Form 130 Short Forms Wellscounty

What is the Form 130 Short Forms Wellscounty

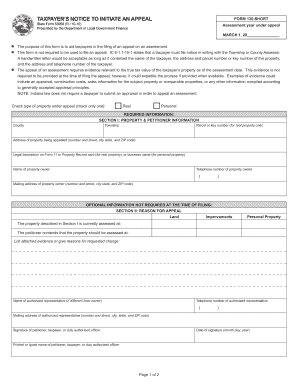

The Form 130 Short Forms Wellscounty is a specific document used in Well County for various administrative and legal purposes. This form is essential for individuals and businesses needing to submit official information to local authorities. It may serve different functions, such as applications, declarations, or notifications, depending on the context in which it is used. Understanding the purpose of the form is crucial for ensuring compliance with local regulations.

How to use the Form 130 Short Forms Wellscounty

Using the Form 130 Short Forms Wellscounty involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from local government offices or official websites. Next, fill out the required fields accurately, providing all necessary information. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online, by mail, or in person.

Steps to complete the Form 130 Short Forms Wellscounty

Completing the Form 130 Short Forms Wellscounty requires attention to detail. Begin by gathering any documents or information needed to fill out the form. Follow these steps:

- Download or obtain the form from an official source.

- Read the instructions carefully to understand what information is required.

- Fill in your personal or business details as requested.

- Provide any additional information that may be necessary, such as signatures or dates.

- Review the form for accuracy before submission.

Legal use of the Form 130 Short Forms Wellscounty

The legal use of the Form 130 Short Forms Wellscounty is governed by local laws and regulations. When completed correctly, the form can serve as a legally binding document. It is important to ensure that all information is accurate and that the form is submitted within the required timeframes. Failure to comply with legal requirements may result in penalties or delays in processing.

Key elements of the Form 130 Short Forms Wellscounty

Key elements of the Form 130 Short Forms Wellscounty typically include the following:

- Identification of the individual or entity submitting the form.

- Specific details related to the purpose of the form.

- Signatures of the parties involved, if applicable.

- Date of submission.

Each of these elements plays a crucial role in ensuring the form's validity and compliance with local regulations.

Who Issues the Form

The Form 130 Short Forms Wellscounty is typically issued by local government authorities, such as the county clerk's office or relevant administrative departments. These offices are responsible for providing the necessary forms and ensuring they meet legal standards. It is advisable to check with the appropriate office to obtain the most current version of the form and any specific instructions for its use.

Quick guide on how to complete form 130 short forms wellscounty

Complete Form 130 Short Forms Wellscounty effortlessly on any device

Electronic document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 130 Short Forms Wellscounty on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Form 130 Short Forms Wellscounty with ease

- Obtain Form 130 Short Forms Wellscounty and click on Get Form to commence.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 130 Short Forms Wellscounty and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 130 short forms wellscounty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 130 Short Forms Wellscounty used for?

The Form 130 Short Forms Wellscounty is primarily used for streamlining the document signing process in Wells County. This form allows users to easily manage and eSign necessary documents, eliminating the hassle of traditional paperwork and enhancing efficiency.

-

How can airSlate SignNow help with Form 130 Short Forms Wellscounty?

airSlate SignNow provides a straightforward platform to fill out and eSign Form 130 Short Forms Wellscounty digitally. Our solution ensures that the process is secure, fast, and compliant, making it easier for businesses and individuals to complete essential paperwork.

-

What are the pricing options for using airSlate SignNow for Form 130 Short Forms Wellscounty?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs for handling Form 130 Short Forms Wellscounty. You can choose from our free trial, monthly subscriptions, or annual plans, which provide cost-effective solutions for document management.

-

What features does airSlate SignNow offer for Form 130 Short Forms Wellscounty?

airSlate SignNow includes a rich set of features for managing Form 130 Short Forms Wellscounty, such as customizable templates, automated reminders, and secure storage. Additionally, our platform supports various file formats, making it a versatile tool for document signing.

-

Are there any integrations available with airSlate SignNow for Form 130 Short Forms Wellscounty?

Yes, airSlate SignNow integrates seamlessly with several popular applications and tools, enhancing the workflow for Form 130 Short Forms Wellscounty. Users can connect with platforms like Google Drive, Salesforce, and more, simplifying document management across their existing systems.

-

What are the benefits of using airSlate SignNow for Form 130 Short Forms Wellscounty?

Using airSlate SignNow for Form 130 Short Forms Wellscounty comes with benefits like increased productivity, reduced turnaround time for document signing, and enhanced compliance. Our user-friendly interface ensures a smooth experience, allowing users to focus on their core tasks.

-

Is airSlate SignNow secure for handling Form 130 Short Forms Wellscounty?

Absolutely! AirSlate SignNow prioritizes security, employing advanced encryption methods and compliance with industry standards to protect Form 130 Short Forms Wellscounty. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Form 130 Short Forms Wellscounty

Find out other Form 130 Short Forms Wellscounty

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template