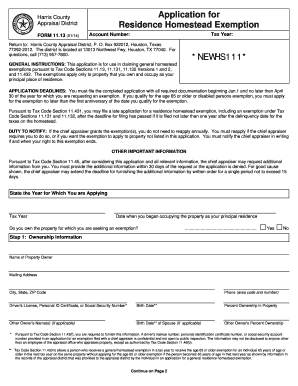

Harris County Application for Residence Homestead Exemption Form 1113 0114

What is the Harris County Application for Residence Homestead Exemption Form?

The Harris County Application for Residence Homestead Exemption Form, often referred to as Form , is a crucial document for homeowners in Harris County, Texas. This form allows eligible residents to apply for a homestead exemption, which can significantly reduce property taxes on their primary residence. The exemption is designed to provide financial relief to homeowners by lowering the assessed value of their property, thus decreasing the amount of property tax owed. Understanding this form is essential for homeowners looking to take advantage of available tax benefits.

Steps to Complete the Harris County Application for Residence Homestead Exemption Form

Completing the Harris County Application for Residence Homestead Exemption Form involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your driver's license number, Social Security number, and details about your property. Next, accurately fill out the form, providing all required information such as your name, address, and the date you moved into your home. After completing the form, review it for any errors or omissions. Finally, submit the form to the Harris County Appraisal District by the specified deadline, ensuring you keep a copy for your records.

How to Obtain the Harris County Application for Residence Homestead Exemption Form

The Harris County Application for Residence Homestead Exemption Form can be easily obtained through various channels. Homeowners can download the form directly from the Harris County Appraisal District's official website. Alternatively, physical copies of the form are available at the appraisal district office. It is advisable to ensure you have the most current version of the form to avoid any issues during the application process.

Eligibility Criteria for the Harris County Application for Residence Homestead Exemption Form

To qualify for the Harris County homestead exemption, applicants must meet specific eligibility criteria. The property must be the applicant's primary residence, and the homeowner must have owned the property as of January first of the tax year. Additionally, the applicant must not have claimed a homestead exemption on any other property. Certain exemptions may also be available for individuals over sixty-five years of age or those with disabilities, providing further financial relief.

Form Submission Methods for the Harris County Application for Residence Homestead Exemption Form

Submitting the Harris County Application for Residence Homestead Exemption Form can be done through several convenient methods. Homeowners can submit the completed form online via the Harris County Appraisal District's website, which offers a secure portal for digital submissions. Alternatively, the form can be mailed to the appraisal district office or submitted in person. It is important to check the submission guidelines and deadlines to ensure timely processing of the application.

Key Elements of the Harris County Application for Residence Homestead Exemption Form

The Harris County Application for Residence Homestead Exemption Form includes several key elements that must be accurately completed. Essential information required on the form includes the homeowner's name, property address, and the date of occupancy. Additionally, the form may require details regarding any previous exemptions claimed and the reason for applying for the homestead exemption. Ensuring that all sections of the form are filled out correctly is vital for a successful application.

Quick guide on how to complete harris county application for residence homestead exemption form 1113 0114

Effortlessly Prepare Harris County Application For Residence Homestead Exemption Form 1113 0114 on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Harris County Application For Residence Homestead Exemption Form 1113 0114 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Harris County Application For Residence Homestead Exemption Form 1113 0114 effortlessly

- Locate Harris County Application For Residence Homestead Exemption Form 1113 0114 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Harris County Application For Residence Homestead Exemption Form 1113 0114 to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the harris county application for residence homestead exemption form 1113 0114

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the harris county homestead exemption form?

The Harris County homestead exemption form is a document that allows homeowners to claim an exemption on their property taxes for their primary residence. This exemption can signNowly reduce the amount of property tax owed, providing financial relief to eligible homeowners in Harris County. Completing the form is essential to benefit from these savings.

-

How do I fill out the harris county homestead exemption form?

To fill out the Harris County homestead exemption form, you will need some basic information, such as your property address, social security number, and proof of residency. You can obtain the form from the Harris County Appraisal District website and submit it online or via mail for processing. It's crucial to ensure all information is accurate to avoid delays.

-

What are the eligibility requirements for the harris county homestead exemption form?

To be eligible for the Harris County homestead exemption form, you must own and occupy the property as your principal residence on January 1 of the tax year. Additionally, you cannot claim more than one homestead exemption at the same time and must meet certain income limits if applying for a disabled or senior citizen's exemption.

-

When is the deadline to submit the harris county homestead exemption form?

The deadline to submit the Harris County homestead exemption form is typically January 1 to April 30 of the year you are applying for the exemption. Late submissions may result in missed savings, so it’s essential to ensure you file on time. Always check the Harris County Appraisal District website for any updates or specific deadlines.

-

Can I file the harris county homestead exemption form online?

Yes, you can file the Harris County homestead exemption form online. The Harris County Appraisal District provides an online portal where you can complete and submit your application efficiently. This convenient option saves time and provides immediate confirmation of your submission.

-

What are the benefits of the harris county homestead exemption form?

The Harris County homestead exemption form offers signNow benefits, including reductions in your property tax bill and potential eligibility for additional exemptions if you are a senior or disabled. By reducing the appraised value of your home for tax purposes, you can save money each year, making homeownership more affordable over time.

-

Is there a cost associated with submitting the harris county homestead exemption form?

There is no cost to submit the Harris County homestead exemption form. Homeowners can file their applications free of charge, allowing them to take advantage of the tax benefits without any financial burden. Always ensure that you use the official Harris County Appraisal District resources to avoid scams or unofficial fees.

Get more for Harris County Application For Residence Homestead Exemption Form 1113 0114

- Certificate of good standing city of somerville somervillema form

- The 2015 2016 maryland official highway map maryland state form

- Maryland certification application county form

- Maine malt or wine label registration form

- Maine annual fundraising activity report form

- Mi transitory online form

- Cscl cd 540 form

- Michigan designated representative regulatory form

Find out other Harris County Application For Residence Homestead Exemption Form 1113 0114

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease