Form 4684

What is the Form 4684

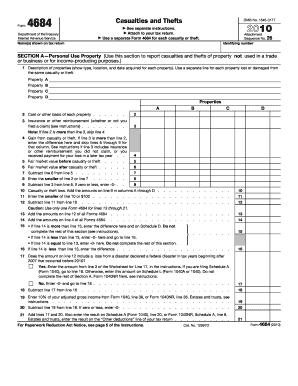

The Form 4684, also known as the Casualties and Thefts form, is used by taxpayers to report losses due to casualties or thefts. This form is essential for individuals and businesses seeking to claim deductions for losses on their federal tax returns. It helps in documenting the nature and extent of the losses incurred, which can significantly impact tax liability. Understanding how to accurately fill out this form is crucial for ensuring compliance with IRS regulations and maximizing potential deductions.

How to use the Form 4684

Using the Form 4684 involves several steps to ensure accurate reporting of losses. Taxpayers must first gather relevant information regarding the casualty or theft, including the date of the event, the type of property affected, and the value of the loss. The form requires detailed descriptions and calculations to substantiate the claims. It is advisable to maintain supporting documentation, such as photographs, police reports, and repair estimates, to validate the reported losses.

Steps to complete the Form 4684

Completing the Form 4684 requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering your personal information, including your name and Social Security number.

- Provide details about the casualty or theft, including the date and type of loss.

- Calculate the amount of loss by determining the fair market value before and after the event.

- Complete the necessary sections that pertain to your specific situation, whether it involves personal property or business assets.

- Attach any required documentation that supports your claims.

Legal use of the Form 4684

The legal use of the Form 4684 is governed by IRS regulations, which stipulate that the form must be filed accurately and timely to claim deductions for casualty and theft losses. To ensure compliance, taxpayers should familiarize themselves with relevant laws, including the Internal Revenue Code provisions that pertain to casualty losses. Adhering to these guidelines is essential for the form to be recognized as valid by the IRS.

Examples of using the Form 4684

There are various scenarios in which the Form 4684 is applicable. For instance, if a homeowner experiences damage to their property due to a natural disaster, they can use this form to report the loss. Similarly, if an individual has personal belongings stolen, such as electronics or jewelry, they can also file a claim using the Form 4684. Each example requires specific documentation to support the reported losses, ensuring that claims are legitimate and substantiated.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4684 align with the general tax filing deadlines set by the IRS. Typically, taxpayers must submit the form along with their annual tax return by April 15 of the following year. However, if an extension is filed, the deadline may be extended to October 15. It is important to stay informed about any changes in deadlines, especially in the wake of natural disasters or significant events that may affect filing requirements.

Quick guide on how to complete form 4684

Effortlessly set up Form 4684 on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without any delays. Manage Form 4684 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The simplest method to modify and electronically sign Form 4684 with ease

- Obtain Form 4684 and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate reprinting new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 4684 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4684

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to '4684'?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents efficiently. The mention of '4684' highlights our unique features that streamline document workflows, making it ideal for companies looking to enhance their productivity.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to diverse needs, ensuring that '4684' users get the best value. Our pricing models cater to startups, small businesses, and large enterprises, offering competitive rates without compromising on features.

-

What key features does airSlate SignNow offer for document management?

Some key features of airSlate SignNow include customizable templates, in-person signing, and advanced security options, all designed for your convenience as a '4684' user. This comprehensive toolkit enables seamless document management and enhances collaboration among teams.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and resources through automated document workflows, which is essential for '4684' efficiency. This leads to quicker turnaround times, improved customer satisfaction, and ultimately, increased revenue.

-

What integrations does airSlate SignNow support?

airSlate SignNow offers a range of integrations with popular applications, making it easier for '4684' users to connect tools they are already using. This functionality enhances workflow automation and data sync across various platforms, helping teams work more effectively.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow employs industry-standard security measures such as encryption and two-factor authentication to protect sensitive data, which is essential for '4684' users. Our commitment to security ensures that your documents are safe throughout the signing process.

-

Can I customize documents using airSlate SignNow?

Absolutely, airSlate SignNow allows users to customize documents easily, catering to the specific needs of '4684' workflows. This feature provides flexibility in formatting and branding, enabling you to maintain your professional identity while sending documents.

Get more for Form 4684

Find out other Form 4684

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will