Fillable 941 Schedule B Form

What is the Fillable 941 Schedule B

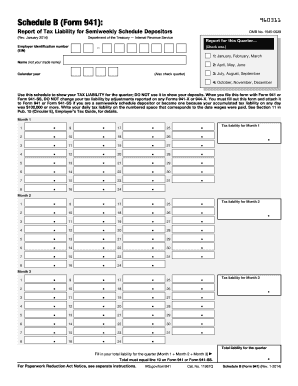

The Fillable 941 Schedule B is an essential form used by employers in the United States to report their tax liabilities related to federal income tax withholding and social security and Medicare taxes. Specifically, this form is a supplementary schedule to Form 941, which is the Employer's Quarterly Federal Tax Return. The Schedule B provides detailed information on the employer's tax liabilities for each day of the month, allowing the IRS to monitor compliance with tax withholding requirements. It is crucial for employers to accurately complete this form to ensure proper reporting and avoid penalties.

Steps to Complete the Fillable 941 Schedule B

Completing the Fillable 941 Schedule B requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your Employer Identification Number (EIN) and details of your payroll for the quarter.

- Access the Fillable 941 Schedule B form, which can be downloaded from the IRS website or completed electronically.

- Fill in the required fields, including the number of employees and the total tax liability for each pay period.

- Ensure that you report any adjustments or corrections accurately, as these can affect your overall tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the Fillable 941 Schedule B

The Fillable 941 Schedule B is legally binding when completed and submitted according to IRS guidelines. To ensure its validity, employers must adhere to the requirements set forth by the IRS, including accurate reporting of tax liabilities and timely submission. The use of electronic signatures through a compliant platform can enhance the legal standing of the document, as eSignatures are recognized under the ESIGN and UETA acts. Employers should also maintain copies of submitted forms for their records in case of future audits.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Fillable 941 Schedule B is critical for compliance. The form must be submitted quarterly, with specific due dates:

- For the first quarter (January to March), the due date is April 30.

- For the second quarter (April to June), the due date is July 31.

- For the third quarter (July to September), the due date is October 31.

- For the fourth quarter (October to December), the due date is January 31 of the following year.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Fillable 941 Schedule B. The form can be filed electronically through the IRS e-file system, which is the fastest method. Alternatively, employers can print the completed form and mail it to the appropriate IRS address based on their location. In-person submission is generally not available for this form, as the IRS encourages electronic filing for efficiency and accuracy. Regardless of the method chosen, it is important to ensure that the form is submitted by the deadline to avoid penalties.

Key Elements of the Fillable 941 Schedule B

The Fillable 941 Schedule B includes several key elements that are crucial for accurate reporting:

- Employer Identification Number (EIN): This unique number identifies your business for tax purposes.

- Tax Period: Indicate the quarter for which you are reporting.

- Daily Tax Liability: Report the total tax liability for each day of the month.

- Total Taxes Due: Summarize the total amount owed for the quarter.

Quick guide on how to complete fillable 941 schedule b

Finish Fillable 941 Schedule B effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Fillable 941 Schedule B on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Fillable 941 Schedule B with ease

- Obtain Fillable 941 Schedule B and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click the Done button to store your modifications.

- Choose how you would like to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Fillable 941 Schedule B and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable 941 schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the schedule b form 941 2021?

The schedule b form 941 2021 is an essential document for employers, used to report their payroll tax obligations. It provides a summary of employment taxes and is a critical part of the IRS Form 941 submission process. Accurately filling this form helps ensure compliance with federal tax regulations.

-

How can airSlate SignNow assist with completing the schedule b form 941 2021?

airSlate SignNow streamlines the process of completing the schedule b form 941 2021 by providing an easy-to-use platform for electronic signatures and document management. Our software allows you to fill out critical forms quickly and securely, ensuring you meet deadlines with ease. With templates and intuitive interfaces, you can focus more on your business.

-

What are the pricing options for using airSlate SignNow for schedule b form 941 2021?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses that require assistance with the schedule b form 941 2021. Our pricing is competitive and transparent, ensuring that you receive excellent value for the robust features provided. Different tiers allow you to choose one that fits your organizational needs and budget.

-

Is airSlate SignNow compliant with the regulations surrounding the schedule b form 941 2021?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that your use of the schedule b form 941 2021 adheres to all necessary regulations. We employ industry-standard security measures to protect sensitive information, which is especially important when handling tax-related documents. Trust airSlate SignNow to keep your records safe and compliant.

-

Can I integrate airSlate SignNow with other applications for the schedule b form 941 2021?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications, enhancing your ability to manage the schedule b form 941 2021 efficiently. This connectivity ensures a streamlined workflow and makes data transfer between systems simple and efficient, enabling better productivity in managing tax documentation.

-

What features does airSlate SignNow offer for managing the schedule b form 941 2021?

airSlate SignNow provides a myriad of features to assist with the schedule b form 941 2021, including electronic signatures, document storage, and pre-built templates. These tools not only simplify the process of filling out the form but also enhance collaboration and communication within teams. Enjoy automated workflows designed to save you time and effort.

-

How does airSlate SignNow ensure the security of the schedule b form 941 2021?

We prioritize security at airSlate SignNow by implementing advanced encryption protocols and secure cloud storage for documents like the schedule b form 941 2021. Your data is protected against unauthorized access and loss, giving you confidence in the integrity of your sensitive information. Our commitment to security ensures your trust in our services.

Get more for Fillable 941 Schedule B

Find out other Fillable 941 Schedule B

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself