Schedule Se Form

What is the Schedule SE?

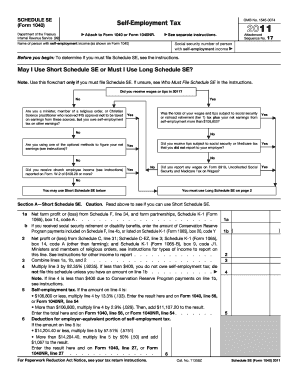

The Schedule SE is a form used by self-employed individuals to calculate their self-employment tax. This tax is essential for funding Social Security and Medicare programs. The form is typically filed alongside the individual’s income tax return, allowing taxpayers to report their net earnings from self-employment. Understanding the Schedule SE is crucial for ensuring compliance with tax obligations and accurately reporting income.

How to use the Schedule SE

Using the Schedule SE involves several steps to accurately report self-employment income. First, gather all relevant financial information, including gross receipts and any allowable deductions. Next, complete the form by following the instructions provided. The form requires you to calculate your net earnings and the corresponding self-employment tax. Finally, ensure that you attach the completed Schedule SE to your Form 1040 when filing your taxes.

Steps to complete the Schedule SE

Completing the Schedule SE requires careful attention to detail. Here are the steps to follow:

- Begin by entering your name and Social Security number at the top of the form.

- Calculate your net earnings from self-employment using the appropriate section of the form.

- Determine the self-employment tax based on your net earnings.

- Complete any additional sections related to special circumstances, such as church employee income.

- Review the form for accuracy before submitting it with your tax return.

Legal use of the Schedule SE

The Schedule SE is legally binding when completed and submitted correctly. It must comply with IRS guidelines to ensure that the reported self-employment income and tax calculations are accurate. Failure to adhere to these guidelines can result in penalties or audits. It is important to maintain thorough records to support the figures reported on the Schedule SE.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule SE align with individual income tax return deadlines. Typically, the due date for filing your tax return, including the Schedule SE, is April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Schedule SE, several documents are necessary. These include:

- Records of all income earned from self-employment.

- Receipts for any business expenses that can be deducted.

- Previous year's tax return, if available, for reference.

Having these documents organized will streamline the process of filling out the Schedule SE and ensure accuracy in your tax reporting.

Quick guide on how to complete schedule se

Effortlessly prepare Schedule Se on any device

Digital document management has become widespread among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Schedule Se on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Schedule Se with ease

- Locate Schedule Se and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers for that specific purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your local device.

Eliminate the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule Se and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule se

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2011 schedule se and how does it relate to airSlate SignNow?

The 2011 schedule se is a part of the IRS tax forms used for reporting self-employment taxes. AirSlate SignNow allows users to easily send, eSign, and manage documents like the 2011 schedule se, ensuring that you can complete your tax forms swiftly and securely.

-

How much does airSlate SignNow cost for users needing the 2011 schedule se?

AirSlate SignNow offers various pricing plans that cater to different user needs. For those specifically handling the 2011 schedule se, the plans are competitively priced, providing a cost-effective solution for document management and eSigning.

-

What features does airSlate SignNow offer for managing the 2011 schedule se?

AirSlate SignNow includes a range of features that streamline the process of managing the 2011 schedule se, such as document templates, bulk sending, and real-time tracking. These features help ensure that your tax documentation is handled efficiently and accurately.

-

Can I integrate airSlate SignNow with other tools for my 2011 schedule se?

Yes, airSlate SignNow offers integration capabilities with various tools and applications that are essential for managing the 2011 schedule se, including CRM systems and cloud storage services. This makes it easy to incorporate eSigning into your existing workflows.

-

What benefits can I expect from using airSlate SignNow for the 2011 schedule se?

Using airSlate SignNow for the 2011 schedule se provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security for your documents. You'll experience fast turnaround times and the convenience of accessing your documents anytime, anywhere.

-

Is it easy to create and send the 2011 schedule se using airSlate SignNow?

Absolutely! AirSlate SignNow offers an intuitive interface that makes creating and sending the 2011 schedule se simple. With easy-to-follow steps, users can eSign and share their tax forms without any hassle.

-

What support is available for users with questions about the 2011 schedule se?

AirSlate SignNow provides comprehensive customer support for all users, including those with inquiries about the 2011 schedule se. You can access resources like FAQs, live chat, and email support to get assistance with your document needs.

Get more for Schedule Se

Find out other Schedule Se

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free