Lansing Tax Forms

What is the Lansing Tax Form?

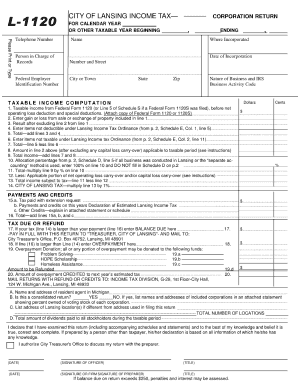

The Lansing city tax form 2018 is a document used by residents of Lansing, Michigan, to report their income and calculate their local tax obligations. This form is essential for ensuring compliance with city tax regulations. It captures various income sources, deductions, and credits that may apply to the taxpayer's situation. Understanding this form is crucial for accurate tax filing and avoiding potential penalties.

How to Obtain the Lansing Tax Form

The Lansing city tax form 2018 can be obtained through several methods. Residents can visit the official City of Lansing website, where forms are typically available for download. Additionally, physical copies may be available at city offices or local tax assistance centers. It is advisable to ensure that the correct year’s form is used to avoid discrepancies during filing.

Steps to Complete the Lansing Tax Form

Completing the Lansing city tax form involves several key steps:

- Gather necessary documents, including W-2s and 1099s, which report income.

- Fill out personal information, including your name, address, and Social Security number.

- Report total income from all sources as required on the form.

- Apply any deductions or credits you are eligible for to reduce your taxable income.

- Calculate the total tax owed or refund due based on the provided instructions.

- Sign and date the form before submission.

Legal Use of the Lansing Tax Form

The Lansing city tax form 2018 is legally binding when filled out and submitted according to the guidelines set forth by the city’s tax authority. To ensure its legal validity, taxpayers must provide accurate information and comply with all filing requirements. Digital signatures, when used, must meet the standards of eSignature laws to be considered valid.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Lansing city tax form. Typically, forms are due by April 15 of the following year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines that may occur due to local regulations or state laws.

Form Submission Methods

The Lansing city tax form 2018 can be submitted through various methods:

- Online submission via the city’s tax portal, if available.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices during business hours.

Penalties for Non-Compliance

Failing to file the Lansing city tax form 2018 on time or providing inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the implications of non-compliance is crucial for residents to avoid unnecessary financial burdens.

Quick guide on how to complete lansing tax forms

Effortlessly Prepare Lansing Tax Forms on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to acquire the correct format and securely save it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents rapidly without any hold-ups. Manage Lansing Tax Forms on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Lansing Tax Forms with Ease

- Find Lansing Tax Forms and then click Get Form to commence.

- Utilize the tools provided to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to finalize your edits.

- Select your preferred method to submit your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Revise and electronically sign Lansing Tax Forms to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lansing tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the lansing city tax form 2018, and why is it important?

The lansing city tax form 2018 is a document required for residents and businesses in Lansing to report their income and calculate their city tax obligations. It’s important because it ensures compliance with local tax laws and helps avoid penalties. Filing this form accurately can also maximize potential tax benefits.

-

How can airSlate SignNow help with submitting the lansing city tax form 2018?

With airSlate SignNow, you can easily create, send, and eSign the lansing city tax form 2018 electronically. This platform simplifies the process of document management, making it easier to keep track of your submissions and deadlines. Plus, you can access your documents from anywhere, ensuring that you never miss an important filing.

-

Is there a cost associated with using airSlate SignNow for the lansing city tax form 2018?

airSlate SignNow offers a cost-effective solution for managing the lansing city tax form 2018. The pricing plans are designed to suit various business sizes and needs, so you can choose one that fits your budget. With the value it provides in terms of efficiency and compliance, many users find it a worthwhile investment.

-

What features does airSlate SignNow provide for the lansing city tax form 2018?

airSlate SignNow offers a variety of features to facilitate the handling of the lansing city tax form 2018. Users can create templates, automate workflows, and collect electronic signatures seamlessly. Additionally, the platform provides security features to ensure your sensitive information is protected during the filing process.

-

Can I integrate airSlate SignNow with other tools for my lansing city tax form 2018?

Yes, airSlate SignNow integrates with numerous business tools that can enhance your experience while handling the lansing city tax form 2018. From accounting software to document management systems, these integrations streamline your workflow and reduce the need for manual entry. This helps in maintaining accuracy and maximizing efficiency.

-

How does eSigning the lansing city tax form 2018 work with airSlate SignNow?

eSigning the lansing city tax form 2018 with airSlate SignNow is straightforward. After filling out the tax form, you can initiate the eSigning process with just a few clicks. The signers will receive a secure link to access the document, and once signed, you will receive a notification and a completed copy for your records.

-

What are the benefits of using airSlate SignNow for the lansing city tax form 2018?

Using airSlate SignNow for the lansing city tax form 2018 provides numerous benefits, including enhanced convenience, efficiency, and compliance. The platform's auto-reminders and tracking features ensure timely submission, while its user-friendly interface makes it easy for anyone to navigate. Overall, it simplifies the tax filing process signNowly.

Get more for Lansing Tax Forms

Find out other Lansing Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors