Know Your Client Form

What is the Know Your Client Form

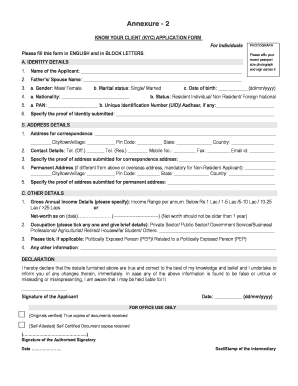

The Know Your Client (KYC) form is a crucial document used by financial institutions and other businesses to verify the identity of their clients. This form helps organizations comply with regulatory requirements aimed at preventing fraud, money laundering, and other illicit activities. The KYC form typically collects personal information such as the client's name, address, date of birth, and identification details. It is essential for establishing a trustworthy relationship between the client and the institution, ensuring that both parties are protected under the law.

How to use the Know Your Client Form

Using the Know Your Client form involves several straightforward steps. First, clients should obtain the form from the institution requiring it. Once in possession of the form, clients must fill it out with accurate and up-to-date information. This includes providing personal identification details and any other requested information. After completing the form, clients should submit it according to the institution's specified method, which may include online submission, mailing, or in-person delivery. Ensuring that the form is filled out correctly is vital for a smooth verification process.

Steps to complete the Know Your Client Form

Completing the Know Your Client form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, such as a government-issued ID and proof of address.

- Fill in personal details, including full name, date of birth, and contact information.

- Provide identification numbers, such as Social Security Number or Tax Identification Number, if required.

- Review the form for accuracy and completeness before submission.

- Submit the form through the designated method provided by the institution.

Legal use of the Know Your Client Form

The legal use of the Know Your Client form is governed by various regulations designed to protect both clients and institutions. In the United States, compliance with laws such as the Bank Secrecy Act and the USA PATRIOT Act mandates that financial institutions conduct due diligence on their clients. This includes collecting and verifying information through the KYC form. When filled out correctly, the form serves as a legally binding document that helps institutions mitigate risks associated with identity theft and fraud.

Key elements of the Know Your Client Form

Several key elements are essential for a comprehensive Know Your Client form. These include:

- Personal Identification: Full name, date of birth, and Social Security Number.

- Contact Information: Current address, phone number, and email address.

- Identification Documents: Details of government-issued IDs, such as driver's licenses or passports.

- Financial Information: Employment status, income sources, and financial history.

- Signature: A declaration that the information provided is accurate and complete.

Required Documents

To complete the Know Your Client form, clients typically need to provide several documents to verify their identity. Commonly required documents include:

- Government-issued photo identification, such as a passport or driver's license.

- Proof of address, which can be a utility bill or bank statement.

- Social Security card or Tax Identification Number documentation.

- Any additional documents requested by the institution, depending on their specific requirements.

Quick guide on how to complete know your client form

Complete Know Your Client Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any delays. Manage Know Your Client Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and electronically sign Know Your Client Form with ease

- Find Know Your Client Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or opt to download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Know Your Client Form to ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the know your client form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a KYC form and why is it important?

A KYC form, or Know Your Customer form, is a standard document used by businesses to verify the identity of their clients. It is crucial for regulatory compliance and helps in preventing fraud by ensuring that organizations know who they are dealing with. Using airSlate SignNow, you can easily create and manage KYC forms efficiently.

-

How does airSlate SignNow streamline the KYC form process?

airSlate SignNow streamlines the KYC form process by allowing businesses to send, sign, and store documents securely in one platform. With its user-friendly interface, you can customize KYC forms to fit your specific requirements. This saves time and enhances the client onboarding experience signNowly.

-

Are there any pricing plans for KYC form solutions with airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. These plans provide various features that include eSigning, document management, and KYC form customization. You can choose a plan that suits your budget and requirements best.

-

Can I integrate airSlate SignNow with my existing CRM to manage KYC forms?

Absolutely! airSlate SignNow integrates seamlessly with many popular CRMs, allowing you to manage KYC forms and client data without switching platforms. These integrations enhance productivity and ensure that your KYC forms are easily accessible where you need them.

-

What security measures are in place for KYC forms in airSlate SignNow?

airSlate SignNow prioritizes security with advanced encryption and authentication protocols to protect your KYC forms. All data is stored securely, ensuring that your clients' information remains confidential and compliant with regulations like GDPR. Rest assured, your data integrity is our top concern.

-

Can I track the status of my KYC forms with airSlate SignNow?

Yes, airSlate SignNow provides effective tracking features that allow you to monitor the status of your KYC forms in real-time. You will receive notifications when a form is signed or updated, giving you complete visibility over the process. This helps you stay informed and manage your workflow efficiently.

-

Is it easy to customize KYC forms using airSlate SignNow?

Yes, customizing KYC forms with airSlate SignNow is straightforward. The platform provides a variety of templates and editing tools, allowing you to tailor forms to meet your specific business needs. This flexibility ensures that your KYC forms will align perfectly with your compliance protocols.

Get more for Know Your Client Form

Find out other Know Your Client Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document