St 391 Form

What is the ST-391?

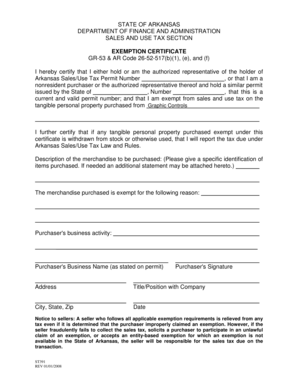

The ST-391 is the Arkansas tax exemption form, officially known as the Arkansas Exemption Certificate. This form allows qualifying entities to make tax-exempt purchases in Arkansas, primarily for resale or use in manufacturing. It is essential for businesses to understand the specific criteria that qualify them for tax exemption under Arkansas law.

How to Use the ST-391

To use the ST-391 effectively, businesses must complete the form accurately and provide it to their suppliers when making tax-exempt purchases. The form serves as proof of the buyer's tax-exempt status, ensuring that sales tax is not charged on eligible transactions. It is crucial to retain a copy of the completed form for record-keeping and compliance purposes.

Steps to Complete the ST-391

Completing the ST-391 involves several key steps:

- Gather necessary information, including the name and address of the purchaser and seller.

- Indicate the reason for the exemption, such as resale or manufacturing use.

- Provide the purchaser's Arkansas sales tax permit number.

- Sign and date the form to validate the exemption claim.

Ensure that all information is accurate to avoid any compliance issues with the Arkansas Department of Finance and Administration.

Legal Use of the ST-391

The ST-391 is legally binding when completed correctly. It must be presented to sellers to substantiate the claim for tax exemption. Misuse of the form, such as using it for non-qualifying purchases, can lead to penalties, including back taxes and fines. Therefore, it is essential to understand the legal implications of using the ST-391.

Key Elements of the ST-391

Key elements of the ST-391 include:

- Purchaser's name and address

- Seller's name and address

- Type of exemption being claimed

- Purchaser's Arkansas sales tax permit number

- Signature and date of the purchaser

These elements are crucial for ensuring that the form is recognized as valid by tax authorities.

Eligibility Criteria

Eligibility for using the ST-391 typically includes businesses that are purchasing items for resale or for use in production. Non-profit organizations may also qualify under specific conditions. It is important for applicants to verify their eligibility based on the latest Arkansas tax regulations to avoid any compliance issues.

Quick guide on how to complete st 391

Manage St 391 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Work on St 391 from any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign St 391 without hassle

- Locate St 391 and then click Obtain Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specially provides for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information carefully and then click on the Complete button to preserve your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign St 391 and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 391

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Arkansas tax exempt form?

An Arkansas tax exempt form is a document used by qualifying organizations or individuals to claim exemption from state sales tax. This form is crucial for nonprofits, governmental entities, and certain other tax-exempt entities to avoid unnecessary tax burdens. By using the Arkansas tax exempt form, entities can streamline their purchasing processes and maintain compliance with state regulations.

-

How can airSlate SignNow help with Arkansas tax exempt forms?

airSlate SignNow provides a seamless solution for managing Arkansas tax exempt forms by allowing businesses to easily create, send, and eSign documents securely. The platform enhances workflow efficiency by enabling users to automate the signing process and maintain organized records of completed forms. This can save time and reduce errors when handling Arkansas tax exempt forms.

-

Is there a cost associated with using airSlate SignNow for Arkansas tax exempt forms?

airSlate SignNow offers various pricing plans to fit different business needs, including options that allow for unlimited document signing. Each plan provides access to features that simplify the management of Arkansas tax exempt forms, making it a cost-effective choice for any organization. Visit our pricing page to find a plan that suits your requirements.

-

What features does airSlate SignNow offer for managing Arkansas tax exempt forms?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking, all designed to enhance the handling of Arkansas tax exempt forms. Users can set up automatic reminders for signers, ensuring prompt action on important documents. These features help streamline workflows and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for processing Arkansas tax exempt forms?

Yes, airSlate SignNow supports integrations with various software applications, allowing users to streamline their processes when managing Arkansas tax exempt forms. Integrating with accounting or ERP systems can enhance data accuracy and reduce manual entry. This improves overall efficiency and saves time when handling multiple forms.

-

How secure is airSlate SignNow for handling Arkansas tax exempt forms?

Security is a top priority for airSlate SignNow, which utilizes advanced encryption and compliance measures to ensure the protection of sensitive information in Arkansas tax exempt forms. Our platform adheres to industry standards and regulations, ensuring that your documents remain safe and secure from unauthorized access. Trust airSlate SignNow to keep your data private and secure.

-

What are the benefits of using airSlate SignNow for Arkansas tax exempt forms?

Using airSlate SignNow for Arkansas tax exempt forms offers numerous benefits, including enhanced workflow efficiency, improved compliance, and reduced turnaround times. The platform enables easy collaboration between team members and stakeholders, simplifying the review and approval process. Enjoy greater accuracy and reliability in handling your Arkansas tax exempt forms with our user-friendly solution.

Get more for St 391

Find out other St 391

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement