Sst Form

What is the SST Form

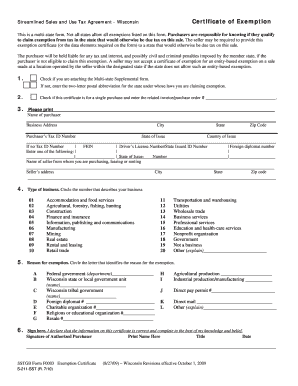

The SST form, or Streamlined Sales Tax form, is a document used to facilitate the collection of sales tax across multiple states in the United States. It is designed for businesses that operate in multiple jurisdictions and need to comply with varying sales tax regulations. The SST form simplifies the process by providing a standardized method that helps ensure compliance with state laws while minimizing the administrative burden on businesses.

How to Use the SST Form

Using the SST form involves several steps to ensure accurate completion and submission. First, businesses must gather necessary information, including sales data and tax rates for the states in which they operate. Next, they fill out the SST form with the required details, ensuring that all entries are accurate and complete. After completing the form, businesses can submit it electronically through designated state portals or by mail, depending on the state’s requirements.

Steps to Complete the SST Form

Completing the SST form requires careful attention to detail. Here are the essential steps:

- Gather all relevant sales data for the reporting period.

- Identify the applicable sales tax rates for each jurisdiction.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the completed form according to the specific guidelines of the state.

Legal Use of the SST Form

The SST form is legally binding when completed correctly and submitted in compliance with state regulations. It is essential for businesses to adhere to the guidelines set forth by the Streamlined Sales Tax Governing Board to ensure that their submissions are valid. This compliance helps prevent potential legal issues, including audits or penalties for incorrect tax collection.

Required Documents

When preparing to complete the SST form, businesses must have several documents ready. These typically include:

- Sales records for the reporting period.

- Tax rate schedules for each jurisdiction.

- Previous tax returns, if applicable.

- Any state-specific documentation required for compliance.

Form Submission Methods

The SST form can be submitted through various methods, depending on the state’s regulations. Common submission methods include:

- Online submission through state tax authority websites.

- Mailing a physical copy to the appropriate state office.

- In-person submission at designated tax offices.

Quick guide on how to complete sst form

Prepare Sst Form seamlessly on any device

Online document handling has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Sst Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Sst Form effortlessly

- Obtain Sst Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Revise and eSign Sst Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sst form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SST form and how does it work with airSlate SignNow?

The SST form is a customizable electronic document that allows users to gather information efficiently. With airSlate SignNow, you can create, send, and eSign SST forms seamlessly, ensuring that all necessary data is collected in a secure and user-friendly manner.

-

How much does it cost to use airSlate SignNow for SST forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting from a free trial to premium packages. Each plan allows you to manage SST forms effectively, ensuring that you have access to all essential features at a competitive price.

-

What features does airSlate SignNow offer for SST forms?

airSlate SignNow provides a variety of features for SST forms, including drag-and-drop form creation, automated workflows, and secure eSignature options. Additionally, you can track document status in real-time, making the handling of SST forms efficient and transparent.

-

How can airSlate SignNow enhance the process of handling SST forms?

Using airSlate SignNow for SST forms streamlines the entire process, reducing paperwork and improving response times. The platform's user-friendly interface allows for quick edits and updates, ensuring that your SST forms meet all required standards and are delivered promptly.

-

Can I integrate airSlate SignNow with other applications for SST forms?

Yes, airSlate SignNow supports integration with various applications, including CRM systems, cloud storage services, and project management tools. This means that you can easily incorporate SST forms into your existing workflows, enhancing productivity and collaboration across teams.

-

Is it secure to use airSlate SignNow for SST forms?

Absolutely! airSlate SignNow prioritizes security, employing encryption and compliance with industry standards to protect your SST forms and data. With robust authentication methods, you can be confident that your documents are safe throughout the eSigning process.

-

What benefits does airSlate SignNow provide for businesses using SST forms?

By using airSlate SignNow for SST forms, businesses can improve efficiency, reduce turnaround times, and cut operational costs. Moreover, the ability to access documents from anywhere boosts flexibility, allowing teams to work collaboratively regardless of location.

Get more for Sst Form

- Waiver of hearing waiver of final conservators report waiver of courts state co form

- 2 east 14th ave courts state co form

- Division courtroom order for expedited residential courts state co form

- Forms sealing of criminal records colorado judicial branch courts state co

- Parenting plan civil union colorado judicial branch courts state co form

- Jdf 1515 form

- Jdf 970 form

- Juvenile delinquency application for public defender courts state co form

Find out other Sst Form

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA