P50 Form

What is the P50 Form

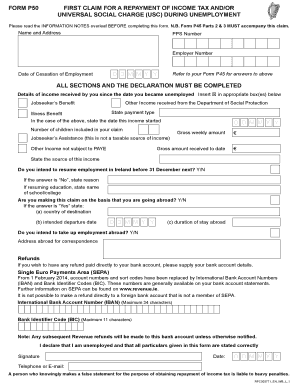

The P50 form is a tax document used in the United States to claim a refund for overpaid taxes. Specifically, it is utilized by individuals who have had their income tax withheld but are eligible for a refund due to various reasons, such as changes in income or tax credits. Understanding the purpose of the P50 form is crucial for taxpayers seeking to ensure they receive the funds they are owed.

How to Use the P50 Form

Using the P50 form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including your previous tax returns and any relevant financial statements. Next, fill out the form with accurate information regarding your income and tax withholdings. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Steps to Complete the P50 Form

Completing the P50 form requires careful attention to detail. Begin by entering your personal information, including your name, address, and Social Security number. Next, provide details about your income sources and the amount of tax withheld. It is essential to double-check all figures for accuracy. After filling out the form, sign and date it before submission. This process ensures that your claim for a tax refund is processed smoothly.

Legal Use of the P50 Form

The P50 form is legally recognized as a valid document for claiming tax refunds when completed correctly. To ensure its legal standing, it must comply with federal tax regulations. This includes providing accurate information and adhering to submission deadlines. Utilizing electronic signature solutions can enhance the security and legality of the form, ensuring that it meets all necessary requirements.

Required Documents

When preparing to submit the P50 form, certain documents are essential. These include your W-2 forms from employers, any 1099 forms for additional income, and documentation supporting your claim for a refund, such as proof of tax credits or deductions. Having these documents readily available will facilitate a smoother filing process and help substantiate your claims.

Form Submission Methods

The P50 form can be submitted through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient way to file, allowing for immediate processing. If submitting by mail, ensure that you send it to the correct address and keep a copy for your records. In-person submissions may be made at designated tax offices, providing an opportunity to ask questions if needed.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for timely submission of the P50 form. Generally, the deadline for submitting tax forms falls on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific updates or changes to deadlines that may occur each tax year.

Quick guide on how to complete p50 form

Effortlessly prepare P50 Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any hold-ups. Manage P50 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign P50 Form with ease

- Find P50 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional pen-and-paper signature.

- Review all the details and then click the Done button to save your updates.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign P50 Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p50 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a p50 form and why is it important?

The p50 form is a crucial document used for claiming a repayment of tax when an individual has left their job or transitioned to a new employment status. Understanding the p50 form is essential for ensuring accurate tax records and timely refunds. By effectively managing this process with a solution like airSlate SignNow, businesses can streamline the document signing and submission process.

-

How does airSlate SignNow streamline the p50 form submission?

airSlate SignNow simplifies the p50 form submission by providing an intuitive platform for eSigning and sending documents securely. This allows users to complete forms quickly, minimizing delays associated with traditional paper methods. With airSlate SignNow, you can track the status of your p50 form to ensure timely processing.

-

Is there a cost associated with using airSlate SignNow for completing a p50 form?

Yes, airSlate SignNow offers various subscription plans that cater to different business needs at competitive prices. These plans include features specifically designed for efficient document management, including the p50 form. You can choose a plan that best aligns with your organization's budget and requirements.

-

Can airSlate SignNow integrate with existing software to manage the p50 form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of business applications, maximizing efficiency when managing the p50 form and other documents. These integrations help streamline workflows, enabling users to access and send the p50 form directly through their existing systems.

-

What are the benefits of using airSlate SignNow for the p50 form?

By using airSlate SignNow for the p50 form, users can benefit from a user-friendly interface, enhanced security features, and the ability to send and sign documents from anywhere. These advantages contribute to faster processing times and reduce the complexity often associated with paperwork. It's a cost-effective solution for businesses of all sizes.

-

Is airSlate SignNow secure for handling sensitive p50 form information?

Yes, airSlate SignNow prioritizes security, ensuring that all sensitive information included in the p50 form is protected with advanced encryption and compliance standards. This ensures that your data is safe during transmission and storage. You can confidently send and manage your p50 form without worrying about data bsignNowes.

-

How easy is it to use airSlate SignNow for someone unfamiliar with the p50 form?

airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with the p50 form. The step-by-step guides and support resources are readily available to aid users in completing their forms. With just a few clicks, anyone can navigate through the process confidently.

Get more for P50 Form

- Lead based paint disclosure sales street address city form

- State ex rel state engineer v hornercourtlistenercom form

- Address of petitionerplaintiff form

- Claim of lien individual form

- Below is hereby released and satisfied in full and the real estate described therein is fully form

- Notarizing montana motor vehicle titlesmontana secretary of state form

- Notice of nonresponsibility corporation form

- Prescription form

Find out other P50 Form

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later