1019 Form

What is the 1019 Form

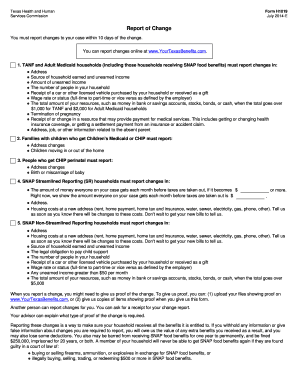

The 1019 form, also known as the form h1019, is a crucial document used in the United States for reporting changes in certain tax-related information. This form is particularly relevant for individuals and businesses that need to update their records with the Internal Revenue Service (IRS) or other relevant authorities. Understanding the purpose of the 1019 tax form is essential for ensuring compliance with tax regulations and maintaining accurate records.

How to Use the 1019 Form

Using the 1019 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant information that needs to be updated, such as personal identification details, tax identification numbers, and any changes in address or business structure. Next, fill out the form carefully, ensuring that all fields are completed as required. Once the form is filled out, it can be submitted electronically or via mail, depending on the specific instructions provided by the IRS or the issuing authority.

Steps to Complete the 1019 Form

Completing the 1019 form requires attention to detail. Follow these steps for accurate completion:

- Start by downloading the latest version of the form from the IRS website or obtaining it from your tax professional.

- Read the instructions carefully to understand the requirements for each section of the form.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details about the changes you are reporting, ensuring that all information is accurate and up to date.

- Review the completed form for any errors or omissions before submission.

Legal Use of the 1019 Form

The legal use of the 1019 form is governed by various regulations that ensure the integrity of the information provided. When completed correctly, the form serves as a legally binding document that can be used to update tax records with the IRS. It is important to ensure compliance with all applicable laws, including the ESIGN Act, which governs the legality of electronic signatures and documents. Using a reliable eSignature solution, like signNow, can help ensure that your submission is secure and compliant.

Filing Deadlines / Important Dates

Filing deadlines for the 1019 form can vary based on the specific circumstances of the taxpayer. It is essential to be aware of key dates to avoid penalties. Generally, the form should be submitted as soon as changes occur to ensure that records are updated in a timely manner. Taxpayers should consult the IRS guidelines or a tax professional for specific deadlines related to their situation.

Form Submission Methods

The 1019 form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to submit the form electronically through the IRS website or authorized e-filing services.

- Mail: The form can also be printed and mailed to the appropriate IRS office. Ensure that the correct address is used to avoid delays.

- In-Person: Some taxpayers may prefer to deliver the form in person at their local IRS office, which can provide immediate confirmation of receipt.

Who Issues the Form

The 1019 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. It is important to use the official form provided by the IRS to ensure compliance with federal regulations. Taxpayers should verify that they are using the most current version of the form to avoid issues with their submissions.

Quick guide on how to complete 1019 form

Prepare 1019 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage 1019 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign 1019 Form smoothly

- Obtain 1019 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal confidential information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1019 Form to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1019 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1019 form and why is it important?

The 1019 form is a crucial document used for tax reporting and compliance. It allows businesses to report various income types accurately, ensuring they meet regulatory requirements. Understanding the 1019 form helps organizations avoid potential fines and maintain good standing with tax authorities.

-

How can airSlate SignNow help with the 1019 form?

airSlate SignNow provides a streamlined solution to eSign and send the 1019 form electronically. Our platform simplifies the process, allowing businesses to complete and securely share the form with ease. This not only saves time but also reduces the hassle of paperwork.

-

What features does airSlate SignNow offer for managing the 1019 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage for the 1019 form. Users can create, edit, and sign documents from any device, ensuring flexibility and efficiency in managing important files. Additionally, our solution complies with legal standards, ensuring your forms are recognized and valid.

-

Is airSlate SignNow cost-effective for handling the 1019 form?

Yes, airSlate SignNow offers affordable pricing plans tailored for businesses of all sizes, making it a cost-effective solution for managing the 1019 form. By reducing printing and mailing costs, our platform can help your business save both time and money. Explore our pricing options to find the best fit for your needs.

-

Can I integrate airSlate SignNow with other software for the 1019 form?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easier to manage the 1019 form alongside your existing systems. Our integrations enhance your workflow by enabling data transfer between platforms, reducing manual entry, and improving overall efficiency.

-

What are the benefits of using airSlate SignNow for the 1019 form?

Using airSlate SignNow for the 1019 form provides several benefits, including enhanced security, faster processing times, and easy access from any device. Our platform is designed to simplify document management, ensuring that your forms are completed accurately and submitted on time. Plus, the user-friendly interface makes it accessible for everyone in your organization.

-

How secure is the 1019 form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the 1019 form. We utilize advanced encryption and compliance measures to protect your information during transmission and storage. You can trust that your data will remain confidential and secure throughout the signing process.

Get more for 1019 Form

- Information and license change missouri division of professional

- Application for license form

- 3154 colorado ave form

- B307 notice of termination form 2016 2019

- Ralr 1 rider 2018 2019 form

- Crisishousingfund for persons witha seriousmentalillness form

- Fix up program minnesota housing finance agency form

- Emergency amp accessibility loan program form

Find out other 1019 Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document