Formulario 480

What is the Formulario 480

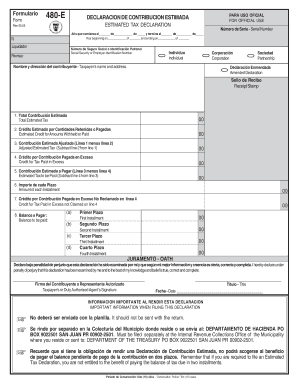

The Formulario 480, also known as the forma 480 puerto rico, is a tax form used in Puerto Rico for reporting income from various sources, including services rendered and other professional activities. This form is essential for individuals and businesses alike, as it helps the Puerto Rico Department of Treasury (Hacienda) track income and ensure compliance with local tax laws. The 480 planillas is particularly relevant for self-employed individuals and professionals who provide services and receive payments that need to be reported for tax purposes.

How to use the Formulario 480

Using the Formulario 480 involves several steps to ensure accurate reporting of income. First, gather all necessary documentation, including records of payments received and any relevant invoices. Next, accurately fill out the form, detailing the income sources and amounts. It is crucial to ensure that all information is correct, as errors can lead to penalties or delays in processing. Once completed, the form can be submitted electronically or via mail to the appropriate tax authority.

Steps to complete the Formulario 480

Completing the Formulario 480 requires careful attention to detail. Here are the steps to follow:

- Collect all income-related documents, such as invoices and payment records.

- Obtain the latest version of the Formulario 480 from the Puerto Rico Department of Treasury website.

- Fill out the form, ensuring all income sources are accurately reported.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate address.

Legal use of the Formulario 480

The legal use of the Formulario 480 is governed by the tax regulations set forth by the Puerto Rico Department of Treasury. It is essential to use the form correctly to avoid legal repercussions, such as fines or audits. The form serves as an official record of income and must be completed in compliance with all applicable tax laws. Proper use ensures that individuals and businesses meet their tax obligations and maintain good standing with the tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 480 are critical to ensure compliance with tax regulations. Typically, the form must be submitted by a specified date each year, often coinciding with the annual tax filing period. It is important to stay informed about these deadlines, as late submissions can result in penalties. Taxpayers should check the Puerto Rico Department of Treasury's announcements for the exact dates each tax year.

Required Documents

To complete the Formulario 480, several documents are required. These include:

- Records of payments received for services rendered.

- Invoices issued to clients or customers.

- Any relevant tax identification numbers.

- Previous year’s tax return, if applicable, for reference.

Having these documents ready will streamline the process of filling out the form and ensure accuracy.

Form Submission Methods

The Formulario 480 can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Electronic submission via the Puerto Rico Department of Treasury's online portal.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Choosing the right submission method can depend on personal preference and the resources available.

Quick guide on how to complete formulario 480 150550

Easily Prepare Formulario 480 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruption. Manage Formulario 480 from any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to alter and electronically sign Formulario 480 effortlessly

- Find Formulario 480 and click on Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, and mistakes that necessitate printing out new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device. Edit and electronically sign Formulario 480 to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 480 150550

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is forma 480 Puerto Rico?

Forma 480 Puerto Rico refers to the tax form used in Puerto Rico for reporting certain types of income. It is essential for individuals and businesses to accurately report their income to the Puerto Rican government. Using tools like airSlate SignNow can streamline the process of filling and eSigning your forma 480.

-

How can airSlate SignNow help with forma 480 Puerto Rico?

airSlate SignNow provides an efficient platform for preparing and eSigning tax documents, including forma 480 Puerto Rico. Its easy-to-use interface ensures that you can manage and send your forms quickly, reducing the administrative burden during tax season.

-

Is there a cost associated with using airSlate SignNow for forma 480 Puerto Rico?

Yes, airSlate SignNow offers several pricing plans designed to fit businesses of all sizes. The investment is minimal compared to the time saved in managing your forma 480 Puerto Rico and other paperwork, allowing you to focus on your core business activities.

-

What features does airSlate SignNow offer for forma 480 Puerto Rico?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage, all of which assist in handling forma 480 Puerto Rico effectively. These features promote collaboration and ensure that your documents remain compliant with local regulations.

-

Can I integrate airSlate SignNow with other applications for managing forma 480 Puerto Rico?

Absolutely! airSlate SignNow offers integrations with popular business applications that can enhance the management of your forma 480 Puerto Rico. These integrations provide a seamless workflow, facilitating better organization of your tax submissions and related documents.

-

What are the benefits of using airSlate SignNow for forma 480 Puerto Rico?

Using airSlate SignNow for forma 480 Puerto Rico allows for greater efficiency in document processing and ensures fast turnaround times with eSignatures. Additionally, it enhances document accuracy, reducing the chances of errors that could lead to delays in tax filing.

-

How secure is the information I submit through airSlate SignNow for forma 480 Puerto Rico?

airSlate SignNow employs advanced security measures to protect your sensitive information submitted in forma 480 Puerto Rico. With encryption and secure access controls, you can feel confident that your data remains safe and private throughout the signing process.

Get more for Formulario 480

- Out of county field trip forms duval county public schools duvalschools

- Form fm 7335

- Personalfamily physician citystate office phone form

- Sunbiz amendment online form

- Sunbiz amendment form

- Florida retirement system certification form

- Request a transcriptsouthwest miami senior high form

- Number permit type form

Find out other Formulario 480

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast