the following year. However, extensions may be available under certain circumstances. It is crucial to stay informed about these deadlines to ensure timely submission and avoid late fees or penalties.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the 88 21 tax information. These guidelines outline the necessary steps, required documentation, and common mistakes to avoid. Familiarizing yourself with these guidelines can significantly enhance the accuracy of your submission and ensure compliance with federal tax laws.

Quick guide on how to complete 88 21 tax information

Complete 88 21 Tax Information with ease on any device

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 88 21 Tax Information on any platform using airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and eSign 88 21 Tax Information effortlessly

- Locate 88 21 Tax Information and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign 88 21 Tax Information and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 88 21 tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for 88 21 with airSlate SignNow?

The pricing structure for 88 21 with airSlate SignNow is designed to be cost-effective for businesses of all sizes. We offer flexible plans that cater to different needs, ensuring you only pay for what you use. By choosing airSlate SignNow, you can access premium features without breaking the bank.

-

What features are included in the 88 21 plan?

The 88 21 plan includes a comprehensive set of features such as document editing, eSigning, and secure storage. Users can also take advantage of customizable templates and advanced analytics. These features enhance your document management process, making it seamless and efficient.

-

How can 88 21 benefit my business?

88 21 empowers your business by streamlining the signing process, reducing turnaround times, and improving document security. Businesses can enhance workflow efficiency and client satisfaction by using airSlate SignNow's user-friendly platform. Ultimately, 88 21 helps you close deals faster and focus on what matters most.

-

What integrations are available with 88 21?

88 21 offers seamless integrations with popular business tools such as Google Drive, Salesforce, and Microsoft Office. These integrations allow you to manage documents across platforms without any hassle, enhancing productivity. airSlate SignNow makes it easy to connect your existing tools to maximize efficiency.

-

Is 88 21 suitable for small businesses?

Absolutely! 88 21 is designed to cater to small businesses looking for an accessible and cost-effective eSigning solution. With its user-friendly interface and essential features, airSlate SignNow simplifies document management. Small businesses can leverage 88 21 to improve their operational efficiency and customer interactions.

-

Can I track the status of documents sent using 88 21?

Yes, with 88 21, users can easily track the status of sent documents in real-time. airSlate SignNow provides notifications and updates, ensuring you are always informed about your document's progress. This feature aids in maintaining accountability and ensuring prompt follow-ups.

-

What security measures are in place for 88 21?

88 21 prioritizes security with robust encryption and compliance with global standards. airSlate SignNow employs industry-leading security protocols to protect your sensitive documents and data. You can confidently eSign and manage your documents knowing that your information is safe.

Get more for 88 21 Tax Information

- Teamcare d didability forms

- Temperature logs for refrigerators 2013 form

- Open house feedback flyer 316kb pdf first american form

- Birth certificate format in english pdf

- Content form 100397846

- Dd form 2853

- Virginia asthma action plan form

- City of spruce grove business license application and checklist sprucegrove form

Find out other 88 21 Tax Information

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors