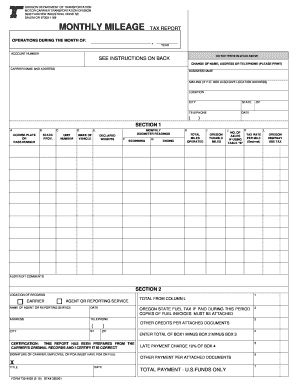

Oregon Monthly Mileage Tax Report Form

What is the Oregon Monthly Mileage Tax Report

The Oregon Monthly Mileage Tax Report is a document required by the Oregon Department of Transportation (ODOT) for businesses that operate vehicles within the state. This report tracks the mileage driven by commercial vehicles and is essential for calculating the mileage tax owed to the state. The report ensures compliance with state regulations and helps maintain accurate records for tax purposes. It is particularly relevant for companies with a fleet of vehicles, as it directly impacts their tax obligations and financial reporting.

How to use the Oregon Monthly Mileage Tax Report

To effectively use the Oregon Monthly Mileage Tax Report, businesses must first gather accurate mileage data from their vehicles. This data should include the total miles driven for the month, broken down by vehicle. Once the mileage is compiled, it can be entered into the appropriate sections of the report. Businesses should ensure that all entries are precise and reflect the actual mileage to avoid discrepancies. After completing the report, it must be submitted to the ODOT as part of the tax filing process.

Steps to complete the Oregon Monthly Mileage Tax Report

Completing the Oregon Monthly Mileage Tax Report involves several key steps:

- Gather mileage data from all vehicles operated during the reporting period.

- Fill out the report form, ensuring all required fields are completed accurately.

- Double-check the entries for accuracy, particularly the total mileage figures.

- Sign and date the report, confirming that the information provided is true and correct.

- Submit the completed report to ODOT by the specified deadline.

Legal use of the Oregon Monthly Mileage Tax Report

The Oregon Monthly Mileage Tax Report must be filled out and submitted in accordance with state laws and regulations. It serves as a legal document that can be used to verify the mileage tax owed by a business. To ensure its legal validity, businesses should maintain accurate records of their mileage and ensure that the report is completed in compliance with all relevant guidelines. Failure to adhere to these requirements may result in penalties or legal repercussions.

Required Documents

To complete the Oregon Monthly Mileage Tax Report, businesses should have the following documents ready:

- Mileage logs for each vehicle, detailing the miles driven during the reporting period.

- Any previous mileage tax reports for reference and consistency.

- Documentation of any changes in vehicle status or ownership that may affect reporting.

Form Submission Methods

The Oregon Monthly Mileage Tax Report can be submitted through various methods to accommodate different preferences. Businesses can choose to submit the report online through the ODOT website, which often provides a streamlined process. Alternatively, the report can be mailed to the appropriate ODOT office or submitted in person at designated locations. It is important to verify the submission method and ensure that the report is sent before the deadline to avoid late fees.

Quick guide on how to complete oregon monthly mileage tax report

Effortlessly prepare Oregon Monthly Mileage Tax Report on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly and without delays. Manage Oregon Monthly Mileage Tax Report on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to edit and electronically sign Oregon Monthly Mileage Tax Report with ease

- Find Oregon Monthly Mileage Tax Report and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Oregon Monthly Mileage Tax Report and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon monthly mileage tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon monthly mileage tax report?

The Oregon monthly mileage tax report is a requirement for businesses operating in Oregon that need to account for their vehicle mileage to determine tax obligations. This report helps ensure compliance with state tax laws and provides accurate data for tax calculations, making it essential for businesses managing transportation.

-

How can airSlate SignNow help with the Oregon monthly mileage tax report?

airSlate SignNow offers an efficient way to automate the creation and submission of the Oregon monthly mileage tax report. By providing editing, eSigning, and secure document storage, airSlate SignNow streamlines the tax reporting process, saving businesses valuable time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Oregon monthly mileage tax report?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, which include features for managing the Oregon monthly mileage tax report. The cost is competitive, providing a cost-effective solution for businesses that need to streamline their documentation and eSigning processes.

-

Can airSlate SignNow integrate with other accounting software for the Oregon monthly mileage tax report?

Absolutely! airSlate SignNow easily integrates with popular accounting software, allowing users to effortlessly manage their Oregon monthly mileage tax report alongside other financial documents. This integration helps maintain consistency in record-keeping and enhances overall efficiency.

-

What features does airSlate SignNow offer for managing the Oregon monthly mileage tax report?

airSlate SignNow provides features such as customizable templates, bulk sending, and real-time tracking for the Oregon monthly mileage tax report. These tools make it easy to gather necessary data, ensure compliance, and facilitate smooth submissions, improving the overall document workflow.

-

How secure is my data when using airSlate SignNow for the Oregon monthly mileage tax report?

Your data security is a top priority at airSlate SignNow. We use advanced encryption protocols and secure data storage to protect all information related to the Oregon monthly mileage tax report, ensuring that sensitive business information remains confidential and compliant with regulations.

-

Can I access my Oregon monthly mileage tax report on multiple devices?

Yes, airSlate SignNow is cloud-based, allowing you to access your Oregon monthly mileage tax report from any device with internet connectivity. This accessibility ensures you can manage your documentation and tax reporting effectively, whether at the office or on the go.

Get more for Oregon Monthly Mileage Tax Report

Find out other Oregon Monthly Mileage Tax Report

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later