Par 101 Form

What is the Par 101

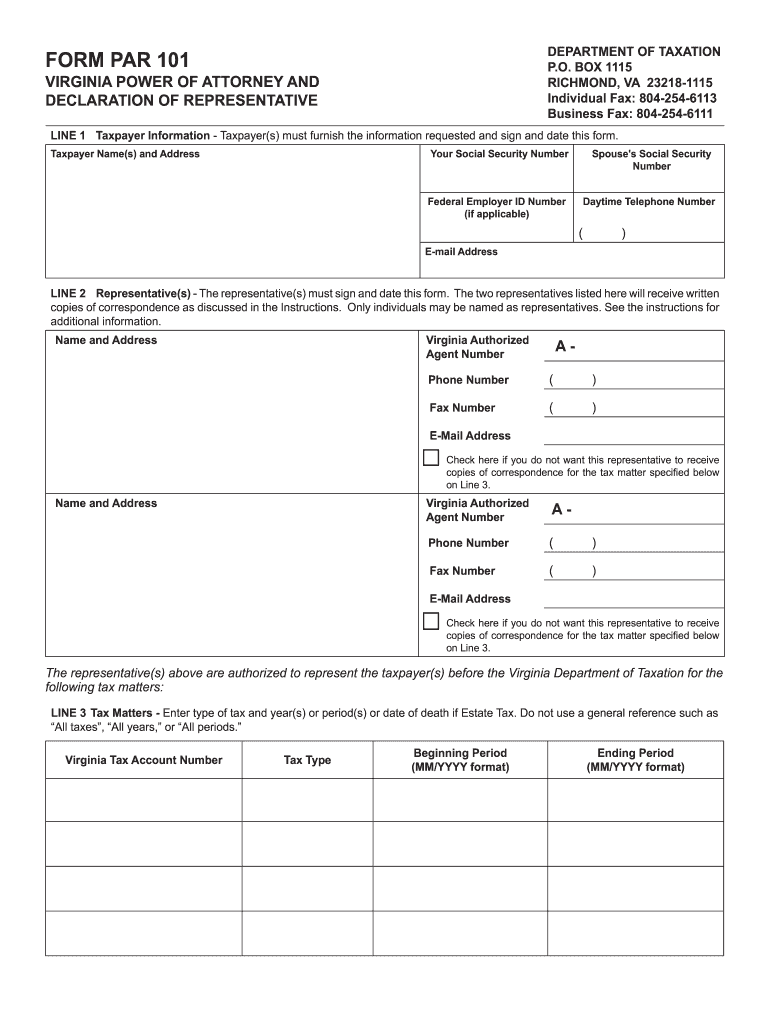

The Par 101 form is a crucial document used primarily in the context of tax reporting and compliance in the United States. It serves as a declaration of certain financial information that taxpayers must submit to the Internal Revenue Service (IRS) to ensure accurate tax assessments. Understanding the purpose and requirements of the Par 101 is essential for individuals and businesses to maintain compliance with federal tax laws.

How to use the Par 101

Using the Par 101 form involves several key steps. First, gather all necessary financial documentation, including income statements and expense records. Next, accurately fill out the form, ensuring that all information is complete and correct. This includes providing personal identification details and financial figures relevant to the reporting period. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferred method of filing.

Steps to complete the Par 101

Completing the Par 101 form requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Fill out your personal information, including name, address, and Social Security number.

- Input income details, ensuring accuracy in reporting all sources of income.

- Document any deductions or credits applicable to your situation.

- Review the entire form for errors or omissions before submission.

Legal use of the Par 101

The legal validity of the Par 101 form hinges on its compliance with IRS regulations. To ensure that your submission is legally recognized, it is vital to follow all guidelines set forth by the IRS. This includes using accurate information, adhering to filing deadlines, and maintaining proper documentation to support the claims made on the form. Failure to comply with these legal requirements can result in penalties or delays in processing.

Examples of using the Par 101

Examples of scenarios where the Par 101 form is applicable include:

- A self-employed individual reporting their business income and expenses.

- A retired person declaring pension income and any other earnings.

- Students who may have part-time jobs and need to report their income for tax purposes.

Each of these examples illustrates the importance of accurately completing the Par 101 to reflect one's financial situation to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Par 101 form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, if that date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes to the tax calendar and plan accordingly to ensure timely submission.

Who Issues the Form

The Par 101 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to obtain the form, along with instructions for completing it accurately. Taxpayers can access the form through the IRS website or request a physical copy through designated channels.

Quick guide on how to complete par 101

Manage Par 101 effortlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Process Par 101 on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented task today.

How to modify and electronically sign Par 101 with ease

- Find Par 101 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose your preferred method for sending your form, whether through email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Par 101 and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the par 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is par 101 and how does it relate to airSlate SignNow?

Par 101 refers to the foundational knowledge necessary for understanding electronic signatures and document workflows. airSlate SignNow simplifies this concept by providing an intuitive platform that empowers businesses to send and eSign documents efficiently.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, typically starting at a competitive price within the eSigning market. This makes it an affordable choice for those looking to implement par 101 solutions without breaking the bank.

-

What features does airSlate SignNow offer?

AirSlate SignNow includes features like customizable templates, advanced signing options, and real-time notifications. These functionalities are designed to enhance the user experience, making it easier to grasp par 101 principles in document management.

-

How can airSlate SignNow benefit my business?

With airSlate SignNow, businesses can streamline their document workflows, reduce turnaround times, and improve compliance. Understanding par 101 is essential for leveraging these benefits, as it helps users recognize the advantages of efficient electronic signing.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with popular software like Google Drive, Salesforce, and more. These integrations allow users to seamlessly incorporate par 101 practices into their existing workflows, enhancing productivity and efficiency.

-

Is airSlate SignNow secure for eSigning?

Absolutely, airSlate SignNow employs industry-leading security measures to protect sensitive information. Understanding par 101 also involves recognizing the importance of security in electronic transactions, which airSlate SignNow prioritizes.

-

What types of businesses can benefit from using airSlate SignNow?

AirSlate SignNow is beneficial for a wide range of businesses, from startups to large enterprises. By mastering par 101, organizations can effectively implement electronic signatures and optimize document handling processes across various sectors.

Get more for Par 101

Find out other Par 101

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now