Indiana State Form 5473

What is the Indiana State Form 5473

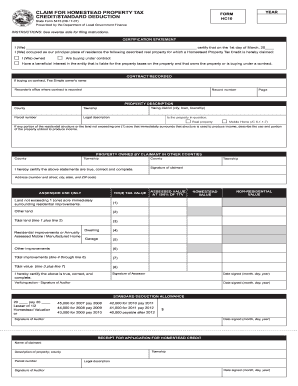

The Indiana State Form 5473 is a document used for specific tax-related purposes in the state of Indiana. This form is primarily associated with the homestead deduction application, allowing homeowners to claim certain tax benefits. By completing this form, individuals can potentially reduce their property tax burden, making it an essential tool for eligible homeowners. Understanding the purpose and requirements of Form 5473 is crucial for those looking to navigate Indiana's tax landscape effectively.

How to use the Indiana State Form 5473

Using the Indiana State Form 5473 involves several key steps to ensure proper completion and submission. First, gather all necessary information, including property details, ownership information, and relevant identification numbers. Next, accurately fill out the form, ensuring all sections are completed as required. Once the form is filled, it can be submitted either online or via mail, depending on the preferred method. Familiarity with the form's instructions will enhance the user experience and help avoid common pitfalls.

Steps to complete the Indiana State Form 5473

Completing the Indiana State Form 5473 requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as proof of residency and property ownership.

- Access the form online or obtain a physical copy from the appropriate state office.

- Fill in personal information, including name, address, and property details.

- Provide any additional information required, such as income details if applicable.

- Review the completed form for accuracy and completeness.

- Submit the form according to the instructions provided, either electronically or by mail.

Legal use of the Indiana State Form 5473

The Indiana State Form 5473 is legally binding when completed and submitted according to state laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of benefits. Compliance with the legal requirements surrounding this form not only protects the homeowner but also ensures the integrity of the tax system in Indiana.

Key elements of the Indiana State Form 5473

Several key elements are crucial for the successful completion of the Indiana State Form 5473. These include:

- Property Information: Details about the property for which the homestead deduction is being claimed.

- Owner Information: Personal details of the property owner, including name and contact information.

- Eligibility Criteria: Information confirming that the applicant meets the necessary requirements for the homestead deduction.

- Signature: The form must be signed by the applicant to validate the information provided.

Form Submission Methods

The Indiana State Form 5473 can be submitted through various methods, catering to different preferences. Homeowners can choose to complete the form online via the Indiana Department of Revenue's website, ensuring a quick and efficient process. Alternatively, the form can be printed and mailed to the appropriate local tax office. In-person submissions may also be possible at designated state offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete indiana state form 5473

Easily Prepare Indiana State Form 5473 on Any Device

The management of documents online has become increasingly popular among both businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and electronically sign your documents promptly without delays. Manage Indiana State Form 5473 on any device using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Edit and Electronically Sign Indiana State Form 5473 Without Stress

- Find Indiana State Form 5473 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Indiana State Form 5473 to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 5473

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana State Form 5473?

The Indiana State Form 5473 is a document used for reporting certain tax-related information in the state of Indiana. It is crucial for businesses and individuals who need to disclose specific financial information to the state. Understanding how to complete the Indiana State Form 5473 correctly is essential for compliance with state regulations.

-

How does airSlate SignNow simplify the signing process for the Indiana State Form 5473?

airSlate SignNow provides an intuitive platform that allows users to eSign the Indiana State Form 5473 quickly and securely. Its user-friendly interface enables you to upload the form, add required signatures, and send it to the appropriate parties without any hassle. This streamlines the entire process, making it easier to handle essential documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the Indiana State Form 5473?

Yes, there is a cost associated with using airSlate SignNow, but it offers flexible pricing plans to suit various business needs. These plans include features that can help manage the Indiana State Form 5473 and other documents effectively. By investing in airSlate SignNow, you gain access to a cost-effective solution for managing your electronic signatures.

-

What features does airSlate SignNow offer for handling the Indiana State Form 5473?

airSlate SignNow offers several features that enhance the handling of the Indiana State Form 5473, including customizable templates, cloud storage, and advanced security options. You can track who has signed the document, send reminders, and even automate follow-ups. These features ensure that your document management process is seamless and efficient.

-

Can I integrate airSlate SignNow with other software for managing the Indiana State Form 5473?

Absolutely! airSlate SignNow offers numerous integration options with popular software applications that enhance the workflow for managing the Indiana State Form 5473. By integrating with tools like Google Drive, Dropbox, and various CRMs, you can streamline your document processes and keep everything organized in one place.

-

What are the benefits of using airSlate SignNow for the Indiana State Form 5473?

Using airSlate SignNow for the Indiana State Form 5473 offers multiple benefits, including faster processing times, improved accuracy, and reduced paper usage. It helps ensure that forms are completed and signed in a timely manner, minimizing the risk of errors. Additionally, this digital solution contributes to a more sustainable business model by reducing reliance on physical paperwork.

-

Is airSlate SignNow secure for handling sensitive documents like the Indiana State Form 5473?

Yes, airSlate SignNow prioritizes security and offers robust measures to protect sensitive documents like the Indiana State Form 5473. The platform utilizes encryption, secure user authentication, and audit trails to ensure that all your data remains confidential and secure. Rest assured that your documents are safe while using airSlate SignNow.

Get more for Indiana State Form 5473

- Inspection checklist for road tankers trakheesae form

- Form cg 7042 2016 2019

- Ssa l725 f3 reginfo form

- Faculty applicationpdf middle georgia state college form

- Dd 2215 audiogram form

- Delta recommendation form

- Kansas liquor license ownership abc 890 8514 abc 890 kansas liquor license ownership form

- Gateway high school official transcript request form

Find out other Indiana State Form 5473

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe