Form 886 a Worksheet

What is the Form 886 A Worksheet

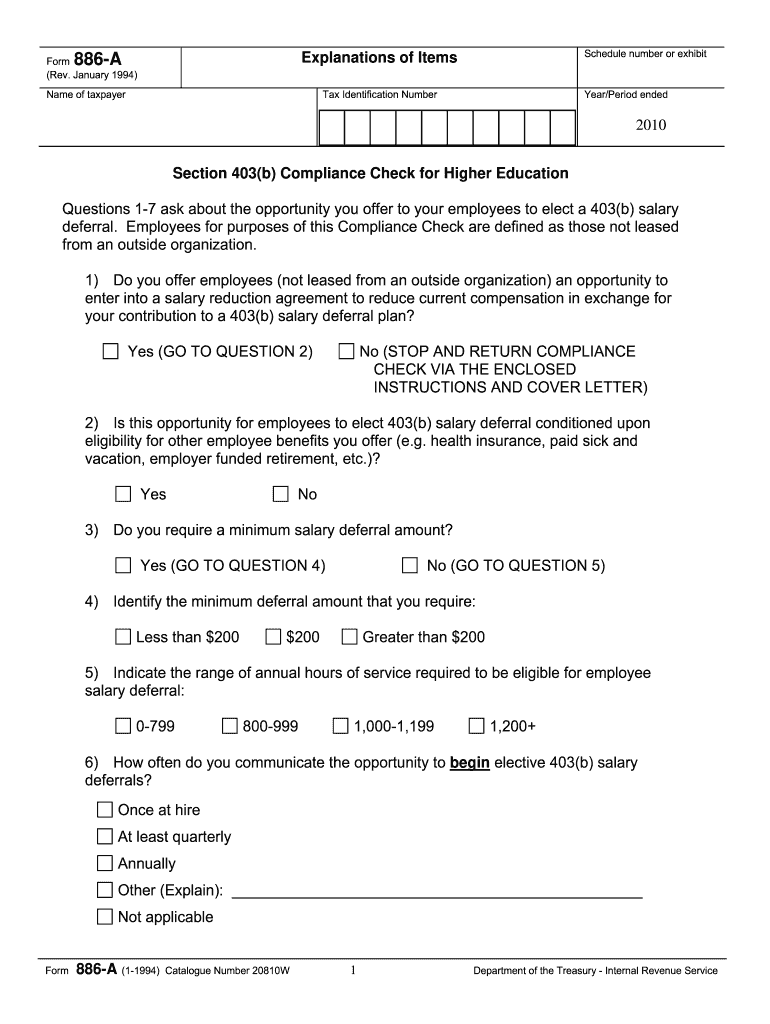

The Form 886 A Worksheet is a document used by taxpayers in the United States to report specific income and expenses related to their business activities. This form is particularly relevant for self-employed individuals and small business owners who need to provide detailed information about their earnings and deductions. The worksheet assists in calculating the net profit or loss from a business, which is then reported on the taxpayer's income tax return. Understanding this form is crucial for ensuring accurate reporting and compliance with IRS regulations.

How to use the Form 886 A Worksheet

Using the Form 886 A Worksheet involves several steps to ensure that all necessary information is accurately reported. Taxpayers should begin by gathering all relevant financial documents, including income statements, receipts for expenses, and any other supporting documentation. The worksheet requires detailed entries for various categories, such as gross receipts, cost of goods sold, and operating expenses. It is important to follow the instructions carefully to avoid mistakes that could lead to discrepancies in tax filings.

Steps to complete the Form 886 A Worksheet

Completing the Form 886 A Worksheet involves a systematic approach. First, input your total gross receipts from your business activities. Next, calculate the cost of goods sold if applicable. After that, list all deductible expenses, ensuring to categorize them correctly, such as advertising, utilities, and wages. Once all entries are made, total the income and expenses to determine your net profit or loss. Finally, review the completed worksheet for accuracy before submitting it with your tax return.

Legal use of the Form 886 A Worksheet

The legal use of the Form 886 A Worksheet is governed by IRS regulations, which stipulate that accurate reporting is essential for compliance. The information provided on this worksheet must be truthful and substantiated by appropriate documentation. Using the worksheet correctly can help prevent issues with the IRS, including audits or penalties for misreporting income or expenses. It is advisable to retain copies of the completed worksheet and all supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 886 A Worksheet align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates and plan accordingly to ensure timely submission. Extensions may be available, but it is important to file the worksheet by the original deadline to avoid penalties.

Required Documents

To complete the Form 886 A Worksheet, several documents are required. Taxpayers should gather their income statements, including 1099 forms and any other records of business income. Additionally, receipts and invoices for all business-related expenses are necessary to substantiate claims made on the worksheet. Keeping organized records throughout the year simplifies the completion process and helps ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 886 A Worksheet, which must be followed to ensure accuracy and compliance. Taxpayers should refer to the IRS instructions for the worksheet, which detail how to report income and expenses, as well as any additional requirements based on their business type. Adhering to these guidelines helps prevent errors and reduces the risk of audits or penalties from the IRS.

Quick guide on how to complete form 886 a worksheet

Complete Form 886 A Worksheet effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely keep it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Handle Form 886 A Worksheet on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form 886 A Worksheet without hassle

- Locate Form 886 A Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow has designed for that function.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 886 A Worksheet and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 886 a worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 886 A and how is it used?

Form 886 A is a document used to request a reconsideration of a tax matter with the IRS. It allows taxpayers to provide additional information or documentation to support their case. airSlate SignNow makes it easy to complete and eSign Form 886 A, ensuring your requests are submitted accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow to fill out Form 886 A?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. The cost may vary based on features and the number of users. However, considering the time savings and efficiency it offers in processing documents like Form 886 A, it's a valuable investment.

-

What features does airSlate SignNow provide for managing Form 886 A?

airSlate SignNow offers a range of features for managing Form 886 A, including templates for quick access and eSigning capabilities. Users can collaborate in real time, track document status, and securely store their forms. This enhances efficiency and ensures that all forms are completed accurately.

-

Can I integrate airSlate SignNow with other applications for Form 886 A?

Yes, airSlate SignNow supports numerous integrations with popular business applications, which can streamline the workflow for Form 886 A. This means you can easily connect your document management system, CRM, or email services to enhance productivity. Integrations help in keeping your processes unified and efficient.

-

What are the benefits of using airSlate SignNow for Form 886 A?

The primary benefits of using airSlate SignNow for Form 886 A include improved accuracy, time efficiency, and a user-friendly interface. Its electronic signature functionality allows for faster approvals, while features like document tracking ensure you stay updated on the submission status. Overall, this leads to a smoother tax process.

-

Is airSlate SignNow compliant with legal standards for eSigning Form 886 A?

Yes, airSlate SignNow adheres to all legal requirements for electronic signatures, making it fully compliant with regulations for documents like Form 886 A. This compliance guarantees that your digitally signed documents are legally binding and can safely be submitted to the IRS. You can trust airSlate SignNow for secure eSigning.

-

How does airSlate SignNow ensure the security of Form 886 A?

airSlate SignNow employs advanced security measures to protect your information when filling out Form 886 A. This includes encryption, secure access controls, and audit trails. With these features, you can be confident that your sensitive data is safeguarded throughout the document lifecycle.

Get more for Form 886 A Worksheet

Find out other Form 886 A Worksheet

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself