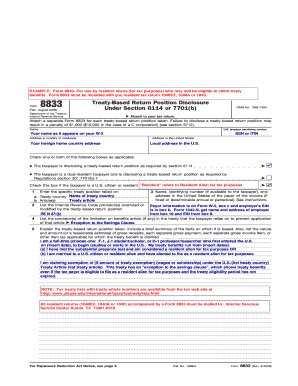

Example of Completed Form 8833

What is the example of completed Form 8833?

Form 8833, also known as the Treaty-Based Return Position Disclosure Under Section 6114 or 7701, is used by U.S. taxpayers to disclose their claim of a tax treaty benefit. A completed example of Form 8833 typically includes specific details about the taxpayer's situation, including their name, address, taxpayer identification number, and the relevant tax treaty provisions. The form outlines the reasons for claiming a tax treaty benefit and provides necessary documentation to support the claim.

Steps to complete the example of completed Form 8833

Filling out Form 8833 involves several steps to ensure accuracy and compliance with IRS requirements. Here are the key steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Identify the specific tax treaty you are claiming benefits under, including the country and relevant article numbers.

- Clearly state the type of income you are reporting and the amount that qualifies for treaty benefits.

- Provide a detailed explanation of the reasons for claiming the tax treaty benefits, referencing the applicable treaty articles.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal use of the example of completed Form 8833

The legal use of Form 8833 is crucial for taxpayers seeking to benefit from international tax treaties. By completing this form, taxpayers disclose their position regarding treaty benefits to the IRS, which helps avoid potential penalties for underreporting income. It is important to ensure that the form is filled out correctly and submitted on time to maintain compliance with U.S. tax laws.

IRS guidelines for Form 8833

The IRS provides specific guidelines for completing Form 8833, which include instructions on eligibility, required information, and filing procedures. Taxpayers should refer to the IRS instructions for Form 8833 to understand the necessary documentation and details required for their specific situation. Following these guidelines helps ensure that the form is processed correctly and that the taxpayer receives any applicable treaty benefits.

Filing deadlines for Form 8833

Filing deadlines for Form 8833 align with the taxpayer's annual tax return deadlines. Typically, this form must be filed along with the income tax return by the due date, including any extensions. It is essential to be aware of these deadlines to avoid penalties and ensure that the tax treaty claims are considered by the IRS.

Required documents for Form 8833

When completing Form 8833, certain documents may be required to substantiate the claims made on the form. These may include:

- Proof of residency in the foreign country.

- Documentation of the income being claimed under the tax treaty.

- Any correspondence from the IRS regarding previous filings or treaty claims.

Gathering these documents in advance can streamline the process of completing and submitting Form 8833.

Quick guide on how to complete example of completed form 8833

Prepare Example Of Completed Form 8833 effortlessly on any device

Online document management has become commonplace for companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documentation, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Example Of Completed Form 8833 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign Example Of Completed Form 8833 with ease

- Locate Example Of Completed Form 8833 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant portions of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that function.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to deliver your form: via email, text (SMS), a shareable link, or download it to your computer.

Put an end to lost or misplaced documents, exhausting form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choosing. Modify and eSign Example Of Completed Form 8833 and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the example of completed form 8833

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 8833 example and why is it important?

A form 8833 example illustrates how to report tax treaty benefits correctly. This form helps claim exemptions or reductions on certain types of income. Understanding a form 8833 example can ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with my form 8833 example?

AirSlate SignNow provides an intuitive platform that allows you to easily create and customize a form 8833 example. With electronic signatures and document management features, you can streamline the filing process and ensure timely submissions.

-

What features does airSlate SignNow offer for creating forms like the form 8833 example?

AirSlate SignNow offers robust features including drag-and-drop form builders, templates, and e-signatures that can simplify the creation of a form 8833 example. You can also collaborate with your team and track document statuses in real-time.

-

Is there a cost associated with using airSlate SignNow for a form 8833 example?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Each plan includes access to features that facilitate creating and managing a form 8833 example, providing great value for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications to manage my form 8833 example?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, such as CRMs and cloud storage services. This capability allows you to efficiently manage your form 8833 example alongside your other business workflows.

-

What are the benefits of using airSlate SignNow for a form 8833 example compared to paper forms?

Using airSlate SignNow for a form 8833 example offers several benefits, including faster processing times, enhanced security with encryption, and reduced paper waste. Electronic submissions also provide a more organized approach to managing tax documents.

-

How secure is my information when I create a form 8833 example with airSlate SignNow?

AirSlate SignNow employs advanced security measures to protect your information while creating a form 8833 example. This includes data encryption, secure storage, and compliance with industry standards to ensure your documents are safe.

Get more for Example Of Completed Form 8833

- Vdoe college verification form fillable 2016 2019

- City of woodinville 17301 133rd ave ne woodinville wa city form

- Form 1952 wisconsin supplement to financial report

- Pathway renewal 2016 2018 form

- Notice of intent to transfer alaska commercial fisheries entry form

- Alaska adec seafood processors application 2016 2018 form

- In determining your suitability for the position of an apsc certified officer in accordance with alaska police form

- General permit application package noi 15 alabama form

Find out other Example Of Completed Form 8833

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later