Is it Truehttpswww Taxhow Netstaticformpdfstates1538366400mi F Mi 2210 PDF

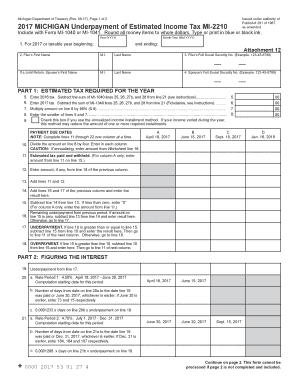

What is the F MI Form?

The F MI form, specifically known as the MI-2210, is a tax document used by individuals in the United States to report underpayment of estimated taxes. This form is essential for taxpayers who may not have withheld enough tax throughout the year or have not made adequate estimated tax payments. Understanding the purpose and requirements of the F MI form can help ensure compliance with tax obligations and avoid potential penalties.

Steps to Complete the F MI Form

Completing the F MI form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Use the form to calculate any underpayment and determine if you owe additional taxes.

- Review the completed form for accuracy before submission.

Legal Use of the F MI Form

The F MI form is legally binding when completed accurately and submitted on time. It is crucial for taxpayers to adhere to IRS guidelines regarding estimated tax payments to avoid penalties. The form must be signed and dated, and electronic signatures are acceptable, provided they comply with the necessary legal frameworks. Ensuring that the form is filled out correctly can help mitigate risks associated with tax liabilities.

Filing Deadlines / Important Dates

Timely submission of the F MI form is critical. The IRS typically sets specific deadlines for filing estimated tax payments, which align with quarterly payment schedules. Taxpayers should be aware of these dates to ensure they meet their obligations and avoid late fees. Keeping a calendar of important tax dates can help manage these deadlines effectively.

Form Submission Methods

The F MI form can be submitted through various methods, including:

- Online submission via the IRS e-file system.

- Mailing a paper copy to the appropriate IRS address.

- In-person submission at designated IRS offices.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Penalties for Non-Compliance

Failure to file the F MI form or underpayment of estimated taxes can result in significant penalties. The IRS may impose fines based on the amount owed and the duration of the delay. Understanding these penalties can motivate timely and accurate filing, helping taxpayers avoid unnecessary financial burdens.

Quick guide on how to complete mi 2210

Effortlessly prepare mi 2210 on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools essential for quickly creating, editing, and electronically signing your documents without delays. Handle f mi on any platform through airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest way to modify and electronically sign mi 2210 with minimal effort

- Locate mi f and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adapt and electronically sign f mi to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to mi f

Create this form in 5 minutes!

How to create an eSignature for the f mi

How to make an electronic signature for the Is It Truehttpswwwtaxhownetstaticformpdfstates1538366400mi F Mi 2210 2017pdf online

How to generate an electronic signature for the Is It Truehttpswwwtaxhownetstaticformpdfstates1538366400mi F Mi 2210 2017pdf in Chrome

How to create an eSignature for signing the Is It Truehttpswwwtaxhownetstaticformpdfstates1538366400mi F Mi 2210 2017pdf in Gmail

How to create an eSignature for the Is It Truehttpswwwtaxhownetstaticformpdfstates1538366400mi F Mi 2210 2017pdf from your mobile device

How to make an eSignature for the Is It Truehttpswwwtaxhownetstaticformpdfstates1538366400mi F Mi 2210 2017pdf on iOS

How to generate an electronic signature for the Is It Truehttpswwwtaxhownetstaticformpdfstates1538366400mi F Mi 2210 2017pdf on Android devices

People also ask mi f

-

What is airSlate SignNow and how does it work with f mi?

airSlate SignNow is a user-friendly eSignature solution that enables businesses to send and sign documents electronically. With f mi integration, you can ensure efficient document management and streamline your workflow, allowing for faster approvals and improved productivity.

-

What are the pricing plans available for airSlate SignNow with f mi?

airSlate SignNow offers various pricing plans to accommodate different business needs with f mi features. From a free trial to individual, business, and enterprise options, you can choose a plan that suits your budget and requirements, ensuring you get the best eSignature experience.

-

What key features does airSlate SignNow provide for users of f mi?

airSlate SignNow includes essential features like customizable templates, automated workflows, and secure cloud storage. Utilizing f mi capabilities, it enhances collaboration and simplifies the process of document signing, making it easier for teams to manage their work.

-

How does airSlate SignNow benefit businesses using f mi?

Businesses utilizing airSlate SignNow with f mi can expect signNow time savings and reduced operational costs. The intuitive platform enhances efficiency by streamlining the workflow and eliminating the need for paper documents, ultimately improving overall business communication.

-

Can airSlate SignNow integrate with other applications while using f mi?

Yes, airSlate SignNow offers seamless integrations with numerous applications while leveraging f mi functionality. This ensures that you can connect with tools you already use, such as CRM and project management software, to enhance your document workflows and improve data management.

-

What security measures are in place for airSlate SignNow and f mi users?

airSlate SignNow prioritizes security with features such as advanced encryption, secure storage, and compliance with industry regulations. For f mi users, this means you can send and sign documents confidently, knowing that your sensitive information is well-protected.

-

Is there a mobile app for airSlate SignNow that supports f mi?

Yes, airSlate SignNow offers a mobile application that supports f mi, allowing users to send and sign documents on-the-go. This app provides the convenience of managing your documents anytime and anywhere while keeping all necessary features at your fingertips.

Get more for f mi

Find out other mi 2210

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online