Ar See Gr 53 Form

What is the Ar See Gr 53

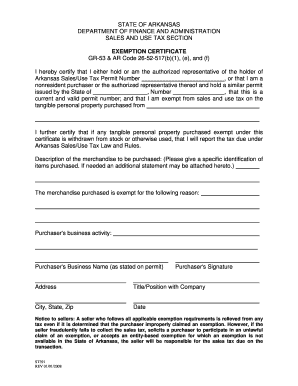

The Ar See Gr 53 is a specific form utilized in the state of Arkansas, primarily for reporting and documenting certain financial or legal information. This form is essential for individuals and businesses to ensure compliance with state regulations. It serves as a formal declaration, often required for various administrative processes, including tax filings and legal submissions.

How to use the Ar See Gr 53

Using the Ar See Gr 53 involves several straightforward steps. First, gather all necessary information and documentation that pertains to the form's requirements. This may include personal identification, financial records, or other relevant data. Next, complete the form by accurately filling in the required fields. Ensure that all information is clear and legible. After completing the form, review it for any errors or omissions before submission.

Steps to complete the Ar See Gr 53

Completing the Ar See Gr 53 requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, such as the Arkansas state website or a legal office.

- Read the instructions thoroughly to understand the requirements and sections of the form.

- Gather all necessary documentation that supports the information you will provide.

- Fill out the form, ensuring accuracy and clarity in your entries.

- Double-check all information for completeness and correctness.

- Sign and date the form where required.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal use of the Ar See Gr 53

The Ar See Gr 53 is legally binding when completed and submitted according to state regulations. It is crucial to ensure that the form is filled out accurately and that all required signatures are obtained. Failure to adhere to the legal requirements can result in penalties or rejection of the form. Understanding the legal implications of this form is essential for compliance and to avoid any potential legal issues.

Key elements of the Ar See Gr 53

Several key elements are integral to the Ar See Gr 53. These include:

- Identification Information: Personal or business identification details are necessary for proper processing.

- Financial Data: Accurate financial information must be provided to support the claims made in the form.

- Signatures: Required signatures validate the information submitted and confirm the authenticity of the form.

- Submission Method: Understanding how to submit the form correctly is vital for its acceptance.

Who Issues the Form

The Ar See Gr 53 is issued by the state of Arkansas, typically through a government agency responsible for managing financial or legal documentation. This could include the Department of Revenue or other relevant state departments. It is essential to ensure that you are using the most current version of the form, as updates may occur periodically.

Quick guide on how to complete ar see gr 53

Accomplish Ar See Gr 53 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents rapidly without delays. Handle Ar See Gr 53 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Ar See Gr 53 effortlessly

- Locate Ar See Gr 53 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that function.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your choice. Alter and eSign Ar See Gr 53 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar see gr 53

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ar see gr 53 and how does it relate to airSlate SignNow?

The term ar see gr 53 refers to an advanced feature set available in airSlate SignNow that enhances document signing. It enables users to streamline their workflows with additional security and compliance measures, ensuring that your important documents are handled safely.

-

How much does airSlate SignNow cost when using ar see gr 53?

Pricing for airSlate SignNow with the ar see gr 53 feature varies based on the plan you choose. We offer flexible subscription options that cater to different business needs, making it a cost-effective solution for document management.

-

What are the key features of airSlate SignNow's ar see gr 53?

Key features of ar see gr 53 include advanced electronic signature capabilities, user authentication, and document tracking. These functions are designed to enhance the signing experience and improve overall productivity for businesses.

-

Can airSlate SignNow integrate with other applications when using ar see gr 53?

Yes, airSlate SignNow with ar see gr 53 offers seamless integration with various applications, including CRMs and cloud storage solutions. This integration capability allows businesses to automate their workflows and keep their documents coordinated and organized.

-

What are the benefits of utilizing airSlate SignNow's ar see gr 53?

Utilizing ar see gr 53 within airSlate SignNow provides numerous benefits, including increased efficiency in document processing and enhanced security measures. This tailored solution helps businesses save time and reduce errors in their signing processes.

-

Is support available for airSlate SignNow users using ar see gr 53?

Absolutely! airSlate SignNow provides dedicated support for users leveraging the ar see gr 53 feature. Our support team is available to assist with any questions or issues you may encounter while using our platform.

-

How does ar see gr 53 enhance the signing process in airSlate SignNow?

Ar see gr 53 enhances the signing process by providing features like customizable signing workflows and real-time notifications. These features ensure that users can manage their documents efficiently while maintaining compliance with industry regulations.

Get more for Ar See Gr 53

Find out other Ar See Gr 53

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later