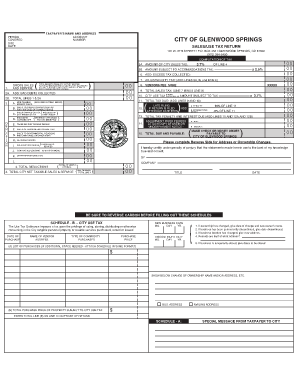

City of Glenwood Springs Sales Tax Form

What is the City of Glenwood Springs Sales Tax

The city of Glenwood Springs sales tax is a local tax imposed on the sale of goods and services within the city limits. This tax is collected by businesses at the point of sale and is a vital source of revenue for local government services, including infrastructure, public safety, and community programs. The sales tax rate can vary based on specific products or services, and it is important for both consumers and businesses to be aware of these rates to ensure compliance with local regulations.

Steps to Complete the City of Glenwood Springs Sales Tax

Completing the city of Glenwood Springs sales tax form involves several key steps:

- Gather necessary information, including your business details and sales records.

- Access the sales tax form through the official city website or designated government portal.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total sales tax due based on your sales figures and the applicable tax rate.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or via mail, depending on the submission method you choose.

Legal Use of the City of Glenwood Springs Sales Tax

The legal use of the city of Glenwood Springs sales tax is governed by local tax laws and regulations. Businesses must collect the appropriate sales tax from customers and remit it to the city within specified deadlines. Failure to comply with these laws can result in penalties, including fines and interest on unpaid taxes. It is essential for businesses to maintain accurate records of sales and tax collected to ensure compliance and facilitate audits if necessary.

Form Submission Methods

The city of Glenwood Springs sales tax form can be submitted through various methods:

- Online: Many businesses prefer to submit the form electronically through the city’s official website, which often provides a streamlined process.

- Mail: Businesses can also print the completed form and mail it to the designated city office.

- In-Person: Submitting the form in person at the city’s finance department is another option for those who prefer direct interaction.

Required Documents

When completing the city of Glenwood Springs sales tax form, certain documents may be required to support your submission. These may include:

- Sales records detailing transactions made during the reporting period.

- Documentation of any exemptions that may apply to specific sales.

- Previous sales tax returns, if applicable, for reference and consistency.

Penalties for Non-Compliance

Failure to comply with the city of Glenwood Springs sales tax regulations can lead to significant penalties. These may include:

- Fines based on the amount of tax owed.

- Interest charges on overdue tax payments.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete city of glenwood springs sales tax

Complete City Of Glenwood Springs Sales Tax effortlessly on any device

Internet document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without holdups. Manage City Of Glenwood Springs Sales Tax across any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign City Of Glenwood Springs Sales Tax effortlessly

- Obtain City Of Glenwood Springs Sales Tax and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize relevant parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign City Of Glenwood Springs Sales Tax and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of glenwood springs sales tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Glenwood Springs sales tax rate?

The city of Glenwood Springs sales tax rate is currently set at X%. This rate can vary depending on the type of goods and services you are purchasing. It is essential to stay updated with any changes to ensure compliance while using services like airSlate SignNow.

-

How does airSlate SignNow help with the city of Glenwood Springs sales tax?

airSlate SignNow provides businesses the tools needed to prepare and manage documents that involve sales tax obligations. By creating and eSigning documents easily, businesses can focus on compliance with the city of Glenwood Springs sales tax regulations without getting bogged down by paperwork.

-

Are there any specific features in airSlate SignNow for tax documentation?

Yes, airSlate SignNow offers features like customizable document templates and easy eSigning options tailored for tax purposes, including city of Glenwood Springs sales tax documentation. These features streamline the process, making it quicker and more efficient for businesses to manage their tax-related paperwork.

-

Does airSlate SignNow integrate with accounting software that tracks city of Glenwood Springs sales tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting tools that help track the city of Glenwood Springs sales tax. This allows businesses to maintain accurate records, ensuring that they stay compliant and can easily reference necessary documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Whether you are a small business dealing with the city of Glenwood Springs sales tax or a larger company, there is a plan that can meet your needs while being cost-effective.

-

Is airSlate SignNow user-friendly for new customers handling city sales taxes?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for new customers to navigate and handle documentation like city of Glenwood Springs sales tax forms. The intuitive interface ensures that everyone can efficiently send and sign documents without extensive training.

-

What benefits does airSlate SignNow offer for managing sales tax documents?

The primary benefit of airSlate SignNow for managing sales tax documents is the speed and efficiency it brings to the process. By allowing for electronic signatures and the quick generation of forms related to the city of Glenwood Springs sales tax, businesses save time and reduce the risk of errors.

Get more for City Of Glenwood Springs Sales Tax

- Candy making manual uidahoedu university of idaho extension extension uidaho form

- School safety patrol belts for sale form

- Cook county anti predatory lending form

- Mwrd chicago form

- Chassi il paperwork 2010 form

- Model partnership agreement form with signed letter the

- Indianaiep training manuals crown point community school form

- Re evaluation not needed agreement form kansas state

Find out other City Of Glenwood Springs Sales Tax

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF