16 See Rule 31 1 a Certificate under Section 203 of the Income Tax Act, 1961 for Tax Deducted at Source from Income Chargeable U Form

Understanding the 16 See Rule 31 1 a Certificate Under Section 203

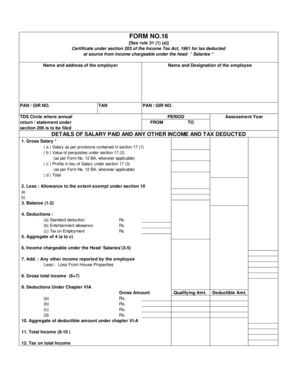

The 16 See Rule 31 1 a certificate is a crucial document under Section 203 of the Income Tax Act, 1961. It pertains to tax deducted at source (TDS) from income chargeable under the head of salaries. This certificate includes essential details such as the name and designation of the employee, the name and address of the employer, and the Permanent Account Number (PAN) of both parties. The Government of India mandates this form to ensure transparency in tax deductions and to facilitate proper filing of income tax returns.

Steps to Complete the 16 See Rule 31 1 a Certificate

Completing the 16 See Rule 31 1 a certificate involves several key steps to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary information: Collect details such as the employee's name, designation, PAN, and the employer's name and address.

- Fill out the form: Input the gathered information accurately in the designated fields of the certificate.

- Verify details: Double-check all entries for correctness to avoid discrepancies that could lead to issues with tax filings.

- Obtain signatures: Ensure that the relevant parties sign the certificate to validate it.

- Submit the certificate: Provide the completed certificate to the concerned tax authorities or maintain it for personal records.

Legal Use of the 16 See Rule 31 1 a Certificate

The legal use of the 16 See Rule 31 1 a certificate is significant for both employers and employees. This document serves as proof of TDS deductions, which is essential for filing income tax returns. It also protects employees from being taxed on income that has already been subjected to TDS. Properly issued and completed, this certificate can be presented to the tax authorities to demonstrate compliance with tax regulations.

Key Elements of the 16 See Rule 31 1 a Certificate

Understanding the key elements of the 16 See Rule 31 1 a certificate is vital for accurate completion. The main components include:

- Name of the employee: The full name as per official records.

- Designation: The job title of the employee.

- Name and address of the employer: Complete details of the organization.

- PAN: The unique identification number for both the employee and employer.

- Tax deduction details: Information regarding the amount of tax deducted at source.

How to Obtain the 16 See Rule 31 1 a Certificate

Obtaining the 16 See Rule 31 1 a certificate typically involves a straightforward process. Employers are responsible for issuing this certificate to their employees. To obtain it:

- Request from employer: Employees should formally request the certificate from their employer.

- Ensure timely issuance: Employers should provide the certificate promptly, especially during tax filing seasons.

- Review the document: Employees should verify the accuracy of the information on the certificate upon receipt.

IRS Guidelines and Filing Deadlines

While the 16 See Rule 31 1 a certificate is governed by Indian tax laws, it's essential for U.S. residents to understand the implications of foreign income and TDS on their U.S. tax filings. The IRS has specific guidelines regarding foreign income reporting, and taxpayers must adhere to filing deadlines to avoid penalties. It is advisable to consult a tax professional familiar with both U.S. and Indian tax regulations to ensure compliance.

Quick guide on how to complete 16 see rule 31 1 a certificate under section 203 of the income tax act 1961 for tax deducted at source from income chargeable

Compile 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U effortlessly on any gadget

Digital document management has become widely accepted among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, enabling you to locate the right template and safely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to modify and eSign 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U with ease

- Obtain 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Modify and eSign 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 16 see rule 31 1 a certificate under section 203 of the income tax act 1961 for tax deducted at source from income chargeable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form no 16A as per rule 31 1 A in excel format?

Form no 16A as per rule 31 1 A in excel format is a tax document that provides details about the tax deducted at source for payments made to business professionals. This format simplifies the process of record-keeping and tax filing for businesses. By utilizing airSlate SignNow, you can easily manage and access this form in a digital format.

-

How can airSlate SignNow help with form no 16A as per rule 31 1 A in excel format?

AirSlate SignNow offers a streamlined process for sending and eSigning documents such as form no 16A as per rule 31 1 A in excel format. Our platform ensures secure storage and easy retrieval of your forms, making compliance straightforward. With user-friendly features, you can efficiently manage all your tax documentation.

-

What are the pricing options for using airSlate SignNow for form no 16A as per rule 31 1 A in excel format?

AirSlate SignNow offers flexible pricing plans designed to suit various business needs when handling documents like form no 16A as per rule 31 1 A in excel format. You can select from monthly or annual subscriptions based on the volume of documents you need to manage. Visit our pricing page for more details on each plan.

-

Is it possible to integrate airSlate SignNow with other software for form no 16A as per rule 31 1 A in excel format?

Yes, airSlate SignNow offers robust integrations with various productivity tools, allowing you to incorporate form no 16A as per rule 31 1 A in excel format into your existing workflows. This integration enhances efficiency by automating document management and reducing manual entry errors. Check our integration page for a list of compatible software.

-

Can I customize form no 16A as per rule 31 1 A in excel format using airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize form no 16A as per rule 31 1 A in excel format to meet your specific requirements. Our platform provides various templates and editing tools to tailor your documents. This feature helps ensure that all essential details are accurately represented.

-

What are the security features of airSlate SignNow when handling form no 16A as per rule 31 1 A in excel format?

AirSlate SignNow prioritizes security with advanced encryption and authentication measures for documents like form no 16A as per rule 31 1 A in excel format. Your documents are protected both in transit and at rest, ensuring that sensitive information remains confidential. You can confidently eSign and share your forms knowing they are secure.

-

How can I track the status of form no 16A as per rule 31 1 A in excel format sent through airSlate SignNow?

When you use airSlate SignNow, you have the ability to track the status of your documents, including form no 16A as per rule 31 1 A in excel format. You'll receive real-time notifications on when a document is viewed, signed, or completed. This transparency helps you maintain control over your workflow.

Get more for 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U

Find out other 16 See Rule 31 1 a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable U

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online