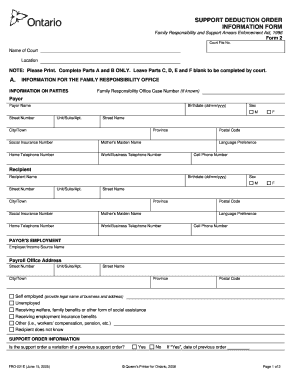

Support Deduction Order Information Form

What is the Support Deduction Order Information Form

The Support Deduction Order Information Form is a legal document used in the United States to facilitate the collection of child or spousal support payments through payroll deductions. This form is essential for ensuring that support obligations are met consistently and efficiently. It provides a structured way for employers to deduct the specified amounts directly from an employee's paycheck, thereby simplifying the payment process for both the payor and the recipient.

How to Use the Support Deduction Order Information Form

Using the Support Deduction Order Information Form involves several key steps. First, the form must be completed accurately with the necessary details, including the names of the parties involved, the amount to be deducted, and the frequency of deductions. Once filled out, the form should be submitted to the appropriate employer or payroll department. It is important to ensure that all information is correct to avoid delays in processing the deductions.

Steps to Complete the Support Deduction Order Information Form

Completing the Support Deduction Order Information Form requires careful attention to detail. Here are the essential steps:

- Gather all necessary information, including personal details of the payor and recipient.

- Clearly specify the amount to be deducted from each paycheck.

- Indicate the frequency of deductions, such as weekly or monthly.

- Review the form for accuracy before submission.

- Submit the completed form to the employer's payroll department.

Legal Use of the Support Deduction Order Information Form

The Support Deduction Order Information Form is legally binding when executed correctly. It must comply with state laws regarding support payments and payroll deductions. By using this form, employers and payors can ensure that they are adhering to legal requirements, thereby minimizing the risk of disputes or penalties related to support obligations. It is advisable to consult with a legal professional if there are any uncertainties about the form's legal implications.

Required Documents

To complete the Support Deduction Order Information Form, certain documents may be required. These typically include:

- A copy of the court order specifying the support amount.

- Identification documents for both the payor and recipient.

- Proof of employment for the payor, such as a recent pay stub.

Having these documents on hand will facilitate the accurate completion of the form and ensure compliance with legal standards.

Form Submission Methods

The Support Deduction Order Information Form can be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online submission via the employer's payroll system.

- Mailing the completed form to the payroll department.

- Hand-delivering the form to the employer's office.

It is important to confirm the preferred submission method with the employer to ensure timely processing of the deductions.

Quick guide on how to complete support deduction order information form

Complete Support Deduction Order Information Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily acquire the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Handle Support Deduction Order Information Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The most effective way to edit and electronically sign Support Deduction Order Information Form with ease

- Obtain Support Deduction Order Information Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Support Deduction Order Information Form and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the support deduction order information form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a support deduction order form 1?

The support deduction order form 1 is a document that facilitates the automatic deduction of support payments. This form ensures that payments are processed efficiently and on time, providing peace of mind for both payers and recipients. Utilizing airSlate SignNow, you can easily manage and eSign your support deduction order form 1.

-

How can the support deduction order form 1 benefit my business?

Using the support deduction order form 1 helps streamline the payment process, reducing administrative burdens. It ensures consistent cash flow and proper record-keeping, which is essential for financial planning. With airSlate SignNow, this form can be completed and sent quickly, enhancing overall efficiency.

-

Is there a cost associated with using the support deduction order form 1 through airSlate SignNow?

airSlate SignNow offers competitive pricing plans that are designed to fit various business needs. Depending on the features you choose, the use of the support deduction order form 1 is included in these plans. Check our pricing page to find a plan that suits your specific requirements and budget.

-

Can I integrate the support deduction order form 1 with other applications?

Yes, airSlate SignNow provides extensive integrations with popular applications, making it easy to incorporate the support deduction order form 1 into your existing workflows. This feature allows for seamless document management and enhances productivity across your organization. Explore our integrations page to see the full list of compatible applications.

-

How does airSlate SignNow ensure the security of my support deduction order form 1?

Security is a top priority for airSlate SignNow; we implement robust encryption and secure data storage protocols. When you use the support deduction order form 1, your sensitive information is protected against unauthorized access. Additionally, we comply with industry standards to safeguard all transactions and documents.

-

Can I track the status of my support deduction order form 1?

Absolutely! airSlate SignNow provides tracking features that enable you to monitor the status of your support deduction order form 1 in real-time. You will receive notifications about changes or updates, ensuring you're always informed about the progress of your documents.

-

What types of businesses can benefit from the support deduction order form 1?

Any business that handles support payments can benefit from the support deduction order form 1, regardless of size or industry. From small startups to large enterprises, this form simplifies payment processes and improves cash flow management. Using airSlate SignNow, businesses of all types can enhance their document workflows.

Get more for Support Deduction Order Information Form

- Forms and documents college of education wayne state

- Cover letter feedback request form wesley college wesley

- School verification form

- Literacy comprehensive exam application west chester form

- Elements new student outdoor program is an outdoor adventure experience for new incoming freshmen to the university of west form

- Substantive change monitoring policy form

- Student recordsinformation

- Medical studentresident rotation application form

Find out other Support Deduction Order Information Form

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free