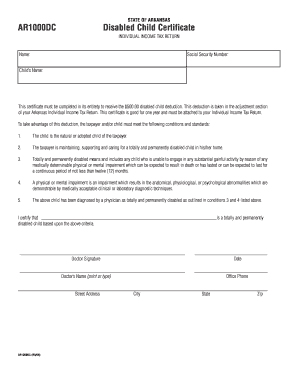

Ar1000dc Form

What is the AR1000DC?

The AR1000DC is a specific form used in various administrative and legal contexts. It serves as an essential document for individuals or businesses to fulfill certain regulatory requirements. Understanding its purpose and function is crucial for ensuring compliance with applicable laws.

How to Use the AR1000DC

Using the AR1000DC involves several straightforward steps. First, gather all necessary information and documentation required for completion. Next, fill out the form accurately, ensuring that all fields are completed as per the guidelines. After filling it out, review the form for any errors before submission. This careful approach helps to avoid delays or complications.

Steps to Complete the AR1000DC

Completing the AR1000DC requires attention to detail. Follow these steps for a smooth process:

- Collect required documents and information relevant to the form.

- Access the form through the appropriate channels, whether online or in physical format.

- Fill in the form, ensuring accuracy in all entries.

- Review the completed form for any mistakes or missing information.

- Submit the form according to the specified submission methods.

Legal Use of the AR1000DC

The AR1000DC holds legal significance, particularly in contexts where compliance with regulations is necessary. It is essential to ensure that the form is filled out correctly and submitted on time to avoid potential legal issues. Understanding the legal implications of the form can aid in its proper use and compliance with relevant laws.

Who Issues the Form

The AR1000DC is typically issued by a governmental agency or regulatory body. Identifying the issuing authority is important, as it provides context for the form's requirements and ensures that users are following the correct procedures. This information also helps users understand any additional obligations related to the form.

Filing Deadlines / Important Dates

Filing deadlines for the AR1000DC can vary based on the specific context in which it is used. It is crucial to be aware of these deadlines to ensure timely submission. Missing a deadline may result in penalties or other consequences, making it important to stay informed about relevant dates associated with the form.

Examples of Using the AR1000DC

There are various scenarios in which the AR1000DC may be utilized. For instance, it may be required for tax purposes, business registrations, or compliance with specific regulations. Understanding these examples can help users recognize when the form is applicable and the importance of completing it correctly.

Quick guide on how to complete ar1000dc 29155402

Complete Ar1000dc effortlessly on any device

Online document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ar1000dc on any device with airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

How to alter and eSign Ar1000dc with ease

- Find Ar1000dc and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Ar1000dc and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1000dc 29155402

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar1000dc and how does it work?

The ar1000dc is an advanced document signing tool offered by airSlate SignNow, designed to streamline the electronic signature process. It allows users to send, manage, and securely sign documents online, enhancing workflow efficiency. With its user-friendly interface, the ar1000dc makes it easy for anyone to eSign documents from anywhere.

-

How much does the ar1000dc cost?

Pricing for the ar1000dc varies based on the plan chosen, with options aimed at both small businesses and large enterprises. airSlate SignNow offers competitive pricing that provides excellent value for its features. Visit our pricing page for more details and to find the best option for your business needs.

-

What features does the ar1000dc include?

The ar1000dc comes packed with features such as customizable templates, multi-party signing, and document tracking. Additionally, it supports various file formats and offers integration with popular business applications. These features help improve the overall signing experience and efficiency.

-

What are the benefits of using the ar1000dc for my business?

Using the ar1000dc benefits your business by reducing turnaround time for document signing and increasing operational efficiency. It helps eliminate the hassles of paper-based processes and provides a secure platform for electronic signatures. Furthermore, the ease of use can lead to enhanced customer satisfaction.

-

Can the ar1000dc integrate with other tools we use?

Yes, the ar1000dc can seamlessly integrate with various third-party applications, including CRM systems and document management tools. This interoperability helps streamline your workflows and ensures that document signing fits seamlessly into your existing processes. Check our integrations page for a complete list of compatible applications.

-

Is the ar1000dc secure for signing sensitive documents?

Absolutely, the ar1000dc prioritizes security with advanced encryption and authentication measures. This makes it a reliable option for signing sensitive documents while ensuring compliance with legal standards. Users can trust that their information is safeguarded throughout the signing process.

-

How do I get started with the ar1000dc?

Getting started with the ar1000dc is simple; you can sign up for a free trial on the airSlate SignNow website. Once registered, you can explore its features and begin sending documents for electronic signatures. Our user-friendly interface guides you through the process effectively.

Get more for Ar1000dc

- Address change request form nasb

- Printed circuit board worksheet imagesfedexcom form

- Page 1 of 5 concept bspecialb brisksb ltd wwwbspecialb brisksbbcob form

- Sample resident bed bug reporting form extension entm purdue

- Overnight guest form 2015 2016docx baruch cuny

- Date of lease form

- Albert j hamilton post 7 thanksgiving basket sponsor sheet form

- Acknowledgement of receipt of privacy noticedoc form

Find out other Ar1000dc

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe