Form194b

What is the Form194b

The Form194b is a specific document used for various purposes, including tax reporting and compliance. It is essential for individuals and businesses to understand its function and requirements. This form is typically required by the Internal Revenue Service (IRS) and serves as a formal declaration of certain financial activities or statuses. Understanding the Form194b is crucial for ensuring compliance with federal regulations and avoiding potential penalties.

How to use the Form194b

Using the Form194b involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required to fill out the form. This may include personal identification details, financial records, and any relevant tax information. Next, carefully complete each section of the form, ensuring that all entries are accurate and truthful. After filling out the form, review it for any errors or omissions before submitting it to the appropriate authority, such as the IRS.

Steps to complete the Form194b

Completing the Form194b can be streamlined by following these steps:

- Gather required documents, including identification and financial records.

- Access the Form194b through official channels, ensuring you have the latest version.

- Carefully fill out each section, paying close attention to detail.

- Double-check all entries for accuracy and completeness.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form194b

The legal use of the Form194b is governed by various regulations set forth by the IRS and other relevant authorities. To ensure that the form is legally binding, it must be completed accurately and submitted within the specified deadlines. Additionally, using a reliable electronic signature solution can enhance the legal standing of the form, as it complies with the ESIGN and UETA acts, which recognize electronic signatures as valid in the United States.

Filing Deadlines / Important Dates

Filing deadlines for the Form194b can vary based on the specific requirements set by the IRS. It is crucial to be aware of these dates to avoid penalties. Generally, the form must be submitted by the annual tax filing deadline, which is typically April 15 for most taxpayers. However, extensions may apply in certain situations, so it is advisable to check the IRS guidelines for any updates or changes regarding filing dates.

Key elements of the Form194b

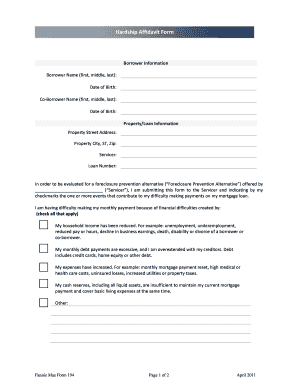

The Form194b contains several key elements that must be accurately completed for it to be valid. These elements include:

- Personal identification information, such as name and Social Security number.

- Details regarding financial activities or statuses relevant to the form.

- Signature of the individual or authorized representative, confirming the accuracy of the information provided.

Each of these components plays a vital role in ensuring that the form meets legal standards and serves its intended purpose.

Quick guide on how to complete form194b

Effortlessly prepare Form194b on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle Form194b on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Form194b with ease

- Obtain Form194b and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method to send your form: by email, text message (SMS), invite link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages your document administration needs in just a few clicks from any device you prefer. Edit and eSign Form194b and ensure excellent communication at any stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form194b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form194b and how can airSlate SignNow help with it?

Form194b is a crucial document for various professional and personal transactions. airSlate SignNow simplifies the process of completing and signing Form194b electronically, ensuring that you can manage your paperwork more efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Form194b?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs. The costs are competitive, providing an affordable way to manage and eSign documents like Form194b without compromising on features and support.

-

What features does airSlate SignNow provide for managing Form194b?

airSlate SignNow provides features like customizable templates, document tracking, and secure cloud storage to enhance your handling of Form194b. These tools streamline your workflow, allowing for faster processing and improved organization.

-

Can I integrate airSlate SignNow with other software for Form194b management?

Absolutely! airSlate SignNow supports integrations with various third-party applications, enabling you to incorporate Form194b directly into your existing workflows. This flexibility ensures you can seamlessly connect documents with your favorite tools.

-

What are the benefits of using airSlate SignNow for signing Form194b?

Using airSlate SignNow for signing Form194b brings convenience, security, and efficiency. You can sign documents from anywhere, store them safely in the cloud, and reduce turnaround times, making it an excellent choice for busy professionals.

-

How does airSlate SignNow ensure the security of Form194b?

airSlate SignNow employs robust security measures to protect your Form194b documents. With features like encryption, two-factor authentication, and compliance with legal standards, you can trust that your sensitive information remains safe.

-

Is it easy to get started with airSlate SignNow for Form194b?

Yes! Getting started with airSlate SignNow to manage Form194b is straightforward. The user-friendly interface guides you through uploading, editing, and eSigning documents effortlessly, even if you're new to digital solutions.

Get more for Form194b

Find out other Form194b

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement