Bank of America W9 Form

What is the Bank of America W-9?

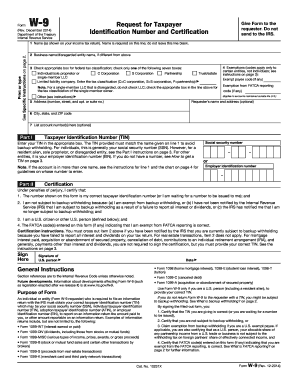

The Bank of America W-9 form is a tax document used by individuals and businesses to provide their taxpayer identification information to the bank. This form is essential for reporting income to the Internal Revenue Service (IRS) and is commonly requested by financial institutions, clients, or contractors. The W-9 form collects information such as the name, business name (if applicable), address, and taxpayer identification number (TIN) of the individual or entity filling it out. It ensures that the bank has accurate information for tax reporting purposes.

How to Obtain the Bank of America W-9

To obtain the Bank of America W-9 form, individuals can visit the official Bank of America website or contact their local branch. The form is typically available in a downloadable PDF format, allowing users to print and complete it. Additionally, customers can request the form directly from their bank representative during in-person visits or through customer service channels. It is important to ensure that the most current version of the W-9 is used, as outdated forms may not be accepted.

Steps to Complete the Bank of America W-9

Completing the Bank of America W-9 form involves several straightforward steps:

- Provide your name as it appears on your tax return.

- If applicable, enter your business name in the designated field.

- Fill in your address, including city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

After completing the form, it can be submitted to the requesting party, such as Bank of America, either electronically or via mail, depending on their submission guidelines.

Legal Use of the Bank of America W-9

The Bank of America W-9 form serves a critical legal purpose in the realm of tax compliance. By providing accurate taxpayer information, individuals and businesses help ensure that the correct amount of taxes is reported to the IRS. This form also protects the bank and the individual from potential penalties associated with incorrect tax reporting. It is important to complete the form truthfully, as providing false information can lead to legal repercussions.

Key Elements of the Bank of America W-9

Several key elements are essential to understand when filling out the Bank of America W-9 form:

- Name: The individual's name or the business name must be provided accurately.

- Taxpayer Identification Number (TIN): This can be either a Social Security number or an Employer Identification Number.

- Address: A complete address is necessary for proper identification and correspondence.

- Signature: The form must be signed and dated to validate the information provided.

IRS Guidelines for the Bank of America W-9

The IRS provides specific guidelines regarding the use and submission of the W-9 form. It is crucial to refer to these guidelines to ensure compliance with tax regulations. The IRS requires that the form be filled out accurately and submitted to the entity requesting it. Additionally, individuals should keep a copy of the completed form for their records. The IRS may also provide updates or changes to the form, so staying informed about any revisions is important for proper compliance.

Quick guide on how to complete bank of america w9

Effortlessly Prepare Bank Of America W9 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed papers, as you can access the needed form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Bank Of America W9 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Bank Of America W9 with Ease

- Locate Bank Of America W9 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Move past concerns about lost or misplaced files, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Bank Of America W9 and guarantee excellent communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bank of america w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Why would my bank suddenly need a W9?

Your bank may suddenly need a W9 form if they require accurate taxpayer information for reporting purposes. If you've opened a new account or if there's a change in your account status, they may request this form to comply with IRS regulations. Understanding why your bank requests a W9 can help ensure you provide the necessary information promptly.

-

What is the purpose of a W9 form?

A W9 form is used to provide your taxpayer identification information to financial institutions and businesses. It allows them to report income that they pay to you to the IRS. Knowing why your bank suddenly needs a W9 can clarify their need for compliance and help prevent any delays.

-

How can airSlate SignNow streamline the W9 signing process?

airSlate SignNow allows customers to send and eSign W9 forms electronically, making the process quick and efficient. With our secure platform, you can easily manage document workflows and ensure that your financial records are accurate. This can be particularly helpful when responding to requests from your bank about why they would need a W9.

-

Are there any costs associated with using airSlate SignNow for W9 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effectiveness of our solution is designed for businesses of all sizes, ensuring you get the best value while managing documents like W9 forms. Investing in a reliable eSigning tool can save you time and help clarify situations like why your bank suddenly needs a W9.

-

What features does airSlate SignNow offer for efficient document management?

airSlate SignNow includes features like customizable templates, in-app notifications, and secure storage that enhance document management. With these tools, you can easily track the status of your W9 forms and make sure you're prepared for any inquiries from your bank regarding why they may need a W9. These features enhance both productivity and compliance.

-

Can airSlate SignNow integrate with other financial software?

Yes, airSlate SignNow seamlessly integrates with various financial and business software, streamlining workflows. This means that when your bank requests a W9, you can quickly use our platform to send and sign documents without disruption. Integration capabilities are designed to facilitate responses to requests, including understanding why your bank would need a W9.

-

Is airSlate SignNow compliant with industry regulations?

Absolutely, airSlate SignNow adheres to industry standards and regulations to ensure the security and privacy of your documents. This compliance is especially important when dealing with sensitive forms like the W9, which your bank may require. Knowing that our platform meets these standards can help you feel more secure when submitting documents.

Get more for Bank Of America W9

- Contact usmolecular otolaryngology and renal research form

- Patient health questionnaire radiation oncology ucla form

- Musculoskeletal questionnaire application supplement individual disability icc16 17985pdf gr 81178 87436 form

- Anesthesia post operative assessment form

- Information for clients texas aampampm veterinary medical

- Injectable medication precertification request accessible pdf form

- Patient authorization for release of protected health information healthpartners

- The graduate school cornells ecommons cornell university form

Find out other Bank Of America W9

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed