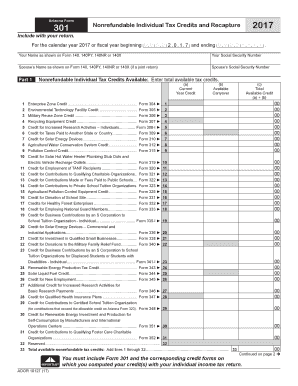

Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits Form

What are nonrefundable individual tax credits?

Nonrefundable individual tax credits are specific tax benefits that reduce the amount of tax owed, but they cannot reduce the tax liability below zero. This means if the credit exceeds the amount of tax owed, the excess is not refunded to the taxpayer. These credits are designed to assist individuals in lowering their tax burden and can include various types, such as credits for education, health care, or energy efficiency improvements. Understanding these credits is crucial for effective tax planning and can lead to significant savings.

How to use nonrefundable individual tax credits

To utilize nonrefundable individual tax credits, taxpayers must first determine their eligibility based on the specific criteria set by the IRS. Once eligibility is confirmed, individuals can claim these credits on their tax return, typically using Form 1040 or related schedules. It is essential to accurately calculate the total amount of credits available and apply them correctly to the tax owed. This process may involve gathering documentation that supports the claim for the credits, such as receipts or proof of expenses.

Key elements of nonrefundable individual tax credits

Key elements of nonrefundable individual tax credits include eligibility requirements, the type of expenses that qualify, and the specific forms needed for claiming the credits. Taxpayers should be aware of the various credits available, such as the Child Tax Credit, Lifetime Learning Credit, and others. Each credit has its own set of rules regarding eligibility, documentation, and the maximum amount that can be claimed. Familiarity with these elements helps ensure that taxpayers maximize their benefits while remaining compliant with tax laws.

Eligibility criteria for nonrefundable individual tax credits

Eligibility for nonrefundable individual tax credits typically depends on several factors, including income level, filing status, and specific circumstances related to the credit. For instance, some credits may have phase-out thresholds based on modified adjusted gross income (MAGI). Additionally, certain credits may only be available to taxpayers with dependents or those pursuing higher education. It is vital for individuals to review the requirements for each credit to determine their eligibility before filing their tax returns.

Required documents for claiming nonrefundable individual tax credits

When claiming nonrefundable individual tax credits, taxpayers must provide necessary documentation to support their claims. This may include receipts, tax forms, and proof of eligibility, such as enrollment in educational programs or proof of energy-efficient home improvements. Keeping organized records throughout the year can simplify the process of gathering these documents at tax time. Additionally, using digital solutions for document storage and management can enhance efficiency and security when preparing tax returns.

Filing deadlines for nonrefundable individual tax credits

Filing deadlines for claiming nonrefundable individual tax credits generally align with the annual tax return deadline, which is typically April 15. However, taxpayers should be aware of any extensions or changes that may occur due to specific circumstances, such as natural disasters or changes in tax law. It is advisable to file tax returns as early as possible to ensure that all credits are claimed and to avoid potential penalties for late filing. Keeping track of important tax dates can help individuals stay organized and compliant.

Quick guide on how to complete nonrefundable individual tax credits available enter total available tax credits

Accomplish Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits effortlessly on any device

Online document administration has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents quickly without delays. Manage Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits on any device using airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to modify and eSign Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits without breaking a sweat

- Locate Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits and click on Get Form to initiate.

- Employ the tools we provide to finalize your document.

- Highlight signNow parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Residential Real Estate: Are there tax credits available to land lords who rent apartments to individuals with medical, financial, family, and personal hardships?

I am not aware of any programs that offer tax credits or other financial incentives to landlords who rent to people with the hardships you describe. That doesn't mean there aren't any; that just means I'm not aware of them. I'm also not familiar with programs available in the cities you mention. There are, of course, many federal, state and local housing programs for "low income" individuals and families, but you're not asking about these.The programs I am aware of that offer tax credits and other financial incentives are only offered for owners and developers of new housing construction. These tax incentives often come from the Industrial Development Agency of the county or city in which the property is located. Medical, family, financial and personal hardships are challenges that almost all people face during their lifetime, so it might be difficult to find someone willing to rent an apartment or home at a reduced rent simply because the renter faces particular hardships.

-

If you played one of those $10,000 a spin slot machines in Vegas would that mean that anytime it won anything even one credit I would still have to fill out a tax form?

Yes, although they can set the machine to accumulated credit mode, and a staffer will sit by recording each jackpot on a form, then quickly resetting the machine so it’s ready to go again. You get a single W2G at the end of the session.It’s close to impossible to play extremely high-limit machines at any decent speed by feeding it currency and stopping for traditional hand-pays.

-

Why does the IRS not allow accountants to help business owners fill out tax forms? When the IRS isn't available to answer clarification questions, why can't I ask my accountant for clarification instead? What's the reasoning behind this IRS rule?

What! The IRS doesn’t allow CPAs to fill in tax returns for their clients? Where have I been? The IRS allows CPAs to help their clients in any respect necessary. The only thing is , if they materially contribute to the preparation of the return, the IRS wants the CPA to sign the return as a preparer. I get that, it makes sense. If I help you do a tax return, essentially I am a “shadow preparer” and the IRS wants me to sign on the return, to be sure I gave you proper and lawful advice.What I think you are relating is a common issue. A client comes in and asks a bunch of questions about how to complete a return. The CPA gives them all sorts of advice, but the client wants to do it themselves. Now the CPA is in an ethical quandary. The IRS demands that the CPA sign on the return, because they have materially participated in the preparation. The client is going to prepare the return, and so the CPA has lost control of what’s actually in the return, yet is going to have to sign it. Most CPAs simply won’t do that. They are going to demand to prepare the return, because their name ( and their professional status) is on the line. That’s what I do. If a client wants to ask me theoretical questions, fine, but if they are asking a bunch of questions about the preparation of their specific return, then I basically say that the IRS demands I sign the return, and there are so many moving parts in a tax return that I really have to prepare it, or charge them for reviewing it, which will probably cost as much or more.You can ( and should) ask your accountant for clarification on tax issues, that’s what we’re here for. But really, why are you so insistent on preparing your own return? It’s kind of like doing your own appendectomy. You probably could, but isn’t it better to have a professional fiddle with those things? I mean, is this really a special interest of yours, a hobby?In my experience, most clients who are convinced they should do their own returns are deluded by the myth that they can understand the tax law without spending hundreds of hours studying it, or they are afraid of paying for expert assistance. In either case, they are penny wise and pound foolish. If your time is only worth the minimum wage, if you are to keep up to date with the tax law, you have already spent time that’s way in excess of what a return professionally prepared will cost. Additionally, you’ve missed out having the return reviewed by someone who sees hundreds of returns, and knows when things stick out like sore audit flags. And, very importantly, you are flying solo without someone to back up and support the work they did.

-

Being a retailer, earlier I purchased goods in VAT of 5% and now I have to sell those under GST. How can I avail input tax credit for those products?

It is to be kept in mind that credit of VAT is taken already in the month of purchase. On 1st July 2017, you will c/f excess unutilised ITC from June 17 return. As regards Excise Duty part, it can be avilaed 100%, if supported by duty paid documents. If duty paid documents are not avilable, them deemed credit of 40% or 60% of applicable CGST can be taken.

-

How much input tax credit can I avail on my carry forward imported stock as of 30th June 2017? What is the timeline to sell carry forward imported material?

Two types of material are thereGoods meant for sale andGoods meant for capital goodsIn both cases treatment is differentOnly payment of additional custom duty can be taken as input credit.In either case the purchase should have been after 1st July 2016If the goods are meant for sale, these should be sold within 6 months from 1st July 2017 or latest by 31st Dec 2017

Create this form in 5 minutes!

How to create an eSignature for the nonrefundable individual tax credits available enter total available tax credits

How to create an eSignature for your Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits online

How to create an eSignature for your Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits in Google Chrome

How to create an eSignature for putting it on the Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits in Gmail

How to make an eSignature for the Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits from your mobile device

How to make an electronic signature for the Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits on iOS devices

How to make an eSignature for the Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits on Android devices

People also ask

-

What are Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits?

Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits refer to tax credits that can reduce your tax liability to zero but cannot create a refund. These credits are important for taxpayers as they can signNowly lower the amount owed to the IRS, especially for those who qualify for various deductions and credits.

-

How can airSlate SignNow help me manage my tax documents?

airSlate SignNow provides a streamlined solution for sending and eSigning documents, making it easier to manage important tax-related paperwork. With features that allow for secure storage and easy retrieval, you can efficiently handle all your documents related to Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits.

-

Are there any costs associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers a variety of pricing plans designed to suit different needs and budgets. Each plan provides essential features to help you manage your tax documents effectively, including those associated with Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are especially useful for organizing and managing documents related to Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits, ensuring you meet all deadlines.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation and accounting software. This integration makes it easy to manage Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits alongside other financial documents in one streamlined platform.

-

What benefits does airSlate SignNow provide for businesses handling tax credits?

Using airSlate SignNow, businesses can simplify the handling of tax documents, leading to increased efficiency and reduced errors. This is particularly beneficial when dealing with Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits, as it helps ensure all necessary documentation is accurately completed and submitted.

-

How secure is airSlate SignNow when it comes to sensitive tax information?

airSlate SignNow prioritizes security with robust encryption protocols and secure data storage. This ensures that your information, especially regarding Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits, is protected from unauthorized access.

Get more for Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits

Find out other Nonrefundable Individual Tax Credits Available Enter Total Available Tax Credits

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later