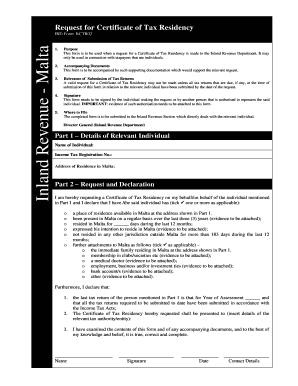

Tax Residence Certificate Malta Form

What is the Tax Residence Certificate Malta

The Tax Residence Certificate Malta is an official document that verifies an individual's or entity's tax residency status in Malta. This certificate is essential for various purposes, such as claiming tax benefits, avoiding double taxation, and complying with local and international tax regulations. It serves as proof that the individual or business is a tax resident of Malta, which can be crucial for tax filings and financial transactions.

How to obtain the Tax Residence Certificate Malta

To obtain the Tax Residence Certificate Malta, individuals or businesses must follow a specific application process. This typically involves submitting a request to the Maltese tax authorities, along with supporting documentation that proves residency status. Required documents may include identification, proof of address, and any relevant financial records. The application can often be completed online, making it convenient for users.

Steps to complete the Tax Residence Certificate Malta

Completing the Tax Residence Certificate Malta involves several key steps:

- Gather necessary documentation, such as identification and proof of residency.

- Fill out the application form accurately, ensuring all information is correct.

- Submit the application to the relevant tax authority, either online or by mail.

- Wait for processing, which may take several weeks, depending on the authority's workload.

- Receive the certificate, which can be used for tax purposes.

Legal use of the Tax Residence Certificate Malta

The Tax Residence Certificate Malta has significant legal implications. It is often required for individuals and businesses to demonstrate their tax residency status to avoid double taxation on income earned in other jurisdictions. The certificate must be presented to tax authorities or financial institutions as needed, ensuring compliance with both local and international tax laws.

Required Documents

When applying for the Tax Residence Certificate Malta, several documents are typically required. These may include:

- Proof of identity, such as a passport or national ID.

- Proof of residency, which can be a utility bill or lease agreement.

- Financial documents that support the residency claim, such as bank statements or tax returns.

Eligibility Criteria

Eligibility for obtaining the Tax Residence Certificate Malta generally requires that the applicant meets specific residency criteria. This often includes being physically present in Malta for a certain number of days within a tax year or having a permanent establishment in the country. Understanding these criteria is essential for individuals and businesses seeking to apply for the certificate.

Quick guide on how to complete tax residence certificate malta

Complete Tax Residence Certificate Malta effortlessly on any device

Digital document management has gained immense popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Tax Residence Certificate Malta on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Tax Residence Certificate Malta with ease

- Locate Tax Residence Certificate Malta and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax Residence Certificate Malta to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax residence certificate malta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax residency certificate Malta?

A tax residency certificate Malta is an official document issued by the Maltese tax authorities that confirms an individual's or entity's tax residency status in Malta. This certificate is often required for tax purposes, including the avoidance of double taxation on income earned abroad.

-

How can I obtain a tax residency certificate Malta?

To obtain a tax residency certificate Malta, you must typically provide evidence of your residency status, including proof of physical presence and ties to Malta. Utilizing airSlate SignNow can streamline the document signing process, allowing you to complete your application efficiently.

-

What is the cost of obtaining a tax residency certificate Malta?

The cost of obtaining a tax residency certificate Malta may vary depending on your circumstances, including any associated application fees and professional assistance needed. With airSlate SignNow, you can manage the signing of related documentation in a cost-effective manner to keep your expenses low.

-

What benefits does a tax residency certificate Malta provide?

A tax residency certificate Malta offers several benefits, including tax relief under double taxation agreements, access to Maltese tax incentives, and confirming your tax residency status. This certificate can help optimize your tax obligations internationally.

-

Can airSlate SignNow help me with my tax residency certificate Malta application?

Yes, airSlate SignNow can assist you in preparing, signing, and sending the necessary documents for your tax residency certificate Malta application. Its user-friendly features ensure a smooth and efficient experience from start to finish.

-

What documents are needed to apply for a tax residency certificate Malta?

To apply for a tax residency certificate Malta, you'll typically need to provide proof of residence, identification documents, and details about your income sources. Using airSlate SignNow, you can easily gather and eSign these documents securely.

-

Is there a specific processing time for the tax residency certificate Malta?

The processing time for a tax residency certificate Malta can vary based on the complexity of your application and the workload of the Maltese tax authorities. However, with airSlate SignNow’s expedited document management, you can help ensure your request is processed as quickly as possible.

Get more for Tax Residence Certificate Malta

- Framing material order form

- Puppy for sale dog for sale form

- Microsoft powerpoint kaizen event evaluation formkaizenfieldbook compatibility mode

- Online filmi form

- Bridgefest bike show entry form

- Mileage reportxls form

- Download the application form here city unity college cityu

- Joseph of cupertino parish form

Find out other Tax Residence Certificate Malta

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template