Form No 16 See Rule 31 1 a PDF

What is the Form No 16 See Rule 31 1 A Pdf

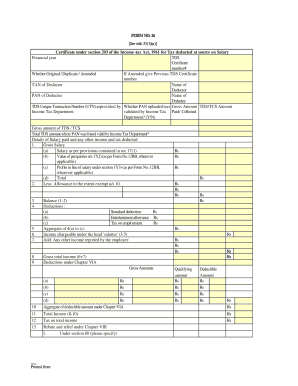

The Form No 16 See Rule 31 1 A is a crucial document in the realm of income tax in the United States. It serves as a certificate issued by employers to their employees, detailing the salary paid and the tax deducted at source (TDS). This form is essential for employees to file their income tax returns accurately. The PDF version of this form allows for easy access and sharing, facilitating the tax filing process for both employers and employees.

How to use the Form No 16 See Rule 31 1 A Pdf

Using the Form No 16 See Rule 31 1 A PDF involves several steps. First, employees should obtain the form from their employer, who is responsible for issuing it. Once received, employees should review the details for accuracy, ensuring that the salary and tax deduction figures are correctly stated. This form can then be used to fill out income tax returns, providing necessary proof of income and tax paid. Digital signatures can be applied to the PDF for secure submission, ensuring compliance with eSignature laws.

Steps to complete the Form No 16 See Rule 31 1 A Pdf

Completing the Form No 16 See Rule 31 1 A PDF requires careful attention to detail. Follow these steps:

- Obtain the form from your employer.

- Verify personal and employment information, including name, address, and PAN (Permanent Account Number).

- Check the salary details and TDS amounts listed on the form.

- Ensure any deductions under sections such as 80C, 80D, etc., are accurately reflected.

- Sign the form electronically if submitting digitally, or print and sign if required.

Key elements of the Form No 16 See Rule 31 1 A Pdf

The Form No 16 See Rule 31 1 A includes several key elements that are vital for tax compliance. These elements typically comprise:

- Employer's name and address.

- Employee's name and PAN.

- Total salary paid during the financial year.

- Details of tax deducted at source.

- Breakdown of any deductions claimed by the employee.

Legal use of the Form No 16 See Rule 31 1 A Pdf

The legal use of the Form No 16 See Rule 31 1 A PDF is governed by the Income Tax Act. This form is recognized as a valid document for substantiating income and tax payments. It is essential for employees to retain this form for their records and to present it during tax assessments or audits. Ensuring that the form is filled out accurately and submitted on time is crucial to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form No 16 See Rule 31 1 A are typically aligned with the annual income tax return submission dates. Employees should be aware of the following important dates:

- Last date for employers to issue Form No 16: usually by June 15 of the assessment year.

- Deadline for filing income tax returns: typically July 31 for individuals.

Quick guide on how to complete form no 16 see rule 31 1 a pdf

Easily prepare Form No 16 See Rule 31 1 A Pdf on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Form No 16 See Rule 31 1 A Pdf on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form No 16 See Rule 31 1 A Pdf effortlessly

- Locate Form No 16 See Rule 31 1 A Pdf and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Verify the details and then click on the Done button to keep your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form No 16 See Rule 31 1 A Pdf and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 16 see rule 31 1 a pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form No 16 as per Rule 31 1 A?

Form No 16 see rule 31 1 a pdf is a certificate issued by an employer to employees that contains details of the salary paid and the tax deducted at source. This form serves as proof of income and tax payment, which is essential for employees when filing their income tax returns.

-

How can airSlate SignNow help with Form No 16?

With airSlate SignNow, businesses can easily create, send, and eSign Form No 16 see rule 31 1 a pdf. Our platform streamlines the documentation process, allowing for quick distribution and collection of signed forms, ensuring compliance and efficiency at your organization.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow offers competitive pricing plans that are tailored for small businesses, making it an affordable choice for managing documents like Form No 16 see rule 31 1 a pdf. Our solution not only reduces printing costs but also enhances productivity by simplifying the signing process.

-

What features does airSlate SignNow provide for managing employee documents?

airSlate SignNow provides features such as customizable templates, real-time document tracking, and automated reminders for eSigning Form No 16 see rule 31 1 a pdf. These tools help ensure a smooth workflow and that your documents are always up-to-date and compliant.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integration capabilities with various software applications, making it seamless to manage and send Form No 16 see rule 31 1 a pdf alongside your existing systems. This ensures that your data flows smoothly and enhances overall operational efficiency.

-

What are the benefits of eSigning Form No 16 using airSlate SignNow?

eSigning Form No 16 see rule 31 1 a pdf through airSlate SignNow offers numerous benefits, including increased speed in document processing, reduced paper waste, and greater security. By using our eSignature solution, you ensure that your forms are signed promptly and stored securely in a centralized repository.

-

How secure is the eSigning process with airSlate SignNow?

The eSigning process with airSlate SignNow is highly secure, utilizing advanced encryption and security protocols to protect your documents, including Form No 16 see rule 31 1 a pdf. We prioritize your data privacy and ensure that all signatures are legally binding and compliant with regulations.

Get more for Form No 16 See Rule 31 1 A Pdf

- Form 7501 2009

- Income tax letterhead in pdf form

- Ut dept of workforce services form

- N95 respirator training and fit testing verification card cdph ca form

- D 40 2014 form

- 2015 general instructions for certain information

- Nursing care plan sheet suggested form ct

- Certification of service amp final salary newjersey form

Find out other Form No 16 See Rule 31 1 A Pdf

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe