Ex103a Form

What is the Ex103a?

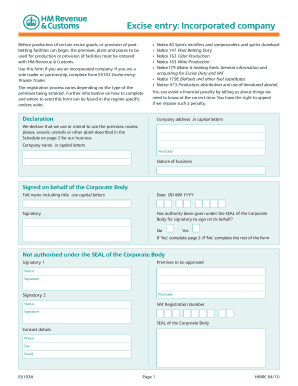

The Ex103a form is a document used in the United Kingdom for the Majesty Revenue Customs Excise (HMRC) purposes. It is primarily associated with the registration and compliance of businesses operating within the UK's tax framework. This form serves as a declaration of a company’s activities and helps ensure that businesses meet their legal obligations regarding tax reporting and compliance. Understanding the Ex103a is essential for any business entity looking to navigate the complexities of UK tax regulations.

How to use the Ex103a

Using the Ex103a form involves several steps that require careful attention to detail. First, businesses must gather all necessary information, including company details, financial records, and any relevant tax identification numbers. Once this information is compiled, the form can be filled out accurately. It is crucial to ensure that all sections are completed thoroughly to avoid any delays or issues with HMRC. After completing the form, businesses can submit it electronically or through traditional mail, depending on their preference and the requirements set by HMRC.

Steps to complete the Ex103a

Completing the Ex103a form requires a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Gather Information: Collect all relevant company information, including registration details and financial data.

- Fill Out the Form: Carefully enter the required information into the Ex103a form, ensuring all fields are completed.

- Review for Accuracy: Double-check all entries for any errors or omissions that could lead to complications.

- Submit the Form: Choose your submission method—either electronically or via mail—and ensure it is sent to the correct HMRC address.

Legal use of the Ex103a

The Ex103a form must be used in accordance with UK tax laws to ensure its legal validity. This means that businesses must adhere to all guidelines provided by HMRC regarding the completion and submission of the form. Failure to comply with these regulations can result in penalties or legal repercussions. It is advisable for businesses to consult with tax professionals or legal advisors to understand their obligations fully and to ensure that their use of the Ex103a aligns with current laws.

Required Documents

To complete the Ex103a form, several documents may be required. These typically include:

- Company registration details

- Financial statements or records

- Tax identification numbers

- Any previous correspondence with HMRC related to tax compliance

Having these documents on hand will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Quick guide on how to complete ex103a

Complete Ex103a effortlessly on any device

Digital document management has become favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Ex103a on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Ex103a without hassle

- Obtain Ex103a and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ex103a and ensure excellent communication at every stage of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ex103a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the connection between airSlate SignNow and UK Majesty Revenue Customs Excise?

airSlate SignNow provides businesses with a streamlined solution to manage their documents efficiently. By integrating with UK Majesty Revenue Customs Excise requirements, users can ensure compliance and simplify the signing process for customs-related documents.

-

How does airSlate SignNow enhance the signing process for UK Majesty Revenue Customs Excise documents?

With airSlate SignNow, users can easily eSign documents relevant to UK Majesty Revenue Customs Excise, saving time and reducing paperwork. The platform's intuitive interface allows for quick document preparation, ensuring that your submissions meet necessary customs compliance.

-

What features does airSlate SignNow offer for UK Majesty Revenue Customs Excise documentation?

airSlate SignNow includes features like customizable templates and automatic reminders that are particularly useful for managing UK Majesty Revenue Customs Excise documents. This ensures you never miss a deadline and can maintain proper documentation throughout the customs process.

-

Is airSlate SignNow cost-effective for businesses dealing with UK Majesty Revenue Customs Excise?

Yes, airSlate SignNow offers a range of pricing plans suitable for businesses of all sizes focused on UK Majesty Revenue Customs Excise. By choosing our platform, companies can save on administrative costs and enhance the efficiency of their document handling, ultimately making it a cost-effective choice.

-

Can airSlate SignNow integrate with other tools related to UK Majesty Revenue Customs Excise?

Absolutely! airSlate SignNow seamlessly integrates with various business applications that can aid in managing UK Majesty Revenue Customs Excise documents. This ensures your document workflows remain efficient and connected to the tools you already use.

-

What are the benefits of using airSlate SignNow for UK Majesty Revenue Customs Excise compliance?

Using airSlate SignNow can signNowly reduce the risk of errors in documentation for UK Majesty Revenue Customs Excise compliance. Our platform offers built-in compliance checks and a secure signing process that enhances overall reliability in customs documentation.

-

How can I ensure security when using airSlate SignNow for UK Majesty Revenue Customs Excise?

airSlate SignNow employs top-tier security protocols to protect your documents related to UK Majesty Revenue Customs Excise. Features like encryption, audit trails, and user authentication help keep your sensitive information safe throughout the signing process.

Get more for Ex103a

Find out other Ex103a

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy